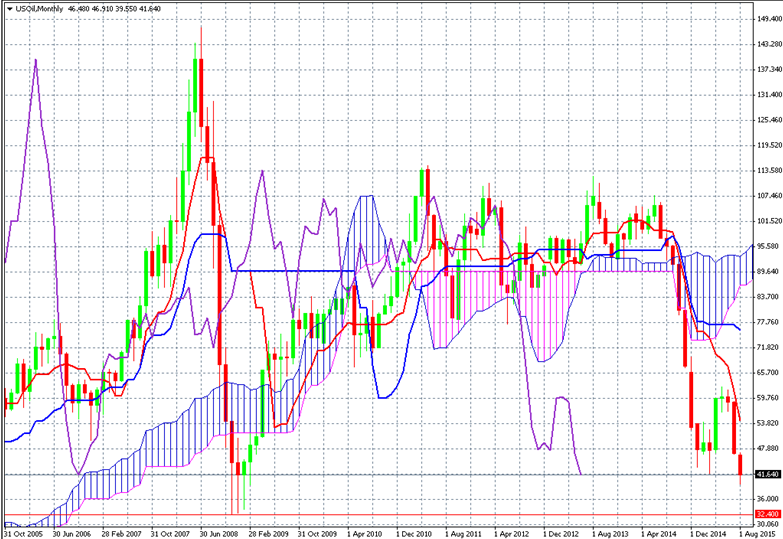

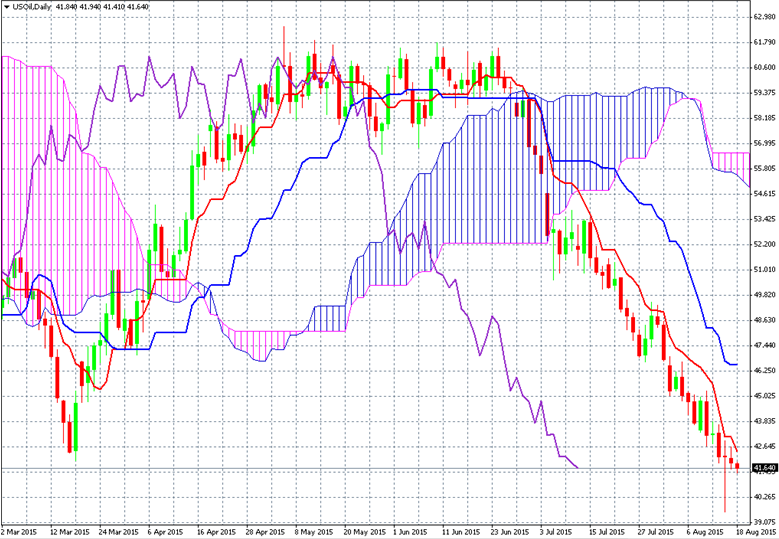

Looking at the Monthly chart there is a strong support level at $32.40, red horizontal line, which is the previous low to last Friday’s. This is an important level as the last time it was reached a major reversal took place, which tends to create psychological barriers when they are met again.

On the day Chart we can see that price has wondered extremely far away from the Ichimoku cloud, which could signal signs of an oversold market. Nevertheless price still remains in a bear market. The candle for August 14th is a classical hammer bottom, typically leading to some reversal as the market plunged to a low of $39.55 and the recovered almost all of that loss, this type of action usually leads to new highs over the coming days, but there is so much selling pressure that this has not been the case.

Trading oil with options

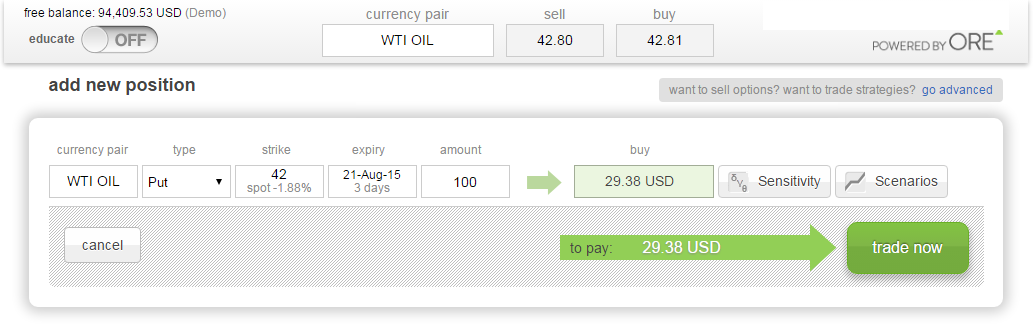

If you think Oil decline will continue you may buy a Put option since a Put allows you reserve a sell price (the strike) over a certain period of time. For example, you may buy a Put to sell 100 barrels of oil at $42 strike until the end of this week. This option is shown in the image below on the ORE Web-platform, you can see it will cost a 29.38 USD premium to buy this option.If oil price falls below $42 by Friday the Put option’s value will increase and you may profit; if oil price falls below $41.40 by expiry you will profit at least 100% and if it falls below $41.10 you will profit at least 200%. If oil does not fall your maximum risk is 29.38 USD. To increase the premium size (and thus the risk and profit potential) you may increase the trade ‘amount’.

