Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

EUR/USD has broken above the 1.0829 level and continues to develop a correction, with the correction target at 1.0861. Once the correction is over, the price could start a new downward movement, aiming for 1.0780. A downward breakout of this level will open the potential for trend expansion to the local target of 1.0690.

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD has breached the 1.2623 level, continuing to develop a correction towards 1.2672. After the correction, the price is expected to decline to 1.2544. With a breakout of this level, the trend will have the potential to continue to the local target of 1.2467.

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY is currently in a consolidation phase around 151.44, without any strong trend. A decline towards 150.77 is not ruled out today, followed by a growth wave to 151.85, from where the trend might continue to 152.60. This is the first target.

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF has broken above the consolidation range around 0.8984. Practically, upward momentum could continue towards 0.9018 today, with the trend potentially developing to the first target of 0.9027.

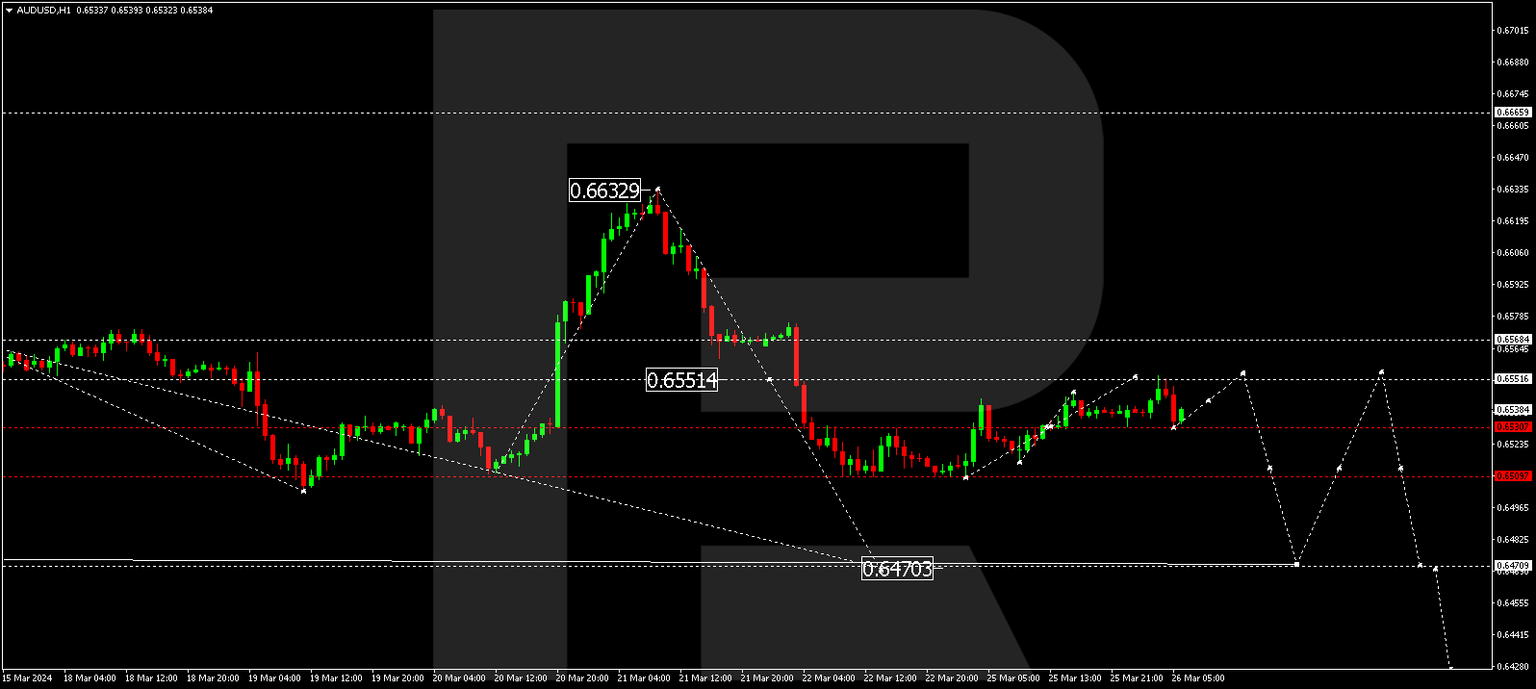

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD is currently in a consolidation phase around 0.6530. Today the consolidation range might expand to 0.6555. Practically, this growth is considered a correction. Once the correction is over, a decline wave towards 0.6500 could start. A breakout of this level will open the potential for a decline by the trend towards the local target of 0.6470.

