Analysis for March 14th, 2016

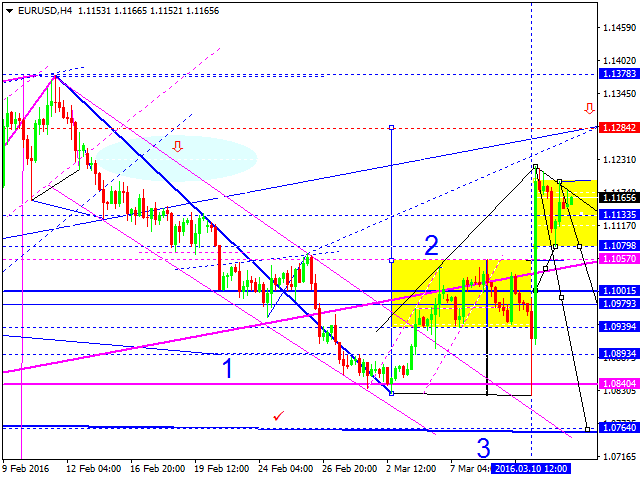

EUR USD, “Euro vs US Dollar”

Eurodollar has completed the descending wave and corrected it. We think, today the price may form another descending wave with the target at 1.1080 and then start consolidating. After breaking the minimums, the pair may continue falling towards 1.0980. An alternative scenario implies that the market may grow to reach 1.1285.

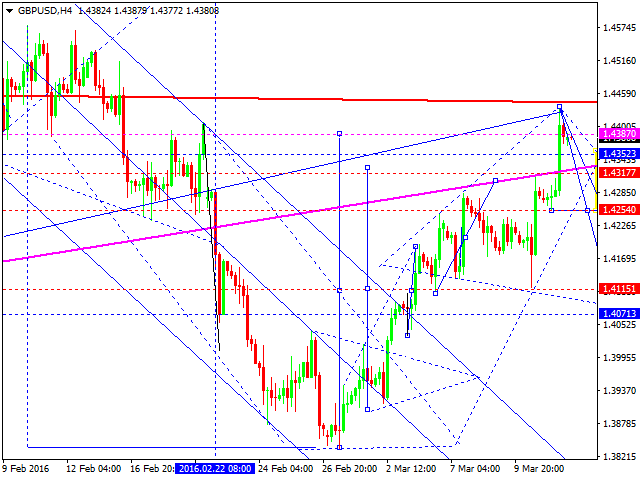

GBP USD, “Great Britain Pound vs US Dollar”

Pound has finished its ascending wave. We think, today the price may form another descending structure with the target at 1.4070. The first part is at 1.4254. After that, the pair may return to 1.4352.

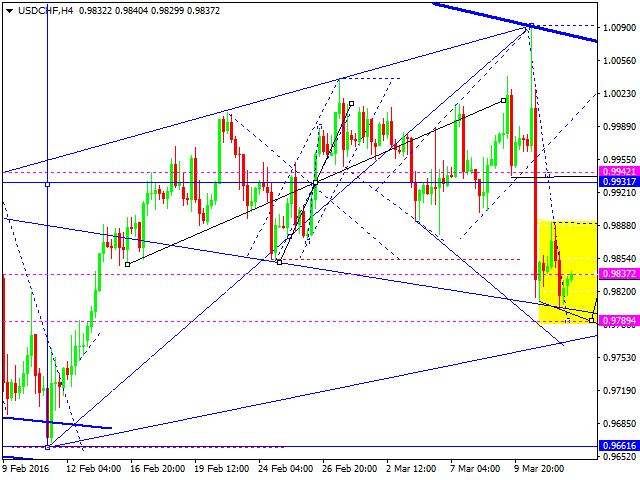

USD CHF, “US Dollar vs Swiss Franc”

We think, today Franc may grow to reach the target at 0.9942; the first target is at 0.9880. Later, in our opinion, the market may fall towards 0.9835 and then start another growth to reach the main target.

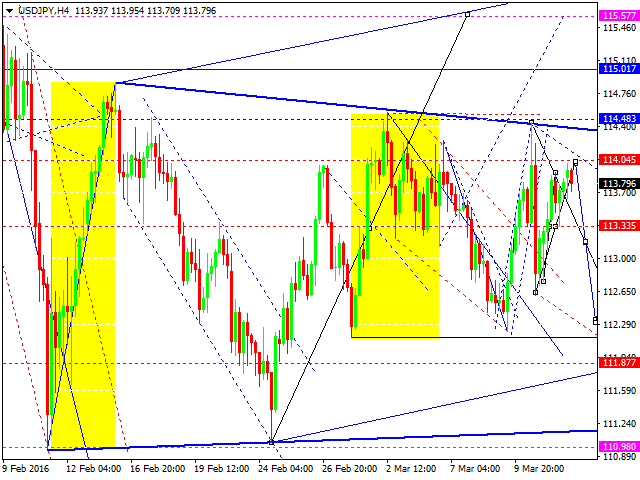

USD JPY, “US Dollar vs Japanese Yen”

Yen is forming the ascending structure towards 114.05. After that, the pair may fall to reach 111.83 and then return to 113.33, thus continue forming its consolidation channel. According to the main scenario, the pair may continue falling inside the downtrend. The next target is at 110.30.

