From price controls to mass starvation

From taxes to spending, Kamala is the most left-wing major party candidate since George McGovern -- who proposed a Universal Basic Income in 1972 and went on to win a single state.

But her most hare-brained scheme -- so far -- has been price controls, where she's to the left of McGovern, threatening to punish grocery stores for daring to charge more than their costs.

In fact, grocery stores make 1 to 2 pennies on the dollar. Meaning they have to pass along costs that come straight from the Washington money printer.

That means price controls would, in short, break food.

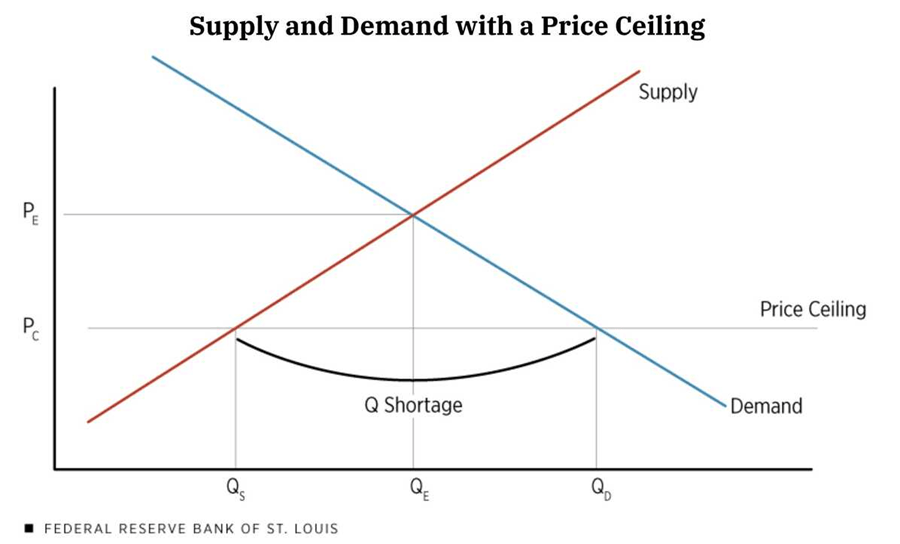

Price controls always fail

In a recent video I mentioned how price controls have been tried many times, and each time they failed so spectacularly they were repealed. After much pain, suffering, and empty shelves.

When France tried, they got a black market that actually did price gouge. Even Venezuela repealed price controls in 2016 after food shortages and nationwide riots.

But what do price controls look like in reality? For that I go to a great thread by Robert Sterling, a former M&A executive at one of the biggest food producers in America.

Robert walks us through a thirteen step process from grocery price controls to widespread food shortages -- something we haven't seen in this country since the Great Depression, when FDR also imposed price controls.

Stage one: Bankrupt grocers

So, first, the government announces grocery stores can't raise prices even though inflation continues -- courtesy of the Fed and Wall Street. That means their costs keep going up, so those pennies of profit turn into losses.

Like any business that's losing money, they shut down.

Of course, not all grocery stores are created equal -- small ones lack economies of scale, and while rich people buy high-margin vegetables and expensive cuts, the poor buy low-margin packaged foods.

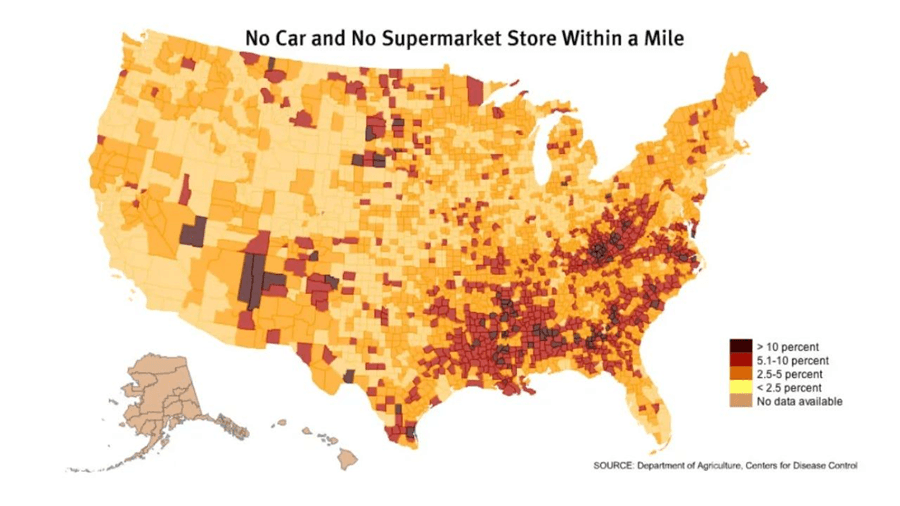

So the small stores and the low-income stores go first.

You get food deserts, as people in urban centers or rural areas have to drive miles -- or take multiple buses -- to find food. And, ironically, you get more concentration, as the little guys drop out.

The survivors increasingly aren't even selling food. They shift shelf-space to things that aren't price-controlled. Clothing, furniture, supplements.

Grocery stores start to look more like a Dollar Store, with a little food and a lot of junk.

As cities clear of food, you'd need police patrolling parking lots and armed escorts on delivery trucks -- perhaps you could even have government-run groceries like Chicago just announced.

Stage two: Bankrupt food producers

The only way to save any grocery stores is to price-control their costs. Meaning food producers like Kraft, Heinz, Tyson, Hormel.

Of course, again, Kraft's costs aren't being controlled -- their ingredients, wages, parts and electricity. So now they're losing money.

Like groceries, they wind down, closing marginal factories and running out equipment then not replacing it.

As food producers downsize or go under, now you start getting actual shortages. And the only solution -- once again -- is price control the next level down. Farmers.

Stage three: Bankrupt farmers

Which brings us to the final stage. Because remember Farmers, too, are now forced to sell at a low price, yet their inputs like fertilizer or tractors are still going up.

They, too, go under.

You are now full Venezuela, with the only alternative to starvation a complete government takeover of the food supply, centrally planned from farmer to grocer.

As Sterling puts it, "The government will struggle to operate one of the most complex industries on the planet. The entire food supply chain starts imploding."

“Imploding” as in starvation.

What’s next

It's very unlikely we'll get to the point of starvation. For the simple reason that at some point the frog boils and the voters -- or rioters -- share their thoughts with policymakers.

That's exactly why price controls fail, from France to Venezuela.

Having said, we managed it before under FDR.

And, unfortunately, if the morons running Kamala's brain trust are dumb enough for price controls, they're dumb enough for a whole lot more.

(Article image is Florence Thompson "Migrant Mother," a migrant pea farmer family by Dorothea Lange in March 1936)

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Peter St. Onge, PhD

Money Metals Exchange

Peter St. Onge writes articles about Economics and Freedom. He's an economist at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University. His website is www.ProfStOnge.com.