Analysis for November 27th, 2014

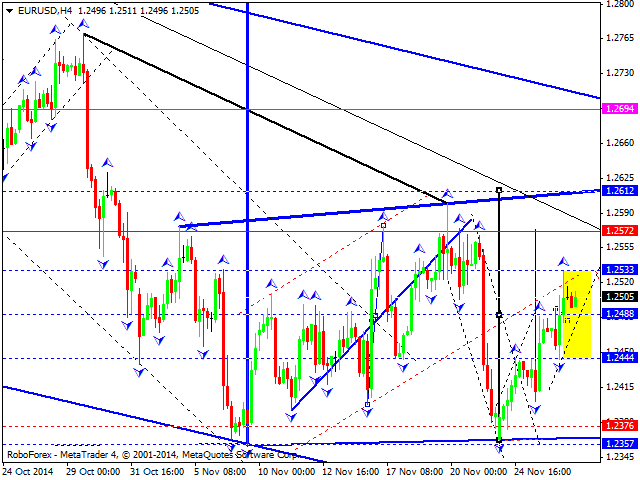

EUR USD, “Euro vs US Dollar”

Eurodollar is under pressure and continues moving upwards; the pair has formed a continuation pattern towards level of 1.2488. We think, today the price may test this level from above and then continue growing to reach the target at level of 1.2610.

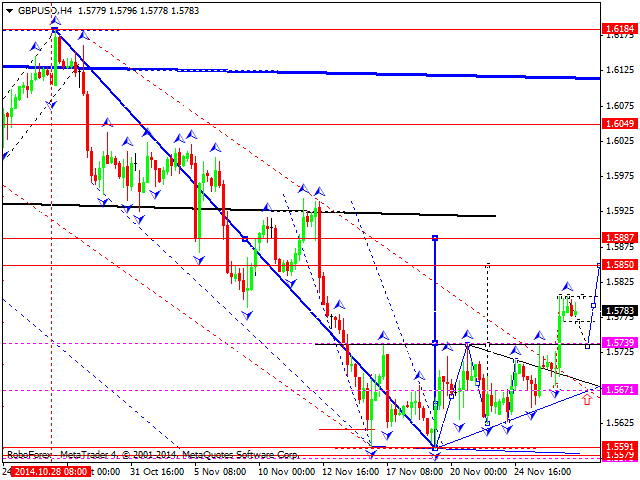

GBP USD, “Great Britain Pound vs US Dollar”

Pound has broken its consolidation channel upwards. We think, today the price may fall towards the channel’s broken border to test it from above and then continue forming an ascending wave to reach a local target at level of 1.5850. Later, in our opinion, the market may form the fourth structure as a correction towards level of 1.5740 and then the fifth one to reach level of 1.5888.

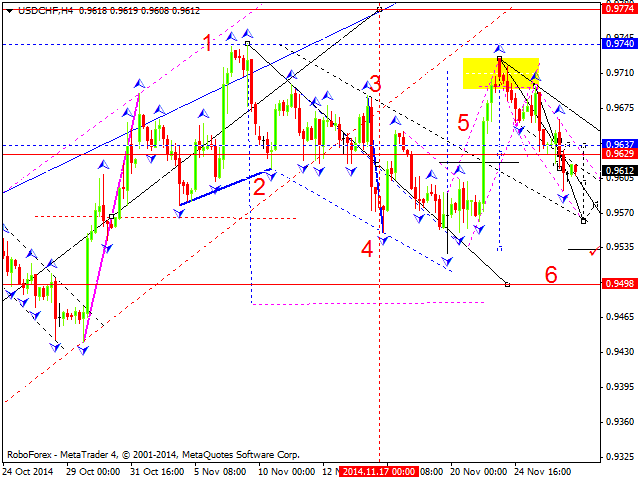

USD CHF, “US Dollar vs Swiss Franc”

Franc is under pressure and continues moving downwards; the pair has formed a continuation pattern near level of 0.9629. We think, today the price may test the broken level from below and then continue falling towards the main target of this extension at level of 0.9533.

