GBP/AUD Elliott Wave technical analysis [Video]

![GBP/AUD Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Crosses/USDHKD/currencies-23923080_XtraLarge.jpg)

GBPAUD Elliott Wave Analysis - Trading Lounge.

British Pound/Australian Dollar (GBPAUD) Day Chart.

GBP/AUD Elliott Wave technical analysis

-

Function: Counter Trend.

-

Mode: Corrective.

-

Structure: Orange Wave 2.

-

Position: Navy Blue Wave 3.

-

Direction next higher degrees: Orange Wave 3.

Details:

The analysis indicates that orange wave 1 appears completed, with orange wave 2 currently in progress.

Wave Cancel Invalidation Level: 1.92313

Analysis overview:

The GBPAUD daily chart highlights a counter-trend movement using the Elliott Wave methodology. The wave mode is classified as corrective, focusing on the development of orange wave 2 within the broader context of navy blue wave 3. This setup represents a temporary pullback within the larger upward trend.

Current wave context:

-

Orange wave 1 seems to have concluded, paving the way for orange wave 2, a corrective movement.

-

This phase involves price retracements within the broader structure, setting up for a potential transition into orange wave 3, an impulsive phase.

Invalidation level:

-

The wave count becomes invalid if the price breaches 1.92313, requiring a re-evaluation of the wave structure and overall trend analysis.

Corrective phase implications:

This stage in the Elliott Wave sequence represents a consolidation period within a larger bullish pattern. The ongoing correction in orange wave 2 lays the groundwork for the anticipated upward move of orange wave 3.

Trading insights:

-

Traders can leverage this phase by monitoring signals that suggest the completion of orange wave 2.

-

Anticipating the subsequent upward trend, aligning strategies with market dynamics can yield better results.

-

Key levels within the corrective structure provide critical decision points for trade setups.

By understanding the wave dynamics and the broader market behavior, participants can enhance their trading decisions, optimizing for the upcoming orange wave 3 phase.

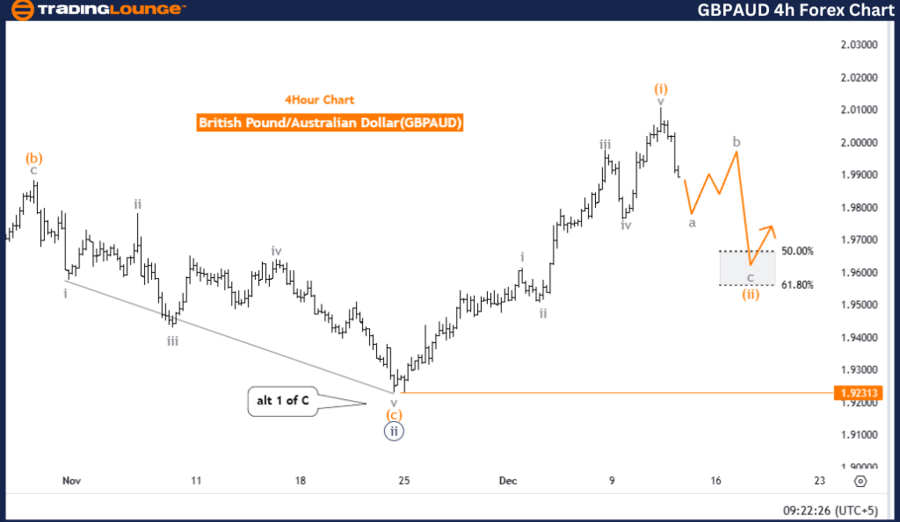

British Pound/Australian Dollar (GBPAUD) 4-Hour Chart.

GBP/AUD Elliott Wave technical analysis

-

Function: Counter Trend.

-

Mode: Corrective.

-

Structure: Orange Wave 2.

-

Position: Navy Blue Wave 3.

-

Direction next higher degrees: Orange Wave 3.

Details:

The analysis indicates that orange wave 1 appears completed, and orange wave 2 is currently unfolding.

Wave Cancel Invalidation Level: 1.92313

Analysis overview:

The GBPAUD 4-hour chart illustrates a counter-trend movement identified using the Elliott Wave framework. The wave mode is corrective, focusing on the development of orange wave 2, which is nested within the broader structure of navy blue wave 3. This pattern highlights a temporary pullback amid the larger upward trend.

Current wave context:

-

Orange wave 1 is likely completed, transitioning into orange wave 2, a corrective phase.

-

This stage represents a retracement, preparing for the next impulsive move into orange wave 3.

Invalidation level:

-

The wave structure becomes invalid if the price breaches the 1.92313 level, requiring a re-assessment of the wave count and overall market structure.

Corrective phase implications:

The ongoing correction within orange wave 2 is a typical consolidation phase in the larger bullish wave formation. This phase allows the market to realign before resuming its upward momentum with orange wave 3.

Trading insights:

-

Traders should monitor for signals indicating the completion of orange wave 2 to capitalize on the anticipated upward movement.

-

Leveraging key levels within the corrective structure can aid in formulating strategic entries and exits.

-

Understanding the Elliott Wave sequence enhances market interpretation, offering a clearer path for aligning trading decisions with future trends.

By identifying key wave dynamics and recognizing potential turning points, market participants can prepare for the next impulsive phase, ensuring strategies align effectively with the broader trend.

Technical analyst: Malik Awais.

GBP/AUD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.