GBP/CHF: The Bear’s domination continues

GBP/CHF has been bearish on its daily chart. The price produced a bearish candle, closing below a significant level of support yesterday. The sellers may look for short opportunities below yesterday’s lowest low. Major intraday charts look good for the bear as well. Thus, the pair may end up creating today another bearish candle. Let's now have a look at those three charts.

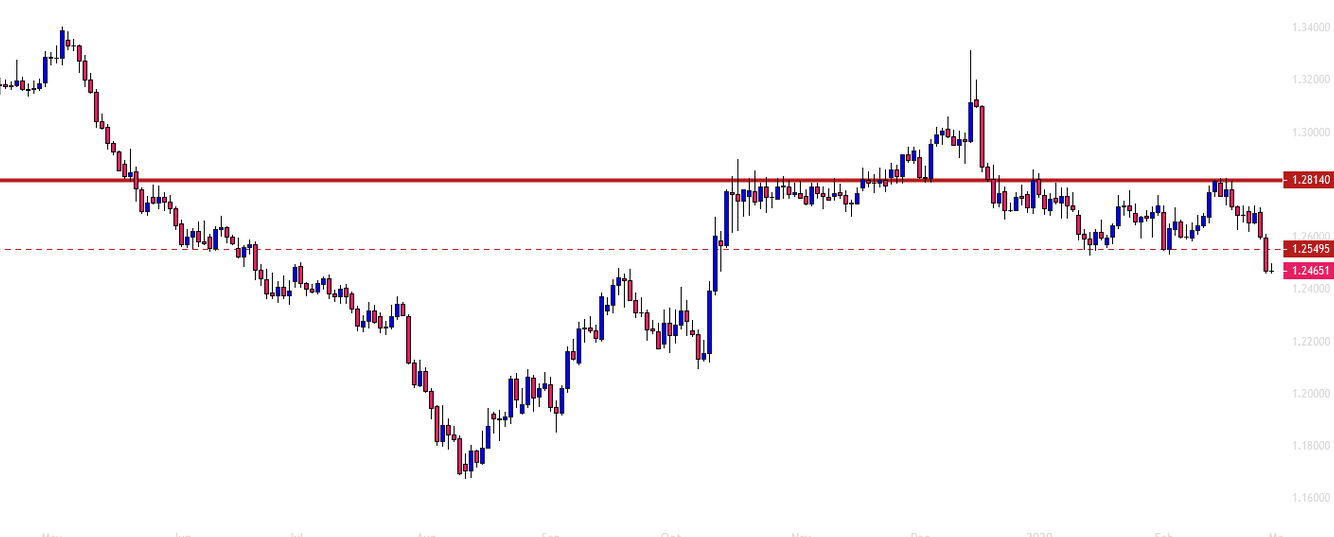

Chart 1 GBP/CHF Daily Chart

The chart shows the price has been rejected at the level of 1.28140. This is where the price reacted heavily earlier. Yesterday’s candle breached through the level of 1.25495 and closed well below it. This is an explicit breakout. Thus, the sellers may go short below the level of 246.60, which is yesterday’s lowest low. GBP/CHF may find its next support at the level of 1.21110. The most significant lowest low is at the level of 1.17000 on the daily chart.

Chart 2 GBP/CHF H4 Chart

The chart shows that it has been having a strong bearish momentum. One of the H4 candles breached through the level of 1.29410, and the next one closed within the level. As of writing, the last candlestick has been bearish. If it ends up making a bearish engulfing candle, the sellers may short on the pair and move the price towards the South further. The pair may find its next support at the level of 1.23830.

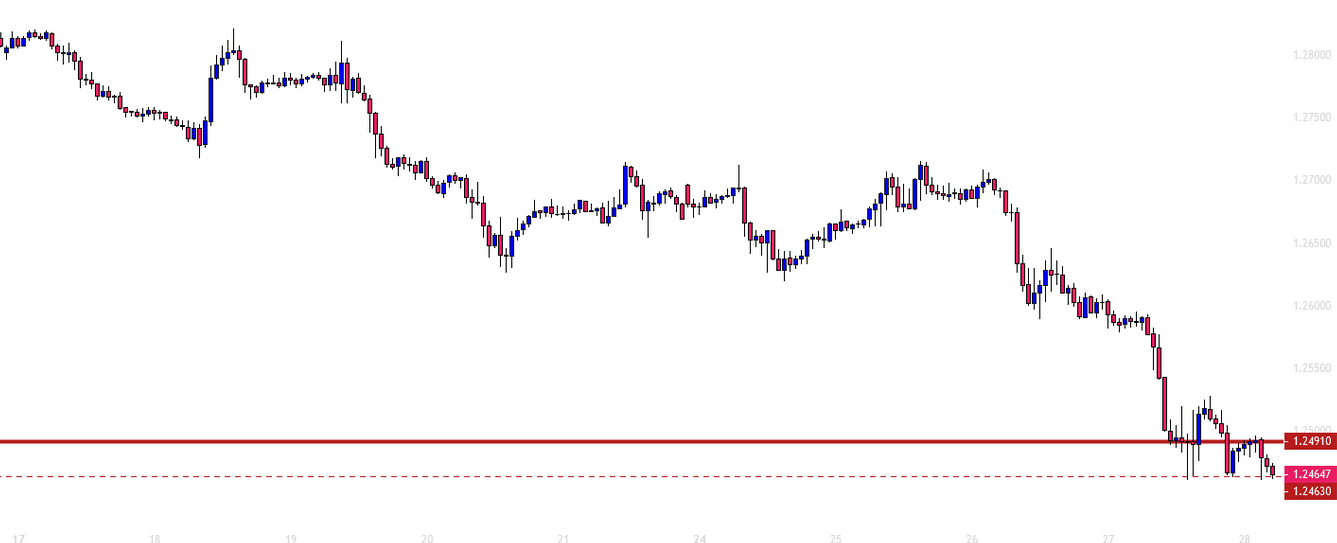

Chart 3 GBP/CHF H1 Chart

We see on the chart shows that the price has been consolidating for a while. The price had a bounce at the level of 1.24630 twice. However, it found its resistance and headed towards the same level again. If the price makes a bearish breakout, the sellers may go short aggressively. The price may find its next support at the level of 1.24150.

On the other hand, if the price has a bounce again and makes a bullish breakout by heading towards the North, the buyers may go long on the pair and push the price towards the North. The price may find its next resistance at the level of 1.25260. As far as risk-reward is concerned, it does not look lucrative for the buyers.

Considering these three charts, the sellers may dominate in the pair today as well. It is the last trading day of the week as well as the month. Thus, if the pair makes a strong bearish move, it may start with a gap next week.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and