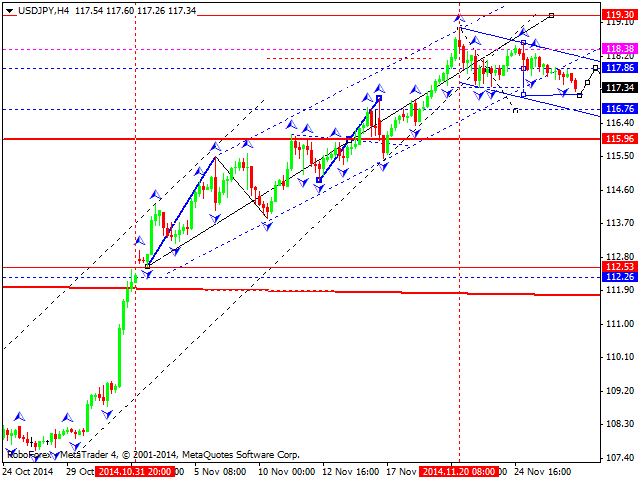

USD JPY, “US Dollar vs Japanese Yen”

Yen is also under pressure and continues falling. We think, today the price may continue this correction towards level of 116.76. Later, in our opinion, the market may resume moving upwards to reach a new maximum.

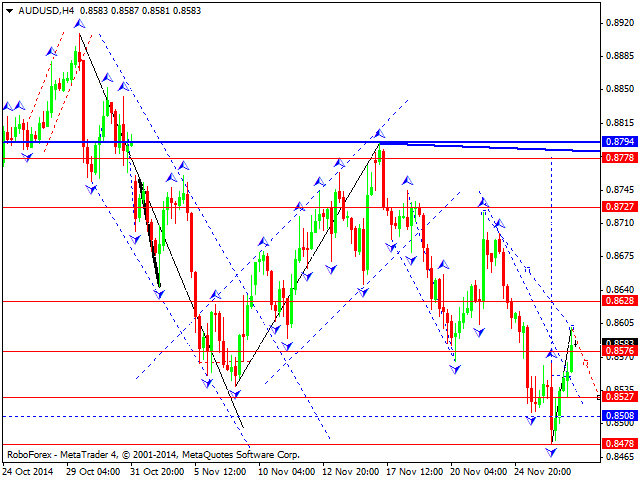

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has completed its descending movement and formed an ascending impulse. We think, today the price may correct this impulse and reach level of 0.8530. Later, in our opinion, the market may start forming another ascending wave with the target at level of 0.8727.

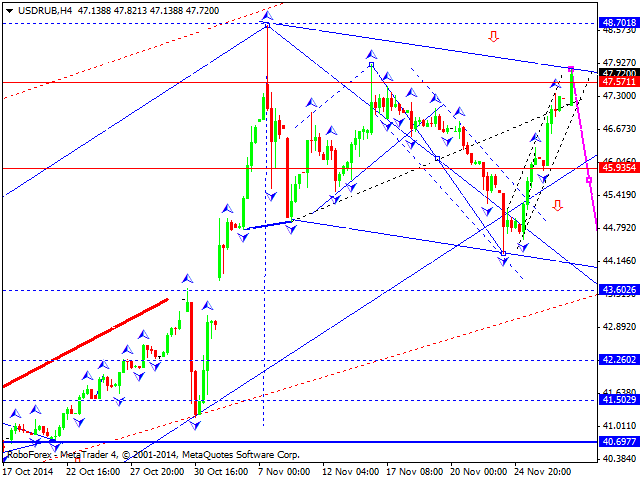

USD RUB, “US Dollar vs Russian Ruble”

Ruble has formed a continuation pattern near level of 45.93 and reached its target. Later, in our opinion, the market may form another descending wave with the target at level of 43.60.

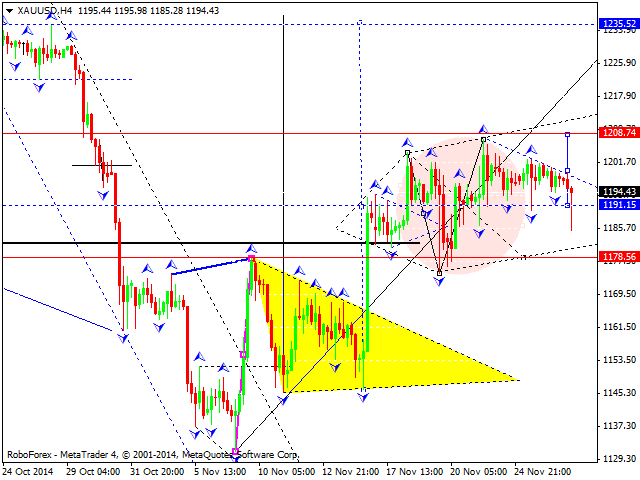

XAU USD, “Gold vs US Dollar”

Gold is still moving downwards inside a consolidation channel. We think, today the price may continue falling and forming this consolidation channel. Possibly, it may test level of 1180. Later, in our opinion, the market may continue growing to reach a local target at 1235.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.