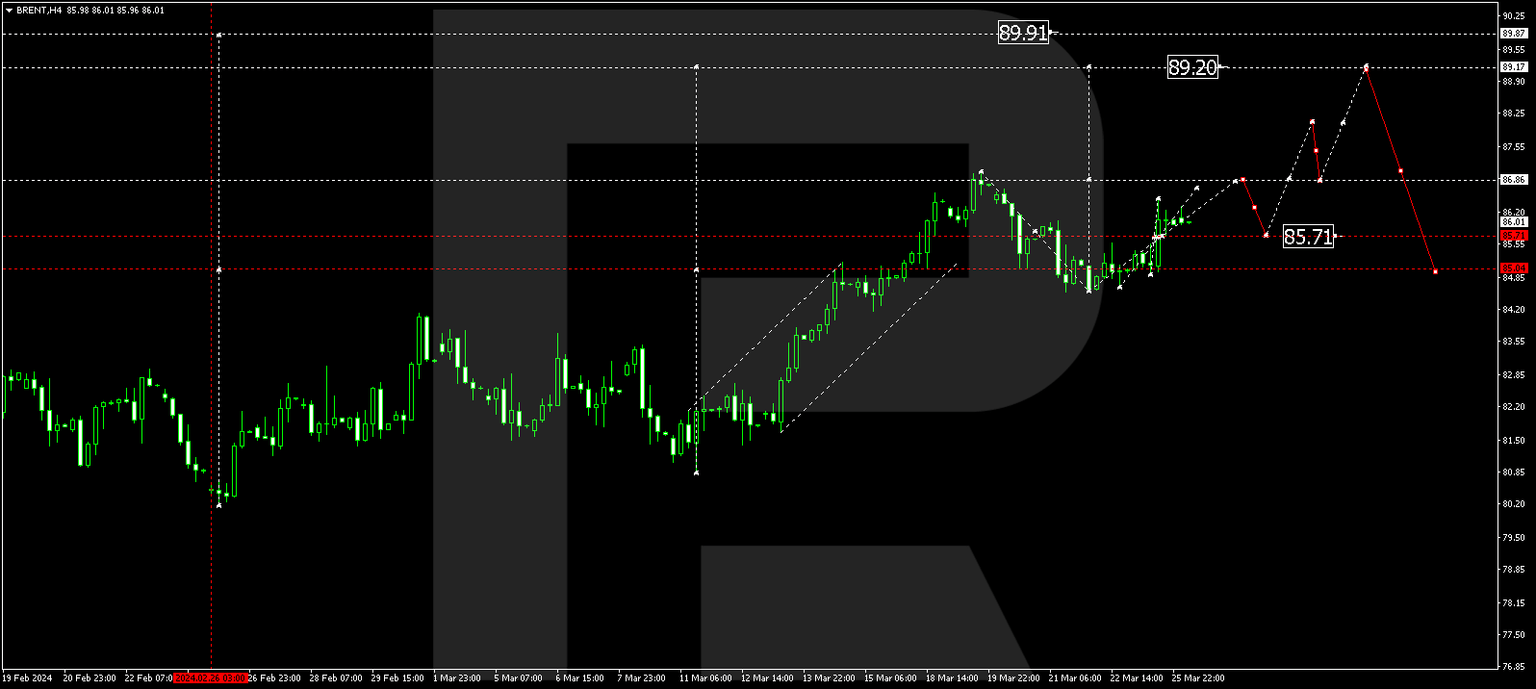

Brent

Brent has broken above the 85.70 level, maintaining its momentum towards 86.86. With a breakout of this level, the trend might expand towards the local target of 89.20. After the price reaches this level, a correction phase towards 85.00 is not ruled out. Next, the trend is expected to continue to 89.90.