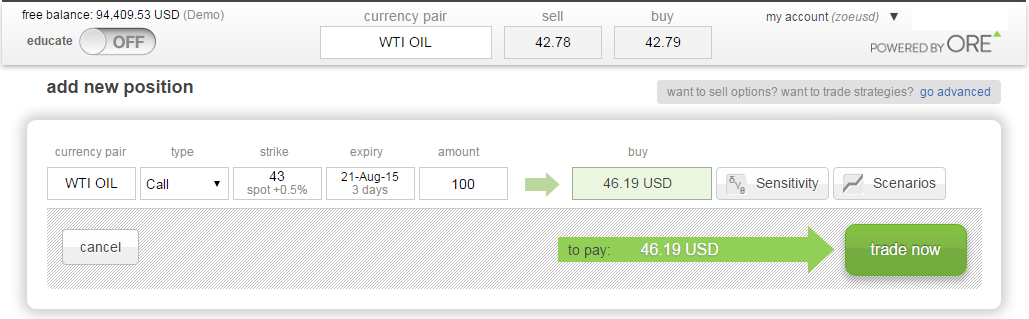

If you think Oil will rise you may buy a Call option since a Call allows you reserve a buy price (the strike) over a certain period of time. For example, you may buy a Call to buy 100 barrels of oil at $43 strike until the end of this week. This option is shown in the image below on the ORE Web-platform, you can see it will cost a 46.19 USD premium to buy this option.

If oil price rises above $43 by Friday the Call option’s value will increase and you may profit; if oil price rises above $43.92 by expiry you will profit at least 100% and if it falls below $44.38 you will profit at least 200%. If oil does not fall your maximum risk is 46.19 USD. To increase the premium size (and thus the risk and profit potential) you may increase the trade ‘amount’.

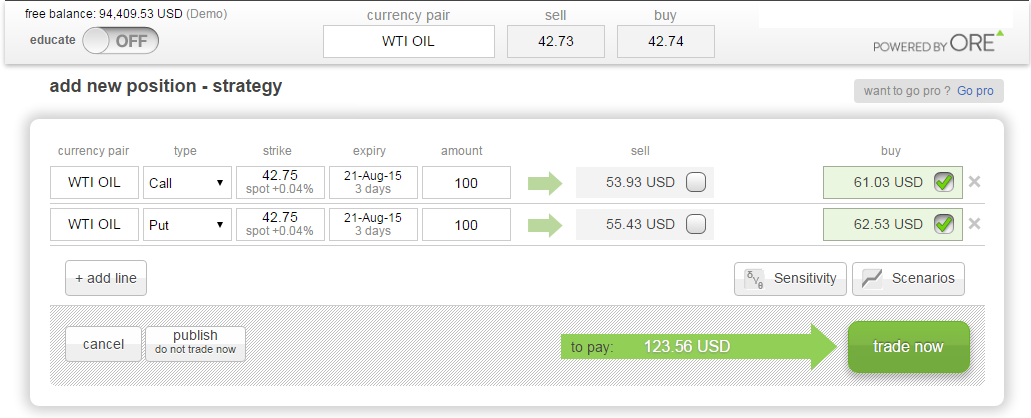

If you think volatility will increase yet you do not have a view on direction, you may buy a Put and a Call option at the same time. Both the Put and the Call have the same strike, expiry date and amount. This option strategy is known as a straddle and returns a profit as long as the market moves significantly up or down.

The image below is an example trade setup on the ORE web-platform. Here the strike is $42.75 to expire on Friday. It costs 123.56 USD to enter this position. If oil prices rises above $74 or falls below $71.51 by Friday a profit will be made - Profit potential can be checked using the Scenario trading tool.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD stays under pressure near 1.0550 on renewed USD strength

EUR/USD holds lower ground near 1.0550 on Wednesday. The US Dollar benefits from rising US Treasury bond yields and the cautious market mood, forcing the pair to stay on the back foot. Several Federal Reserve policymakers will be delivering speeches later in the day.

GBP/USD declines toward 1.2650, erases UK CPI-led gains

GBP/USD loses its traction and retreats toward 1.2650 on Wednesday. Although the stronger-than-expected inflation data from the UK helped Pound Sterling gather strength, the risk-averse market atmosphere caused the pair to reverse its direction.

Gold stays below $2,640 as US yields rebound

Gold struggles to hod its ground and trades below $2,640 on Wednesday. Following Tuesday's slide, the benchmark 10-year US Treasury bond yield stays in positive territory, making it difficult for XAU/USD to building on its weekly gains.

Why is Bitcoin performing better than Ethereum? ETH lags as BTC smashes new all-time high records

Bitcoin has outperformed Ethereum in the past two years, setting new highs while the top altcoin struggles to catch up with speed. Several experts exclusively revealed to FXStreet that Ethereum needs global recognition, a stronger narrative and increased on-chain activity for the tide to shift in its favor.

Sticky UK services inflation to keep BoE cutting gradually

Services inflation is set to bounce around 5% into the winter, while headline CPI could get close to 3% in January. That reduces the chance of a rate cut in December, but in the spring, we think there is still a good chance the Bank of England will accelerate its easing cycle.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.