GBP/JPY outlook: Probe above pivotal 200-DMA is generating initial signal of bullish continuation

GBP/JPY

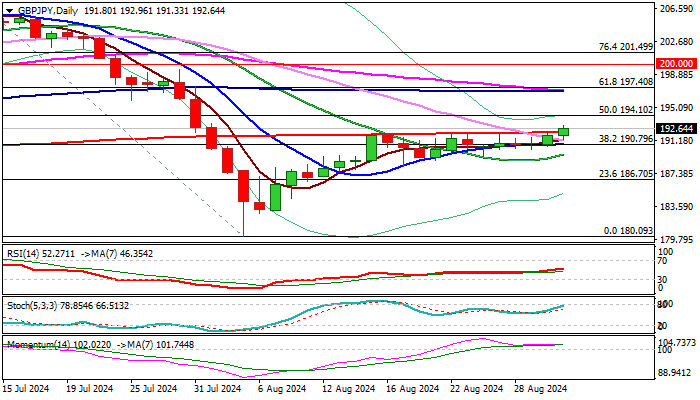

GBPJPY rose to one-month high on Monday and generated initial signal of bullish continuation on probe above the top of month-long range (192.16) reinforced by 200DMA.

Firm break here to confirm signal and open way for fresh upside, with immediate target at 194.10 (50% retracement of 208.11/180.09 downtrend), violation of which to unmask next barriers at 197.00 zone.

Improving daily studies (Tenkan-sen/Kijun-sen bull-cross / strong positive momentum) contribute to brightening outlook, but reaction on 200DMA will key factor.

Caution on failure to clear 200DMA which would signal a false break higher and keep the price in extended sideways mode.

Res: 193.25; 194.10; 195.86; 196.92.

Sup: 192.16; 191.33; 190.79; 189.60.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.