The big news of the domestic session is China shutting its stock market after plummeting into ‘limit down’ territory. Essentially this means the market’s fallen too much (more than 5%) and the market has shut for 15 minutes. After re-opening the lower most limit of 7% was breached and markets subsequently closed for the day. From what I can decipher markets will open as normal again tomorrow, but not before the PBoC and the CFFE get stuck into stemming the rout somehow and perhaps find the source of the extraordinary selling.

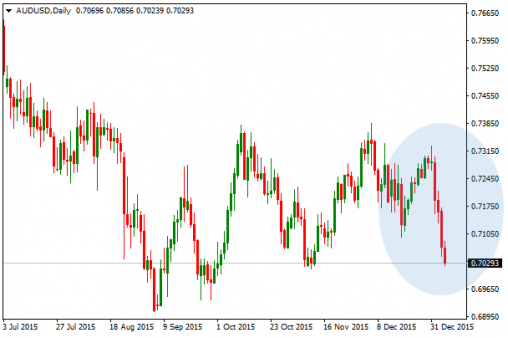

This is of course not good news for the local unit. The Australian dollar has entered its fourth consecutive day of losses, sinking below 71-figure in the US trading sessions and now eyeing 70 US cents. Broadly speaking, Chinese concerns and losses across commodity markets have prompted a general lean towards the Greenback and Yen – which is a good indication that the appetite of market participants have little tolerance for risk assets. The Yen’s the ultimate winner with the USDJPY pair falling below the 118-figure.

The Aussie and Kiwi are getting smashed across the board, but not more than against the Yen which is of course the preferred currency in times of adversity.

Aussie slides – AUDUSD Chart by MT4There’s been much talk in the press recently about the falling Yuan, known as the Renminbi or RMB (CNY). While the PBoC have the capacity to set the daily trading range for the (onshore) Yuan, lower limits continue to be breached, forcing the hand of China’s Central Bank to continue to lower the daily trading range. Meanwhile, the offshore RMB (CNH), which trades in major hubs such as Hong Kong, London, Singapore among other locations, is trading at a (growing) discount to the onshore price. This discrepancy could be seen as a reflection of lower confidence in the region, notwithstanding the PBoC’s efforts to control the depth and ferocity of the decline.

To provide a little background, in recent years China has been taking active steps to internationalise their currency by establishing offshore trading hubs. The internalisation of the RMB (by introducing external, offshore trading hub) provides China a greater capacity to deal in its own currency with the rest of the globe, rather than settle transactions in US dollars or other currencies.

The below chart represents the performance of the CNY (onshore) against the CNH (offshore) over the last 12-months. As we can see, since Oct/Nov there’s been a material rise in value.

CNY/CNH – Chart by BloombergPerhaps a better way of looking at it is by overlaying price action. As we can see below, the CNH is trading at a (growing) discount.

CNY & CNH – Chart by Bloomberg

Risk Warning: Trading Forex and Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. The FSG and PDS for these products is available from GO Markets Pty Ltd and should be considered before deciding to enter into any Derivative transactions. AFSL 254963. ABN 85 081 864 039.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.