Forex trends and patterns before the US CPI release

CADJPY longs at the buying opportunity at 9730/10 worked on the bounce to what should have been strong resistance at 9780/90 but we only paused here before we shot higher to retest last week's high at 9900/05. I still think we should have strong support at 9800/9790 today, but longs need stops below 9775.

Looking at the daily chart, we are stuck in a 4 month, 600 pip sideways channel. Note how the 50, 100 & 200 day moving averages are pointing in different directions on the (attached) NZDUSD daily chart as we trade sideways & the averages begin to flat line - a confusing outlook. The same thing is happening on the CADJPY daily chart.

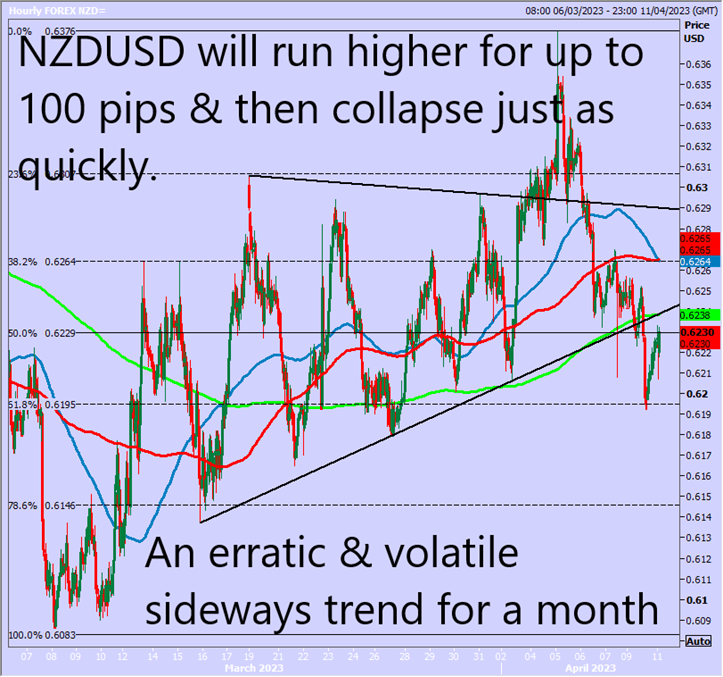

NZDUSD will run higher for up to 100 pips & then collapse just as quickly 7 wipe out the whole gain as we trade in an erratic & volatile sideways trend for a month - looking at the daily chart we are up for a day or 2, then down the for a day or 2.

We could have strong resistance at 6240/60.

Gold broke the best support for the day at 1998/95 as we enter a small correction to hit the next target of 1982/79. A low for the day exactly here. The 1982/77 area should be very strong support (although I have been surprised how we did not manage to hold the 2 higher support levels).

Longs at 1982/77 stop below 1973. A break lower can target 1960/58.

Targets for longs are 1996/98 & above 2000 look for 2010/12. We are in a bull trend so if we continue higher look for 2020 before a retest of 2030/31.

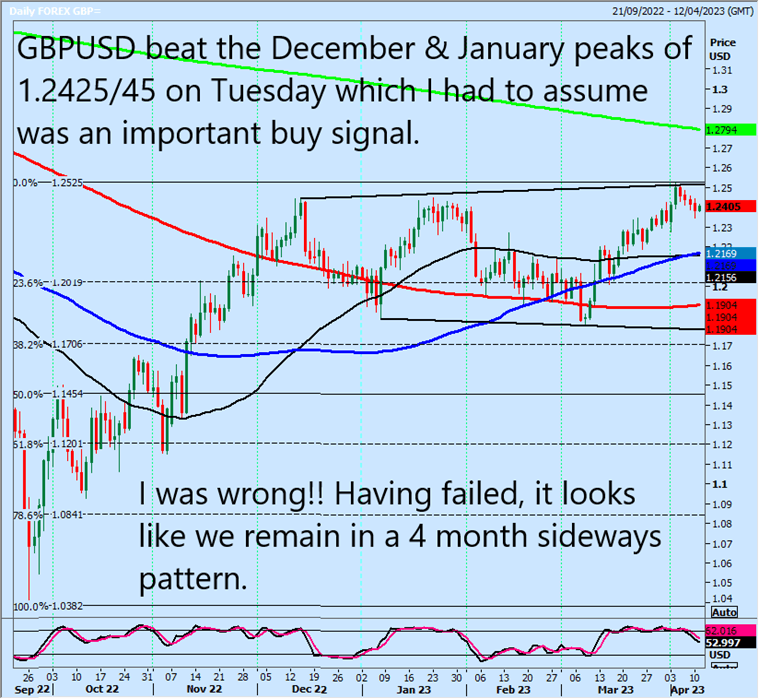

GBPUSD beat the December & January peaks of 1.2425/45 on Tuesday which I had to assume was an important buy signal.

