Analysis for August 01st, 2014

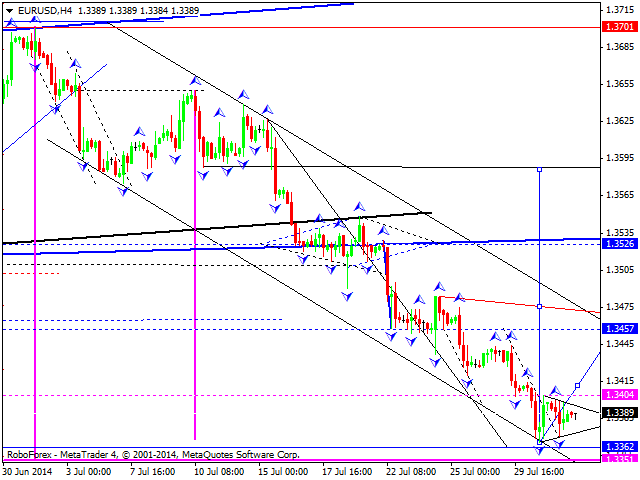

EUR USD, “Euro vs US Dollar”

EURUSD is probably building a consolidation around recent lows. I assume that this structure can be the part of reversal pattern. As basic scenario for today, I will expect retracement to 1.3590. As an alternative, price can first renew low, and rise only after that.

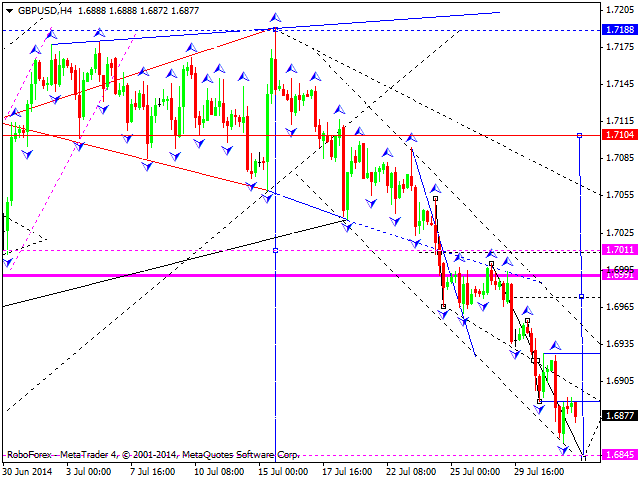

GBP USD, "British pound vs US Dollar"

GBPUSD is continuting to move inside descending channel. For today, I expect that 1.6845 might be violated. After that, I will look for possible consolidation with further reversal structure and continuation of the uptrend.

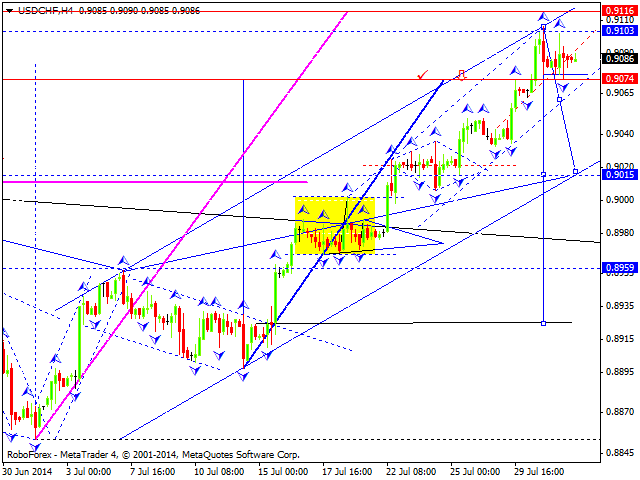

USD CHF, "US Dollar vs Swiss Franc"

USDCHF is building consolidation. I expect that it might be the part of possible reversal structure. As a basic scenario, I will expect descending wave to 0.8930. I will not exclude that price might renew highs first, and decline only after that.

