FX markets face a tug-of-war: A scenario analysis

Key points

-

Mixed economic signals impacting market sentiment: Recent data, including stronger-than-expected retail sales and lower jobless claims, have boosted market sentiment, leading to a more risk-on environment. However, caution is warranted due to the influence of summer liquidity and expectations of aggressive rate cuts.

-

USD faces contrasting forces: The USD is affected by rising Treasury yields, which support the dollar, and diminishing recession fears, which encourage risk-taking and typically weaken the USD. This duality complicates its outlook.

-

JPY's vulnerability amid opposing forces: The JPY is challenged by both rising US yields, which widen the yield differential and fuel carry trading, and reduced recession concerns, which diminish its appeal as a safe-haven.

-

Exploring scenarios for currency reactions: We explore four distinct scenarios—Goldilocks, Reflation, Recession, and Stagflation Concerns—to understand how different currencies might react based on the interplay of yields and recession risks.

Markets remain tense following the labor market shock in early August, which highlighted concerns around rising unemployment rate and fuelled recession concerns in the US.

The debate between a soft landing and a looming recession has been a central theme in market discussions, and we discussed this macro theme in detail in this article. However, yesterday brought a more risk-on sentiment, driven by a variety of data and earnings reports, particularly:

-

US July Retail Sales: A stronger-than-expected 1% month-over-month increase against expectations of 0.4% highlighted a robust consumer sector.

-

Jobless claims: Weekly claims came in lower at 227k, further bolstering market confidence and reducing the risks of a rising unemployment rate.

-

Walmart earnings: The retail giant reported better-than-expected comparable sales and raised its profit outlook, citing a stable consumer base.

Despite this risk-on sentiment, it's crucial to consider the potential limitations of these positive signals which could have played a significant role in these reactions. These include:

-

The extreme market positioning and the expectations of aggressive rate cuts from the Fed.

-

Low liquidity typical of the summer months played significant roles in these reactions.

Consequently, these outcomes should be viewed with caution, especially considering some key caveats:

-

July Retail Sales: The increase was largely driven by auto sales, which might not fully represent broader consumer strength.

-

Jobless claims: These figures tend to be volatile during the summer, making them less reliable.

-

Walmart's performance: The positive results could be attributed to the trade-down effect, where consumers shift from more expensive retailers to more affordable options like Walmart.

USD faces opposing forces, but colluding risks for JPY

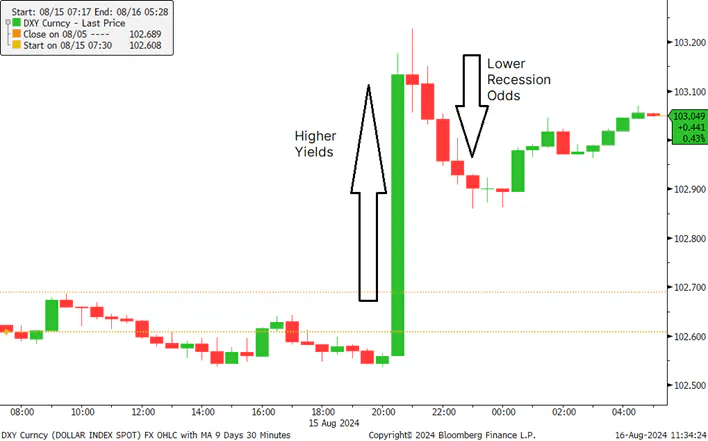

These developments led to higher US Treasury yields as markets questioned the likelihood of a 50bps rate cut by the Federal Reserve in September. Simultaneously, the reduction in recession odds still fostered a risk-on sentiment.

The US dollar (USD) got caught between two contrasting dynamics. On one side, rising Treasury yields are boosting the dollar, reflecting confidence in the US economy and attracting yield-seeking investors. On the other side, diminishing recession concerns are driving a risk-on environment, which typically puts downward pressure on the USD as investors turn to higher-yielding, riskier assets.

Source: Bloomberg. Disclaimer: Past performance does not indicate future performance.

For the Japanese yen (JPY), however, both scenarios have proven challenging, leading to a double whammy. Rising US yields have widened the yield differential with Japan which fuels carry trading, weakening the yen. Meanwhile, the reduction in recession concerns has spurred risk-on flows, further eroding the yen's appeal as a safe-haven asset. As a result, the JPY has erased all its gains since the August 2 US jobs report, underscoring its vulnerability to these opposing forces.

Source: Bloomberg. Disclaimer: Past performance does not indicate future performance.

Given the increasingly complex macro landscape, it’s crucial to assess how different currencies might react under four distinct scenarios, defined by the interplay of yields and recession risks.

Scenario 1: Rapidly softening inflation, strong growth (Goldilocks)

Market dynamics: Expectations for rate cuts remain, but recession concerns ease. This creates a "Goldilocks" environment where growth is strong enough to avoid a downturn, but inflation is softening.

Currency impact: Mildly bearish for the USD as the Fed could still cut to ensure a soft-landing. Gains in Emerging Market (EM) currencies and commodity currencies like AUD as risk appetite improves and global demand stabilizes.

Scenario 2: Stalling/higher inflation, strong growth (reflation)

Market dynamics: Inflation stalls but remains elevated, while growth remains robust. This leads to the market paring back expectations of rate cuts, reducing recession fears.

Currency impact: USD is mixed as yields rise higher, but risk-on sentiment prevails. AUD and GBP gain amid risk-on sentiment. Haven currencies like JPY and CHF underperform with higher US yields fuelling more carry trading and haven demand wanes.

Scenario 3: Softening inflation, weaker growth (recession)

Market dynamics: The Fed engages in aggressive rate cuts to mitigate the economic slowdown.

Currency impact: Support for Fed rate cuts and recession concerns, both, push the haven currencies like JPY and CHF higher. These currencies outperform as investors seek safety amid economic uncertainty.

Scenario 4: Rising inflation, weaker growth (stagflation concerns)

Market dynamics: Stagflation fears drive haven flows into the USD. This environment could pressure the central banks, particularly the Fed, to prioritize inflation control over growth.

Currency impact: USD strengthens as a safe haven, with flows moving away from riskier assets. Commodity currencies and EM currencies suffer as the combination of high inflation and weak growth dampens risk appetite and global demand.

Read the original analysis: FX markets face a tug-of-war: A scenario analysis

Author

Saxo Research Team

Saxo Bank

Saxo is an award-winning investment firm trusted by 1,200,000+ clients worldwide. Saxo provides the leading online trading platform connecting investors and traders to global financial markets.