Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The EUR/USD pair is currently in a consolidation phase around 1.0857. Today, a downward breakout towards 1.0831 is expected. After the price reaches this level, a new narrow consolidation range might form. A downward breakout will open the potential for a wave towards the local target of 1.0780.

GBP/USD, “Great Britain Pound vs US Dollar”

The GBP/USD pair is currently in a consolidation phase around 1.2705 without any strong trend. With an upward breakout, the price could rise towards 1.2764. A downward breakout will open the potential for a decline wave towards 1.2666, potentially continuing towards 1.2604 as the first target of the decline wave.

USD/JPY, “US Dollar vs Japanese Yen”

The USD/JPY pair is currently in a consolidation phase around 156.08 without any strong trend. With a downward breakout, the wave might develop towards 154.44, potentially expanding towards the local target of 152.20.

USD/CHF, “US Dollar vs Swiss Franc”

The USD/CHF pair is currently in a consolidation phase around 0.9109. With an upward breakout, the wave might continue towards 0.9130, potentially expanding towards 0.9150, representing the first target of the next growth wave.

AUD/USD, “Australian Dollar vs US Dollar”

The AUD/USD pair has completed a corrective wave, reaching 0.6684. Today, a decline towards 0.6631 could follow. Once the price reaches this level, a new narrow consolidation range is expected to form around this level. With a downward breakout, the trend might continue towards 0.6555, representing the local target.

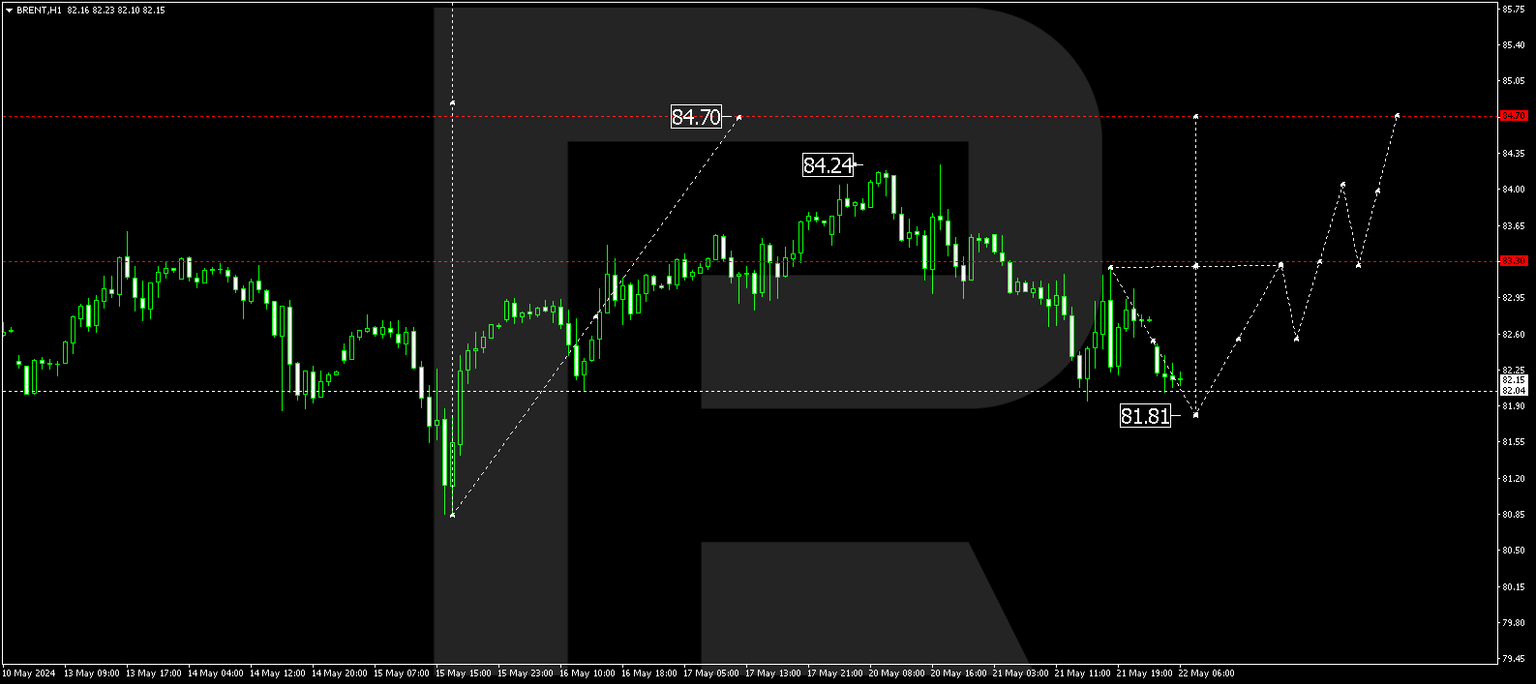

Brent

Brent is currently in a consolidation phase above 82.02. A decline towards 81.81 is not ruled out. After the price hits this level, a new growth wave could start, aiming for 83.30. An upward breakout of this level will open the potential for a wave towards 84.70, representing the first target of the uptrend.

XAU/USD, “Gold vs US Dollar”

Gold has completed a growth wave, reaching 2433.90. Today, the market has formed a consolidation range below this level. With a downward breakout, the wave might develop towards 2390.55. A breakout of the level will open the potential for a movement by trend towards the local target of 2347.74.

S&P 500

The stock index is currently in a consolidation phase around 5303.0. The market has extended the consolidation range towards 5331.0. Today, a decline towards 5303.0 is expected. A downward breakout of this level will open the potential for a wave towards 5272.0, representing the first target.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.