Fresh SPX bull run, or dead cat bounce?

S&P 500 retested the breakout above Apr 9 euphoric highs (the tariff delay news) Friday premarket only to overcome it following positive revisions to UoM consumer data. While the sectoral view was clearly risk-on as predicted (incl. tech outperformance), advance-decline line and volume didn‘t totally confirm. As S&P 500 is approaching mid Mar lows, that leaves a few non-confirmations in place, but following the exhaustion of sellers last couple of days, the closing bell price action was still decent.

And that‘s a part of what matters to me – rotations are the strength of bull uplegs, and given that we‘re one mean tweet away from fresh decline, profits must be taken when they‘re there, both swing and intraday, which is exactly what we‘ve been doing with clients ever since I found it very interesting to call for a long entry during Thursday‘s premarket correction (the unsuccessful attempt to close the Trump gap).

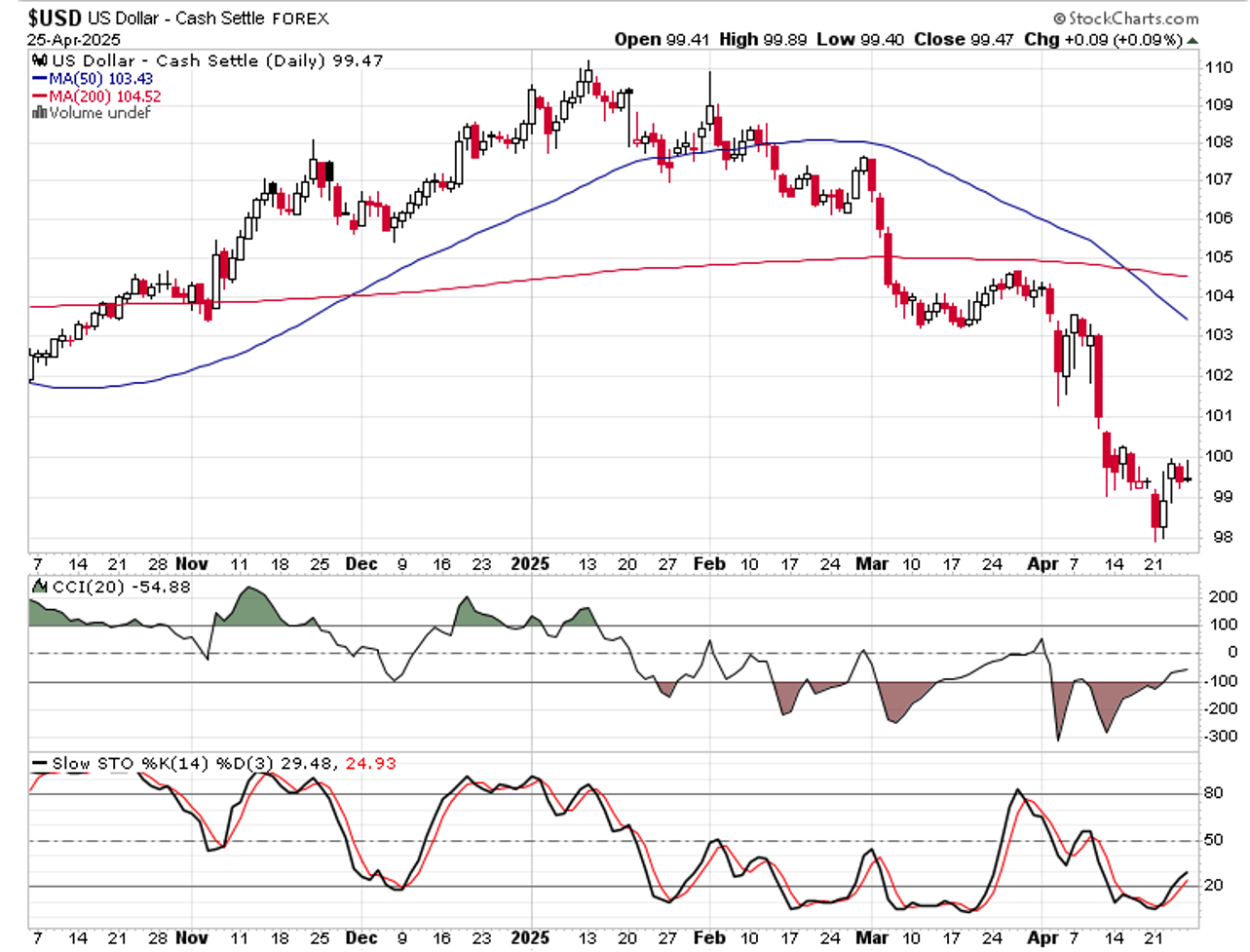

Consumer discretionaries have woken up, defying the recession fears and China tariff standoff – this is a very encouraging sign short-term, however we must keep the longer-term picture in mind – as yields are declining, that‘s a sign about slowing economic growth – and USD decline stands in the way of greater S&P 500 appreciation… I have talked already about international markets beyond DAX many times, and midweek this served as well in capturing long profits.

The same goes for gold reversal called, BTC ascent likewise (becoming clear the prior weekend)… and now we have to count with silver still underperforming the yellow metal, copper reasonably resilient and oil stabilizing in the $62 – $64 area, no surprise to Trading Signals clients.

What are the signs for risk-taking next week? It‘s notable that for all the Treasuries selling that I ascribed to Japan rather than to China, USDJPY is rising again, and that‘s probably the best sign for the still languishing USD.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.