Gold continues to trade close to its lowest level for 3 years, although it is in recovery mode today, attempts to get above $1,260 have been futile in the last few sessions. While $1,200 appears to be decent support for now, there is a nagging fundamental concern that continues to keep me nervous about the outlook for gold: inflation expectations in the US.

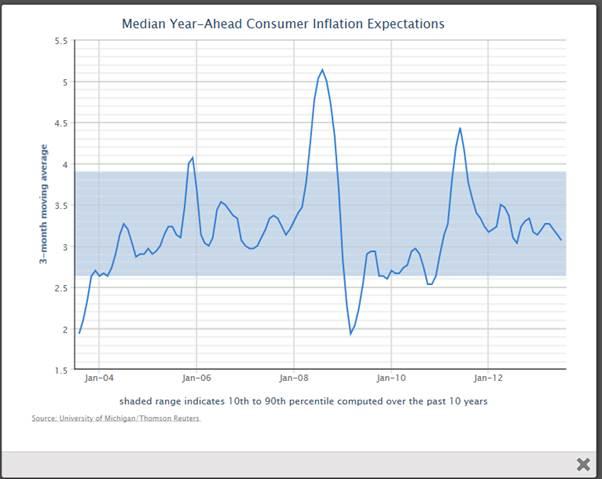

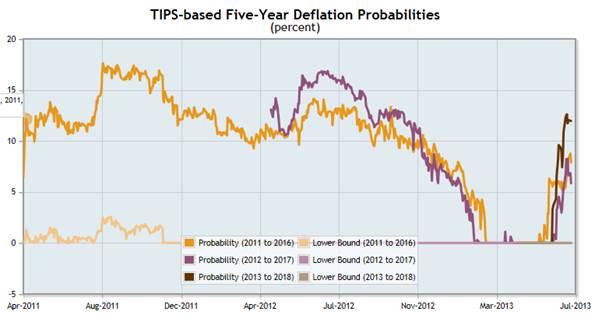

There are two charts that are worth watching: The University of Michigan/Thomson Reuters measure of consumer inflation expectations for the year ahead, which fell further last month and are close to its lowest level in 11 months. Added to this, the Federal Reserve Bank of Atlanta’s 5-year deflation probabilities report from last week may have ticked down from 13% to 12%, but it remains close to its lowest levels since November 2012, before the rallies started in the stock market and in the USD.

One of the key drivers of gold is its status as an inflation hedge, thus, this data further erodes the attractiveness of the yellow metal.

So what’s new about falling inflation?

But what is new about falling prices in the US? CPI inflation has been falling steadily after reaching a high of 3.9% in late 2011. Since February, US CPI has been below the Federal Reserve’s 2% target rate. Likewise, consumer inflation expectations have been heading south since peaking in May 2011.

However, in the last few weeks something new has happened: Treasury yields have risen at their fastest pace since 1987 and the 10-year yield is close to 2.7%, while the 30-year mortgage rate is at 4.7%, both the highest levels for nearly 2 years. Added to this, the Fed may start tapering its QE3 programme as early as September, which could keep upward pressure on interest rates in the medium-term.

Rising rates tends to keep the consumer subdued, which could keep inflation expectations under wraps for some time; it could also keep the probability of deflation firmly on the horizon.

Technical outlook

This keeps us sceptical on any recovery in the gold price in the near term and why we think that a move higher could be met with a wall of selling pressure.

In the short term, any move back to $1,270 (last week’s high) and then $1,310 – the high from 24th June, could thwart the upside.

Figure 1: Consumer inflation expectations

Source: University of Michigan/Thomson Reuters

Figure 2: Deflation expectations

Source: Federal Reserve Bank of Atlanta

CFD’s, Options and Forex are leveraged products which can result in losses that exceed your initial deposit. These products may not be suitable for all investors and you should seek independent advice if necessary.

Recommended Content

Editors’ Picks

AUD/USD weighed down by China, tariffs

AUD/USD remained on the back foot, slipping back to the area of multi-year lows around 0.5950 on the back of mounting fears surrounding tariffs and their impact on the Chinese economy.

EUR/USD refocuses on 1.1000 amid tariffs jitters

EUR/USD reversed two daily pullbacks in a row an d managed to advance to the boundaries of the 1.1000 barrier on the back of fresh weakness hurting the US Dollar and persistent tariff fears.

Gold erases gains, back to the $2,980 zone

Gold prices now lose extra ground and slip back to the area of daily troughs near $2,980 mark per troy ounce following an unsuccesful attempt to maintain the trade above the critical $3,000 level earlier in the day.

XRP drops 3% as Ripple announces $1.25 billion acquisition of prime brokerage firm Hidden Road

Ripple announced on Tuesday that it is acquiring prime brokerage firm Hidden Road to enhance its institutional offerings and increase the adoption of the RLUSD stablecoin and the XRP Ledger (XRPL).

The Fed is looking at a hefty price level

We are still in thrall to tariffs, the faux-macro “data” driving markets. The WSJ editorial board advised other countries to take their tariffs to zero so that Trump’s “reciprocal” tariffs will have to be zero, too. Cute, but no cigar.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.