FX Positioning: EUR’s primacy solid ahead of key events

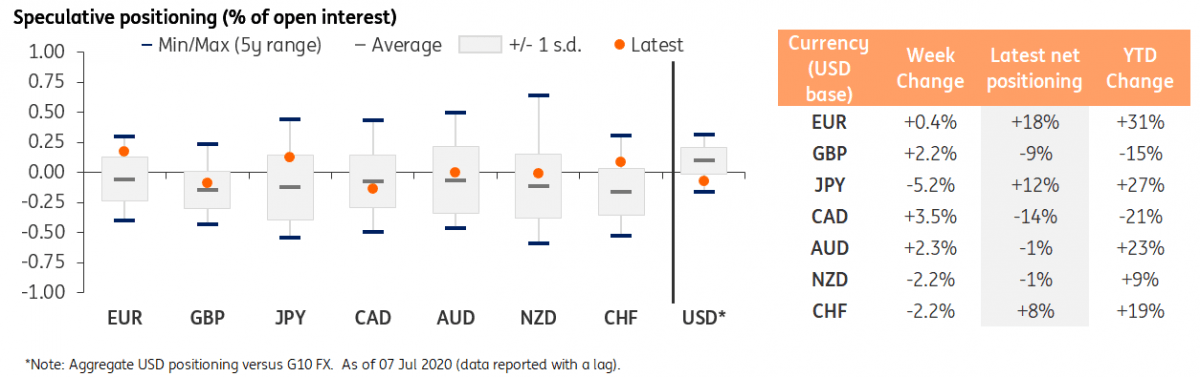

The euro remains the biggest bullish bet in the G10, according to CFTC data, as speculative positioning on the other low-yielders, the Japanese yen and Swiss franc dropped in the week 1-7 July. US dollar positioning also flattened, while the two biggest shorts, the Canadian dollar and British pound, regained some ground.

EUR remains king

EUR/USD net positioning has flattened up in the week 1-7 July after a downward correction in the previous week, according to CFTC data. The EUR is therefore consolidating its role as the most overbought currency in the G10 ahead of a busy period in the eurozone, with the European Central Bank meeting and the EU summit on the Recovery Fund possibly revamping EUR volatility in the coming days.

Incidentally, EUR is clearly showing a detachment from the other low-yielders as its positioning gauge did not follow the drop in JPY and CHF positioning in the week under review. This may be an indication that speculators are identifying some idiosyncratic EUR positives that are keeping EUR/USD attractive to formulate a USD-bearish view. Expectations around the EU Recovery Fund are quite likely among these positive factors, although it is worth noting that the resilience of EUR to some pessimistic comments on the Fund last week shows how markets are well aware that the path to an agreement is set to be bumpy.

Source: CFTC, Macrobond, ING

Downside bets on JPY rise

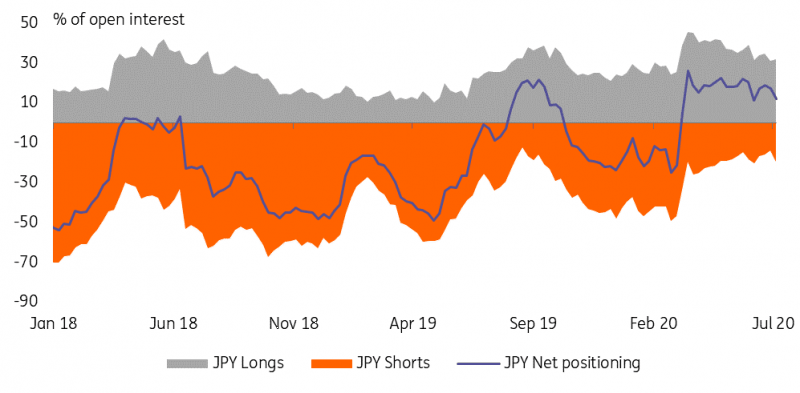

JPY positioning dropped again in the reference week, this time by -5% of open interest, and it is now at +12% of open interest. What is interesting to note is that the positioning gauge was not dampened by a long-trimming effect (longs actually increased in the week), but by a sharp increase in JPY short positions (figure below), which jumped from 14% to 20% of open interest.

Source: CFTC, Macrobond, ING

This is a key difference from the fall in positioning displayed by the other safe havens: CHF saw a long-trimming and USD positioning was unchanged. This might be flagging how speculators are identifying some downside potential inherent to JPY as risk sentiment remains supported.

As mentioned, USD positioning (aggregated positions vs G7 currencies reported by CFTC) flattened up around -7% of open interest, below its five-year/ one–standard deviation band. The lower-bound in five years is at -16% of open interest, recorded in March 2018.

CAD slowly regaining ground, GBP longs rise (but shorts too)

Net positioning on the Canadian dollar has continued to move higher at a fairly stable pace, but remains deeply into oversold territory (at -14% of open interest). The dislocation with the rest of the $-bloc therefore remains intact, with the Australian and New Zealand dollars hovering around neutral territory. As the loonie appears torn between conflicting drivers, the lingering net short positioning continues to be an argument for less pronounced downside potential than its pro-cyclical peers.

Sterling’s positioning has also edged up in the week 1-7 July, mostly thanks to a jump in long positions (+3.5% of open interest). Still, there was no evidence of any short-squeeze as GBP shorts also inched up, although at a slower pace than longs. In the next CFTC report (which will cover the period 8-14 July), we may see the positive impact on GBP positioning of UK Chancellor Rishi Sunak’s fiscal announcement. We have highlighted in our latest G10 FX Week Ahead how the fiscal boost now looks fully priced into GBP and that more upside from now on may prove limited.

Read the original analysis: FX Positioning: EUR’s primacy solid ahead of key events

Author

Francesco Pesole

ING Economic and Financial Analysis

Francesco is an FX Strategist and has been with the firm since May 2019. His main focus is on the G10 space and, in particular, commodity currencies. He began his career at Credit Agricole CIB and holds an MSc in Financial Markets and Investments