GBP/JPY double top at 157.76 weekly resistance? [Video]

![GBP/JPY double top at 157.76 weekly resistance? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-900067218_XtraLarge.jpg)

Overview:

Watch the video for a summary of this week’s news releases and a complete top down analysis of the GBPJPY.

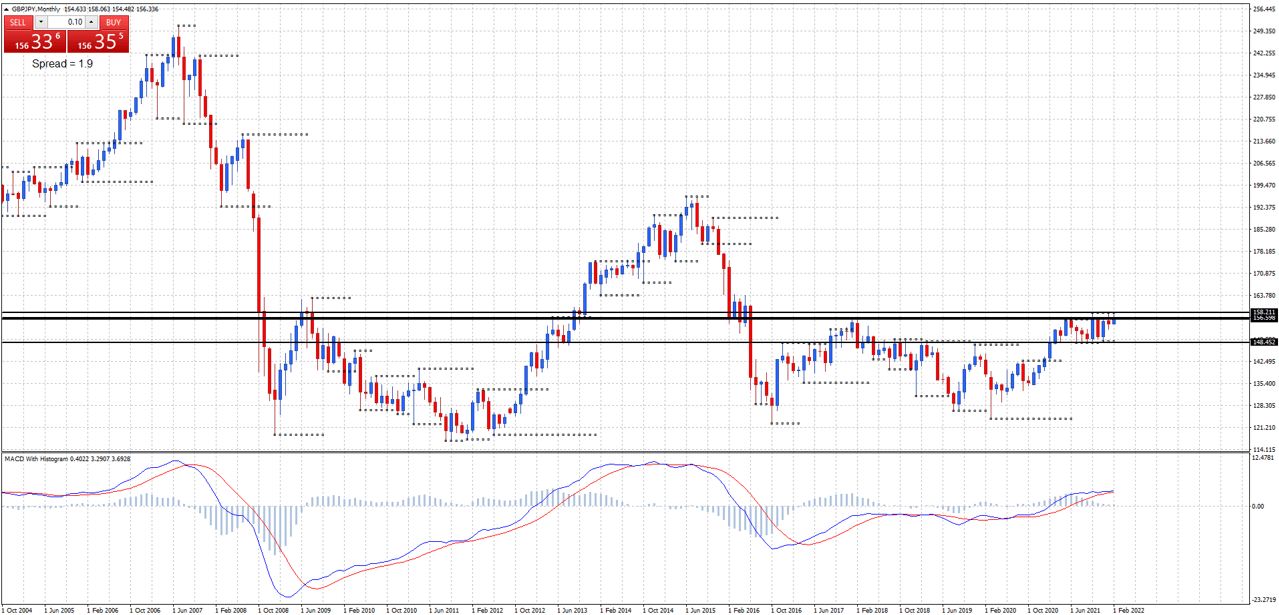

GBPJPY Monthly:

Monthly support at 148.45, resistance at 156.07, 156.59, and 158.21.

Price has rallied back to the 156.07 to 158.21 monthly resistance area and is range bound.

GBPJPY Weekly:

Weekly support at 152.84 and 149.00, resistance at 157.76.

Price may be forming a double top at the 157.76 weekly resistance level. A break of last week’s low would start to confirm the reversal.

GBPJPY Daily:

Daily support at 152.89, resistance at 157.76.

Daily chart is in an uptrend but is trading in the 156.07 to 158.21 monthly resistance area. Price has previously reversed from this area twice, proving that this is a strong resistance area.

Looking for price to fail at the 156.07 monthly resistance level and move back down the range.

Short term target 152.84 weekly support. Long term target 149.00 weekly support.

Watch the video for a full break down of my analysis on how you could trade this pair to the downside based on the 4 hour chart.

Author

Duncan Cooper

ACY Securities

Duncan Cooper is a full-time trader and mentor. He has been actively trading the financial markets for more than 15 years and has traded stocks, options, futures, and the Forex Market since 2005.