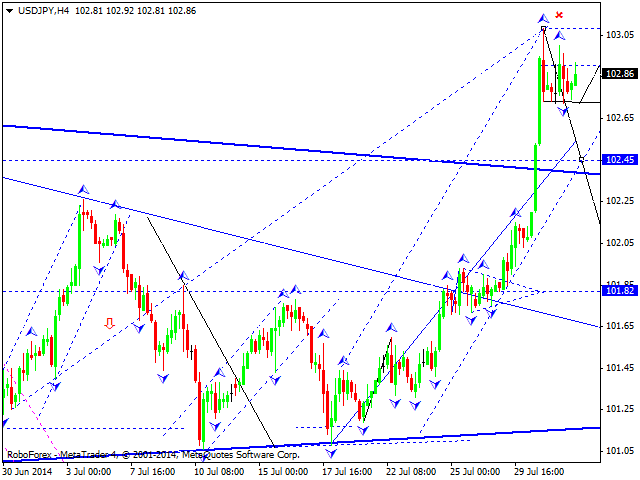

USD JPY, "US Dollar vs Japanese Yen"

USDCHF continues to consolidate on the top of the ascending wave. I assume that it can be the part of reversal structure. As a basic scenario, I will expect ascending wave with 101.70 as a target and continuation of descending impulse with target of 99.30.

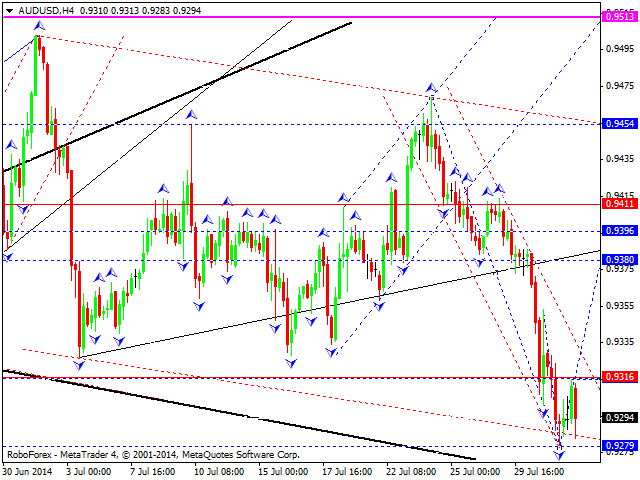

AUD USD, "Australian dollar vs US dollar"

AUDUSD continues to move within descending structure. Potential of this wave can be already exhausted. For today, I expect that consolidation will be continued, but might be extended to the upside with possible further ascending wave with 0.9510 as a target.

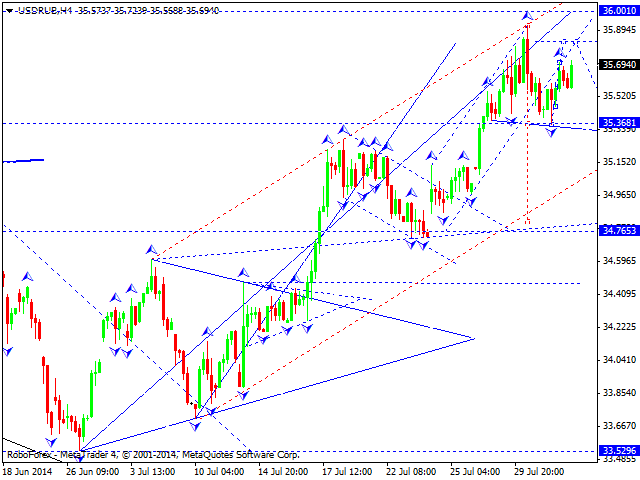

USD RUB, "US Dollar vs Russian Rouble"

Russian rouble is probably continuing to move in ascending structure. For today, I assume that 35.81 might be achieved. After that, I will expect that descending impulse might resumed with 34.70 as a target.

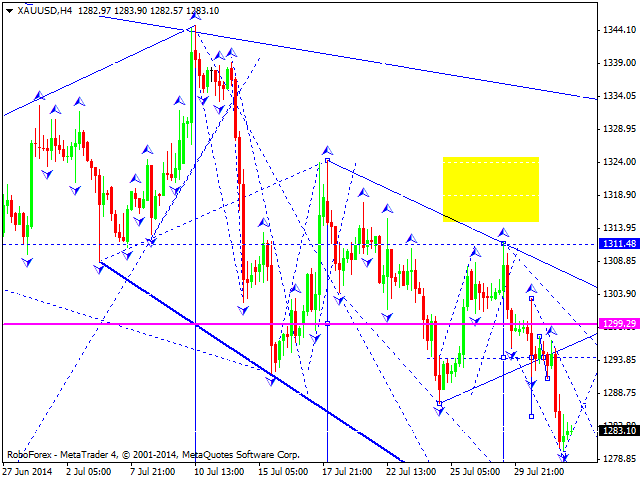

XAU USD, "Gold vs US Dollar"

Gold continues to move within descending structure. I expect consolidation around recent levels with further breakout to the downside and achieving 1275. After that I will expect that price can retrace to 1300.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.