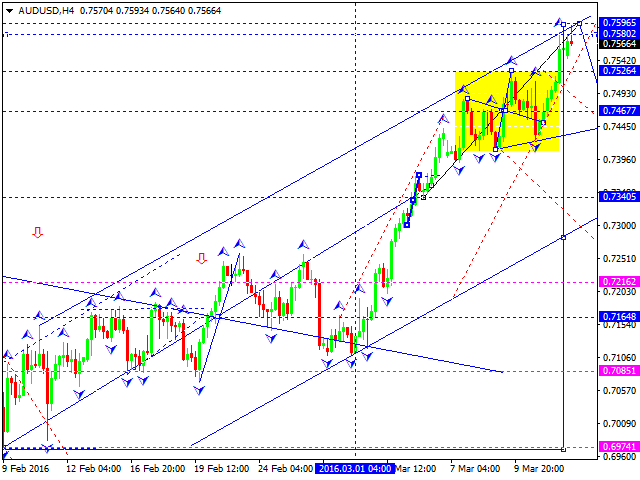

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is forming another descending impulse. We think, today the price may form the wave with the target at 0.7340 and then start another correction towards 0.7467.

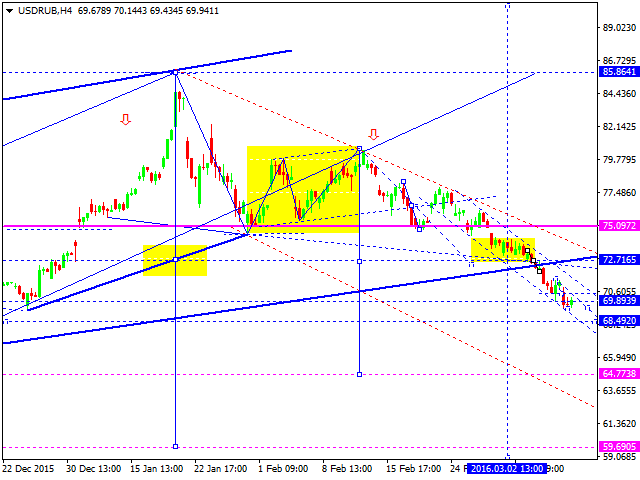

USD RUB, “US Dollar vs Russian Ruble”

We think, today Russian Ruble may be corrected towards 72. Later, in our opinion, the market may continue falling inside the downtrend to reach 65.

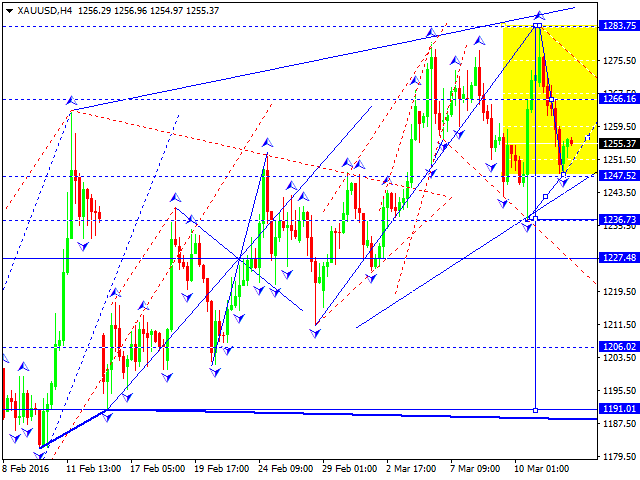

XAU USD, “Gold vs US Dollar”

Gold has completed its descending impulse and today is expected to be corrected towards 1266. Later, in our opinion, the market may fall to reach 1236. After breaking this level, the local target will be at 1206.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

Gold trades near record-high, stays within a touching distance of $3,100

Gold clings to daily gains and trades near the record-high it set above $3,080 earlier in the day. Although the data from the US showed that core PCE inflation rose at a stronger pace than expected in February, it failed to boost the USD.

EUR/USD turns positive above 1.0800

The loss of momentum in the US Dollar allows some recovery in the risk-associated universe on Friday, encouraging EUR/USD to regain the 1.0800 barrier and beyond, or daily tops.

GBP/USD picks up pace and retests 1.2960

GBP/USD now capitalises on the Greenback's knee-jerk and advances to the area of daily peaks in the 1.2960-1.2970 band, helped at the same time by auspicious results from UK Retail Sales.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

US: Trump's 'Liberation day' – What to expect?

Trump has so far enacted tariff changes that have lifted the trade-weighted average tariff rate on all US imports by around 5.5-6.0%-points. While re-rerouting of trade will decrease the effectiveness of tariffs over time, the current level is already close to the highest since the second world war.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.