FX doesn’t always move in same direction

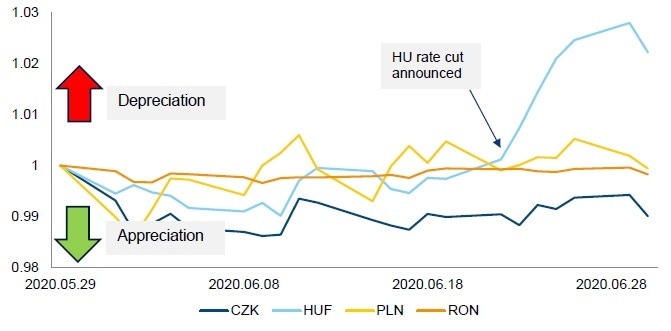

Regional currencies started to diverge in June, which highlights the importance of following local factors. The MNB could be especially in focus for the forint. CEE FX is not immune to global sentiment changes, however. So investors should also watch news about the coronavirus.

Not just external sentiment

As global market momentum somewhat deteriorated in mid-June, CEE currencies also could not appreciate much further. Local factors have become increasingly important. For one, the PLN shows less co-movement with its peers due to its higher stability. But authorities in Poland have sent conflicting messages. The central bank said that the PLN is too strong to help the economy, which attracted attention due to the possibility of intervention, while the FinMin warned that the zloty is a bit too weak. But even these conflicting views did not get the EURPLN out of its narrow trading range. We expect similar levels for the upcoming months.

The MNB set a clearer path for the HUF last week, which led the forint to strongly underperform its peers. First, the surprising cut sent the forint much weaker. Second, another round of easing was flagged for July just days after the first cut resulted in the further depreciation of the forint. The April increase of de-facto rates by 95bp demonstrated, however, that the MNB does not want to see the forint tumbling too much. Therefore, while volatility could remain high at current EURHUF levels, we do not see the forint falling much more in the upcoming months.

There is much less to report about other currencies in the region. The CZK appreciated the most in June. Monetary policy is now in wait-and-see mode in Czechia. The Croatian kuna is anchored by the prospects of ERM II entry this year. Euro adoption may regain some attention after the elections over the weekend and Germany taking over the EU presidency as of July 1. The Romanian leu is being kept stable by the NBR. However, FX weakening could still be one of the methods used to trim the trade balance shortfall, so we penciled in such development for this year. The RSD is stable due to the large firepower of the NBR and relative attractiveness of its real yields.

Relative performance vs. euro

Country overviews

EURHRK – all set for ERM II entry

With the initial COVID-19-related stress subsiding, the HRK outlook has been supported by the news that the ECB provided a EUR 2bn swap line to the CNB. Apart from increasing CNB firepower, the move also signaled that ERM II entry in 2020 remains on track. Hence, with the exchange rate moving around 7.55, following EUR 2.5bn spent in March, the CNB has since taken a break from FX interventions . We stick with our forecast that we would see the HRK predominantly in the 7.50-7.60 band, with an average of around 7.57 and the CNB looking to tame excess volatility going forward.

EURCZK – koruna strengthened recently

The koruna appreciated at the beginning of June. For the coming quarters, we expect it to strengthen further and reach approx. EURCZK 26 at the end of this year. Firstly, the gradual recovery of foreign demand will renew the convergence of the Czech economy towards more developed countries. Secondly, the koruna is still weaker compared to its economic fundamentals, mainly because of the recent capital outflow during the outbreak of the crisis. Thirdly, we see room for the CNB to hike in 2021.

EURHUF – brace yourselves for higher volatility

The recent forint depreciation erased previous outperformance of the HUF in 2Q20. The surprising policy rate reduction carried out at the end of June, however, put the currency again on a weakening path. Still, the April tightening demonstrated that the MNB does not want to see the forint tumbling too much. As short-term rates could stabilize at somewhat lower levels than previously expected, we have increased our point estimate for EURHUF to 350 for 2H20. The volatility of the forint is set to remain high.

EURPLN – focus on local sentiment

Swings in global sentiment as well as increasing risk-off mood due to growing market concerns about the economic recovery and potential second wave of the pandemic have influenced the zloty, which weakened recently. Furthermore, after the last MPC meeting, the central bank expressed concern about the zloty remaining strong despite global turmoil that could dampen the recovery of the Polish economy. All in all, the EURPLN went up to 4.45 and remains locked around that level. We expect the zloty to focus on global factors and remain broadly unchanged. Any strong change in global sentiment could result in a sharp reaction from the zloty

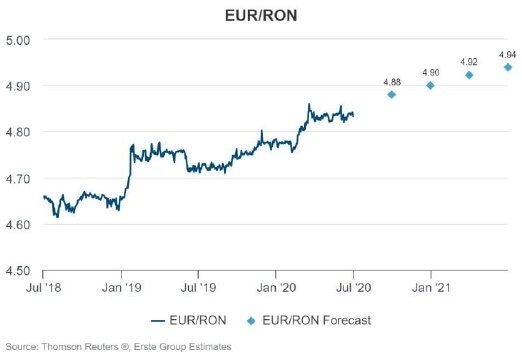

EURRON – NBR keeps currency under control

The NBR is likely keeping a tight grip on the EUR/RON, which has recently traded in a tight range of less than 1pp. We believe that a weaker RON should be one of the solutions used to correct the trade balance shortfall and we expect a gradual weakening trend over the medium term, especially as the COVID-19 demand shock and lower oil prices are likely to keep inflationary pressures at bay. We expect the EUR/RON to trade at 4.90 by year-end.

EURRSD – one of most stable currencies in world

The phrase 'don't fight the central bank' nicely summarizes FX developments in Serbia. The dinar is one of the most stable currencies in the world YTD as, in the first five months, NBS sold a net amount of EUR 875mn, or 6.1% of total foreign reserves. The central bank has plenty of ammunition and, given Serbia's relatively favorable fundamentals, still steady FDI inflows, and the attractiveness of its real yields, we expect depreciation pressures to slowly abate. The EUR/RSD will continue to trade in a tight range around 117.5 throughout the year.

Author

Erste Bank Research Team

Erste Bank

At Erste Group we greatly value transparency. Our Investor Relations team strives to provide comprehensive information with frequent updates to ensure that the details on these pages are always current.