FTSE 100 plays catch up and nears 8,000

Major central banks opened the door to rate cuts this week, this triggered an ‘everything rally’, and stocks are on course for their best week of the year. Perhaps the biggest shock of the week is the FTSE 100, which set a fresh record high on Friday. The countdown is now on for a move to 8,000 for this index, as it enjoys its own ‘everything rally’ with most sectors registering gains.

FTSE 100 beats Europe and the US

The UK’s main blue-chip index has been an outstanding performer, and is currently higher by 2.8% this week, beating the Eurostoxx 50, which is higher by 0.8%. It has also performed better than the S&P 500, which is up by 1.77% and the Nasdaq, which is higher by 1.69% so far. The market rally this week was driven by news that central banks have shifted to a more dovish stance. At the Bank of England, Catherine Mann and Jonathan Haskel, the two remaining hawks at the BOE who had been voting for more rate hikes, changed their tune and opted for rates to remain on hold this month. The dovish shift in the BOE vote split is seen as a major step towards cutting rates later this year. The market now thinks that the first rate cut will come in June, and that there will be 3 rate cuts this year. Just last week, the market thought the first rate cut would come in August and that the BOE would only cut twice this year.

FTSE 250 could also play catch up

This shift in rate cut expectations from the BOE is like a red flag to a bull, and markets have rallied sharply. The FTSE 250 has also made strong gains this week, and although it is not at a record high, it is only 400 points away from the record high made in 2021.

UK consumer continues to spend in February

The economic data is also helping this index. Retail sales for February were better than expected. Core retail sales rose by 0.2% on the month, better than the -0.1% expected. CBI trends for manufacturing orders in March was also better than the rate for February at -18, vs. -20. The manufacturing sector is also getting more optimistic, with expectations for the volume of orders in the next three months doubling from +4 in February to +8 in March.

Cheaper valuations for FTSE 100 enhances its attractiveness

Although the FTSE 100 has defensive qualities that usually don’t rally when markets are given a cyclical boost from rate cut expectations, the ‘everything’ rally this week, means that the FTSE 100 is benefitting even more than the other indices because it was cheap. The P/E ratio for the FTSE 100 is 12, for the S&P 500 it is 25. If the ‘everything rally’ persists and risk sentiment holds up, then there could be further upside for the FTSE 100.

Top quality UK stocks coming back into focus

It is worth noting that some members on the FTSE 100 have had a very strong 2024 so far. For example, Rolls Royce is higher by 40%, Beazley is up by 32% and Flutter is higher by 23%. In the past month alone, Rolls Royce is higher by 17%, Lloyds Bank is up by 14%, Glencore is up by 13% and Rentokil is up by 11%. Thus, while it has been easy to dismiss the FTSE 100 as US tech giants steal all of the glory, some UK companies have made an astounding comeback, and the FTSE 100 will be in focus as we move into Q2.

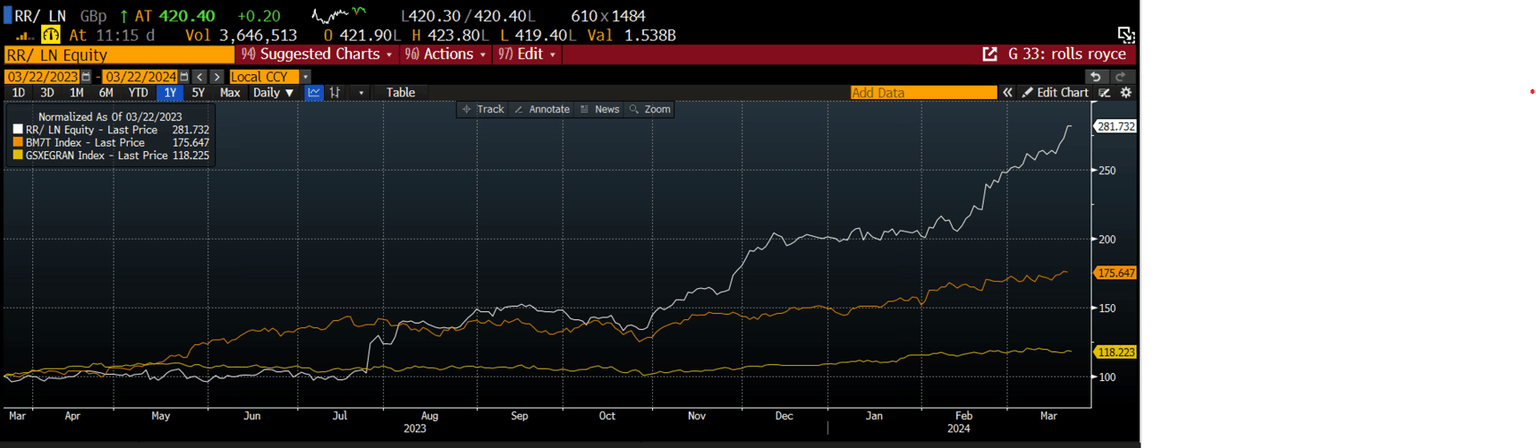

Rolls Royce: One of world’s top performing stocks

The chart below shows Rolls Royce (white), the Magnificent 7 US tech stocks (orange line) and the European Granolas (yellow line). This chart has been normalized to show how they move together on a relative basis. As you can see, Rolls Royce has outpaced them all. Rolls Royce was starting from a lower base, but a strong set of results for 2023, a positive welcome to the new CEO and a cheap valuation has worked in Rolls Royce’s favor, and this stock is one of the best performing in the world right now.

Chart one

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.