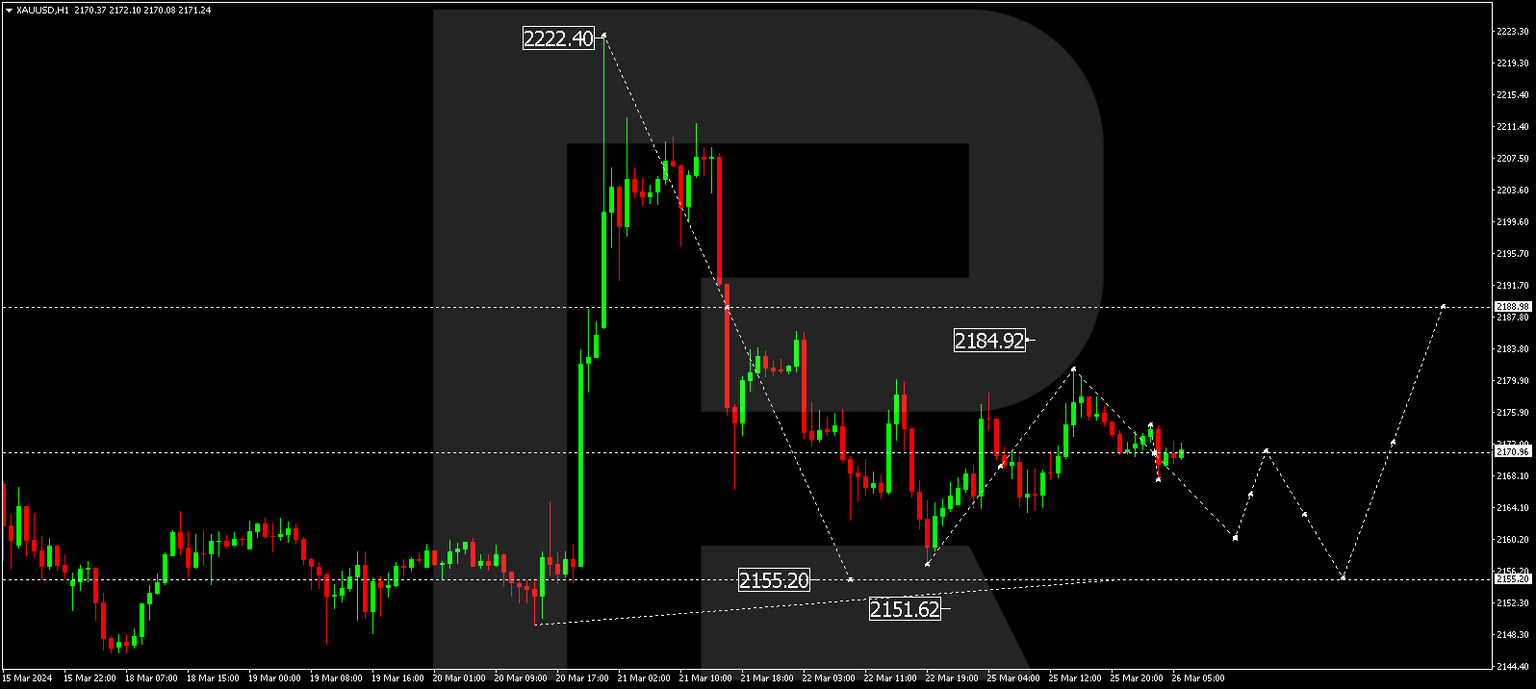

XAU/USD, “Gold vs US Dollar”

Gold is currently in a consolidation phase around 2170.96. Today the consolidation range could expand to 2184.90. Next, a decline wave towards the first target of 2155.20 could develop. After the price reaches this level, a correction could start, aiming for 2188.88.

S&P 500

The stock index has completed a decline wave towards 5220.5. Today, a correction phase towards 5244.5 (testing from below) is expected. Once the correction is over, a decline wave could start, aiming for 5193.0. A breakout of this level will open the potential for a downward movement by the trend towards the local target of 5142.0.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.