I was wrong!! Having failed, it looks like we remain in a 4 month sideways pattern. The pair should have support at 1.2365/45. Longs need stops below 1.2335. A break lower can target 1.2300 & 1.2250.

EURUSD broke strong support at 1.0875/55 & traded down to 1.0830. Everything hinges on tomorrow's US CPI release. The pair is in a 6 month bull trend but having failed to beat the 100 week, 500 day moving averages & the January high it is looking increasingly like we are establishing a 500 pip sideways channel as the moving averages flat line on the daily chart.

Today we could have resistance at the 100 & 200 hour moving averages at 1.0890/1.0900. A break above 1.0920 however can target 1.0935, perhaps as far as 1.0970.

Failure to beat 1.0890/1.0900 targets 1.0840/30 then 1.0805/1.0795.

EURJPY remains in a volatile sideways channel, from the lower trend line at 139.50/139.00 up to the upper trend line at 145.30/50. We are about to test this resistance - shorts need stops above 145.75. A break higher therefore SHOULD be a buy signal targeting 146.00/10 & December high at 146.70/72. Note how the moving averages have completely flat lined over the past 5 months to confirm the total lack of direction. No other pattern to guide us.

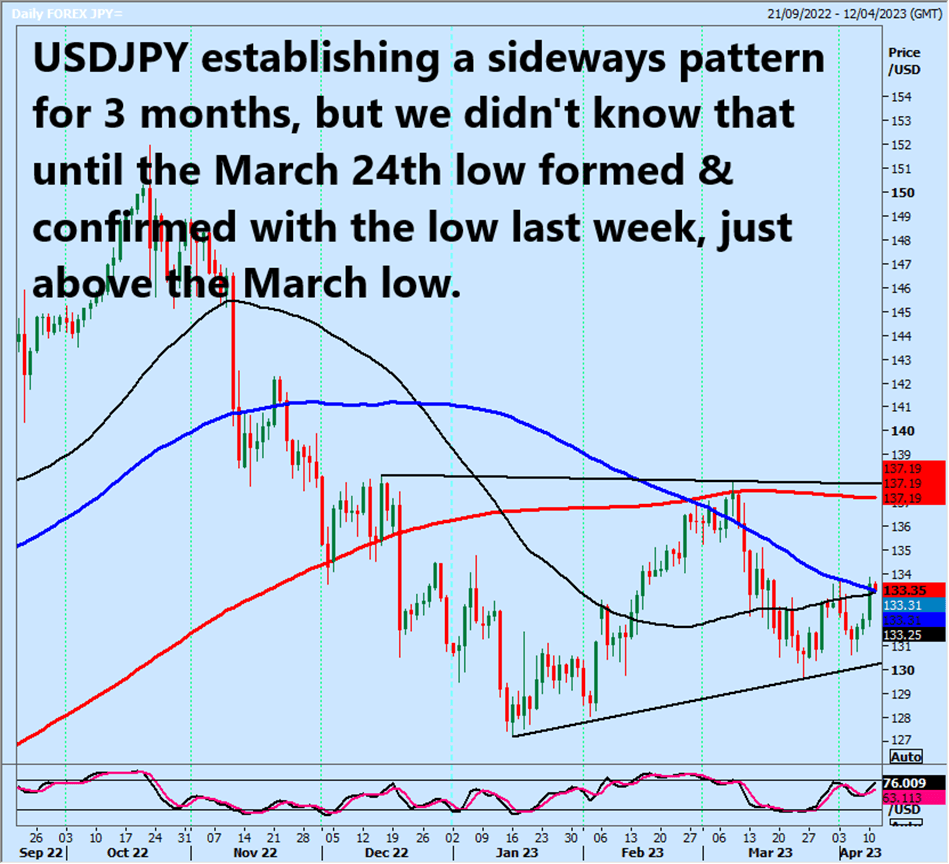

USDJPY has been establishing a sideways pattern for 3 months, but we did not know that until the March 24th low was established & confirmed with the low last week just above the March low.

We should have resistance at 133.60/80 today. A break above 133.90 should therefore be a buy signal targeting 134.70/80.

Author

Jason Sen

DayTradeIdeas.co.uk