Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The EUR/USD pair has completed a decline wave to 1.0878. A consolidation range could form around this level today. With an escape from the range downwards, the wave could extend to 1.0800. This is a local target. Once this level is reached, a growth link to 1.0878 (testing from below) is not excluded. Next, a decline to 1.0777 might follow. This is the first target.

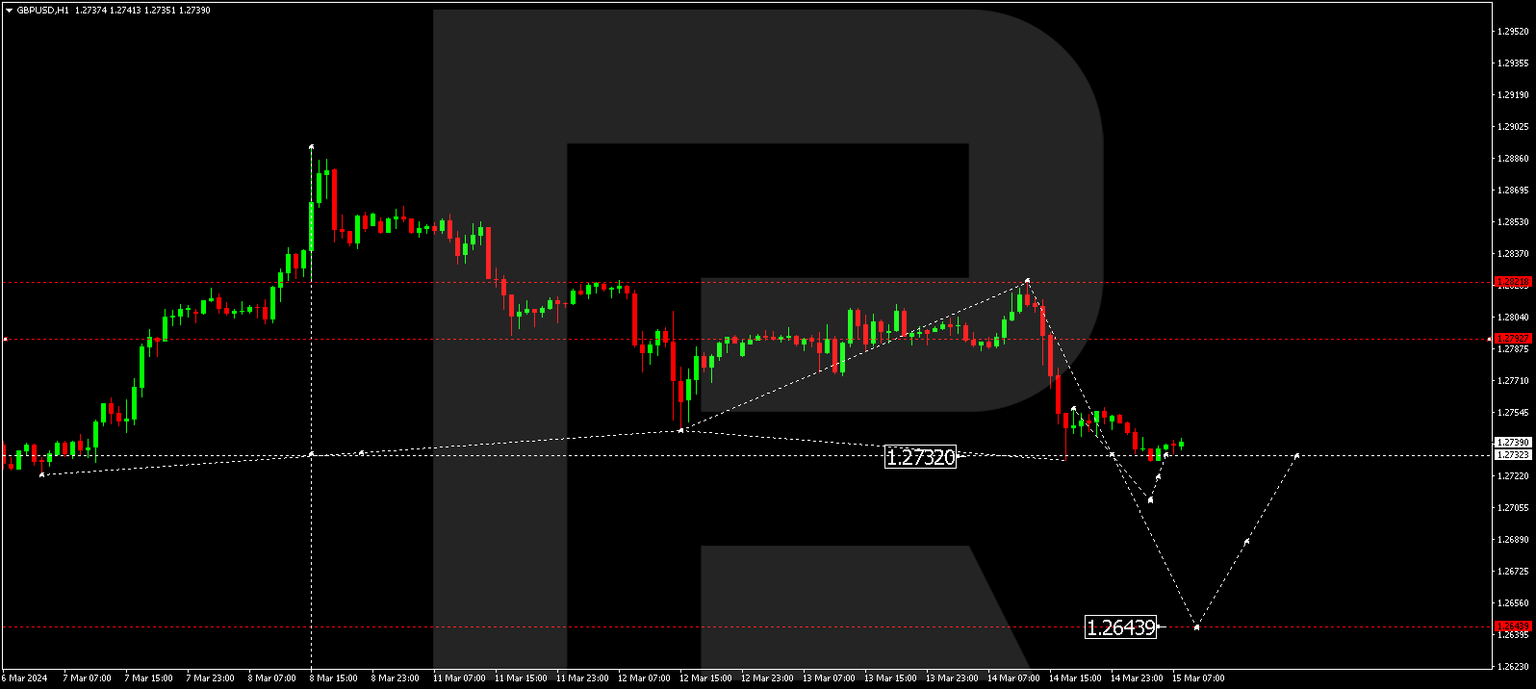

GBP/USD, “Great Britain Pound vs US Dollar”

The GBP/USD pair has completed a decline wave to 1.2732. A new consolidation range could develop around this level today. With an escape from the range downwards, the wave might extend to 1.2644. This is a local target.

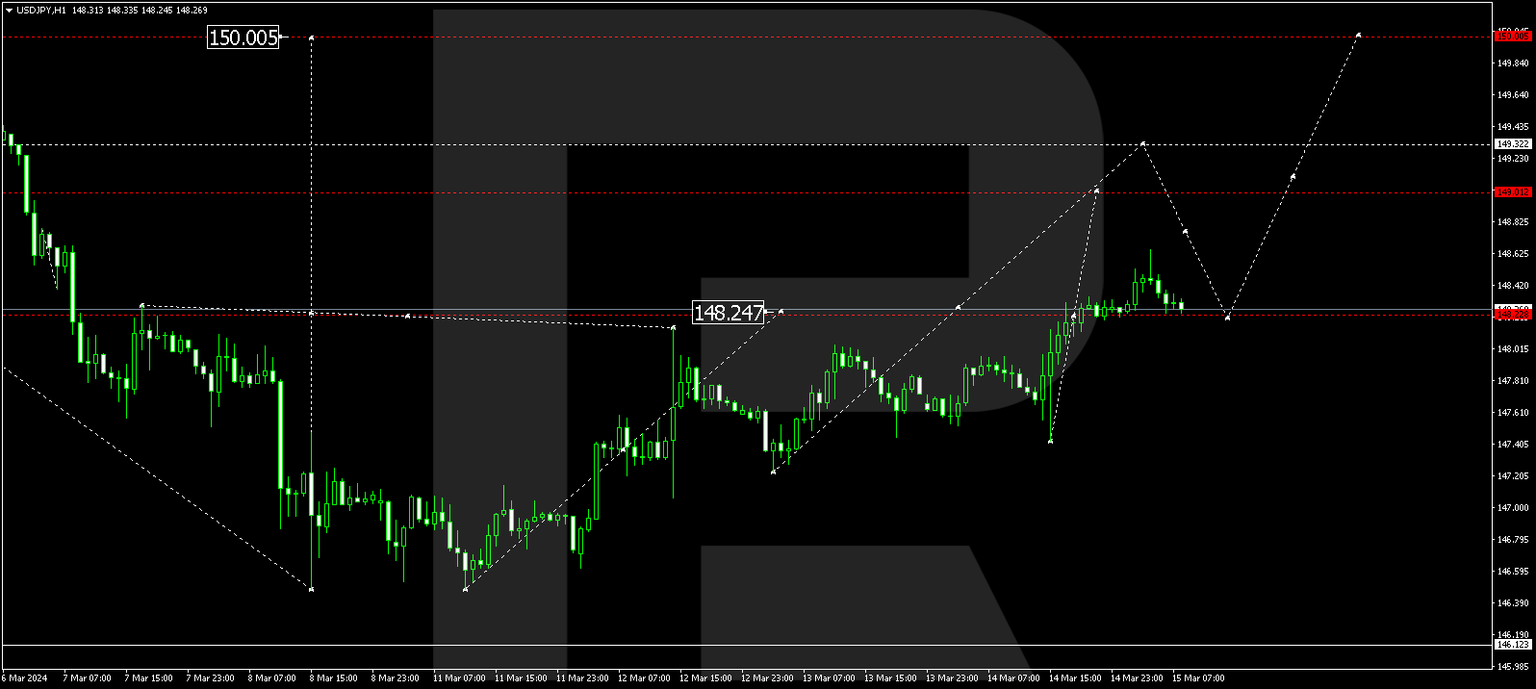

USD/JPY, “US Dollar vs Japanese Yen”

The USD/JPY pair has completed a growth wave to 148.64. A consolidation range could form around this level today. With an upward escape from the range, the wave might continue to 149.32. This is a local target.

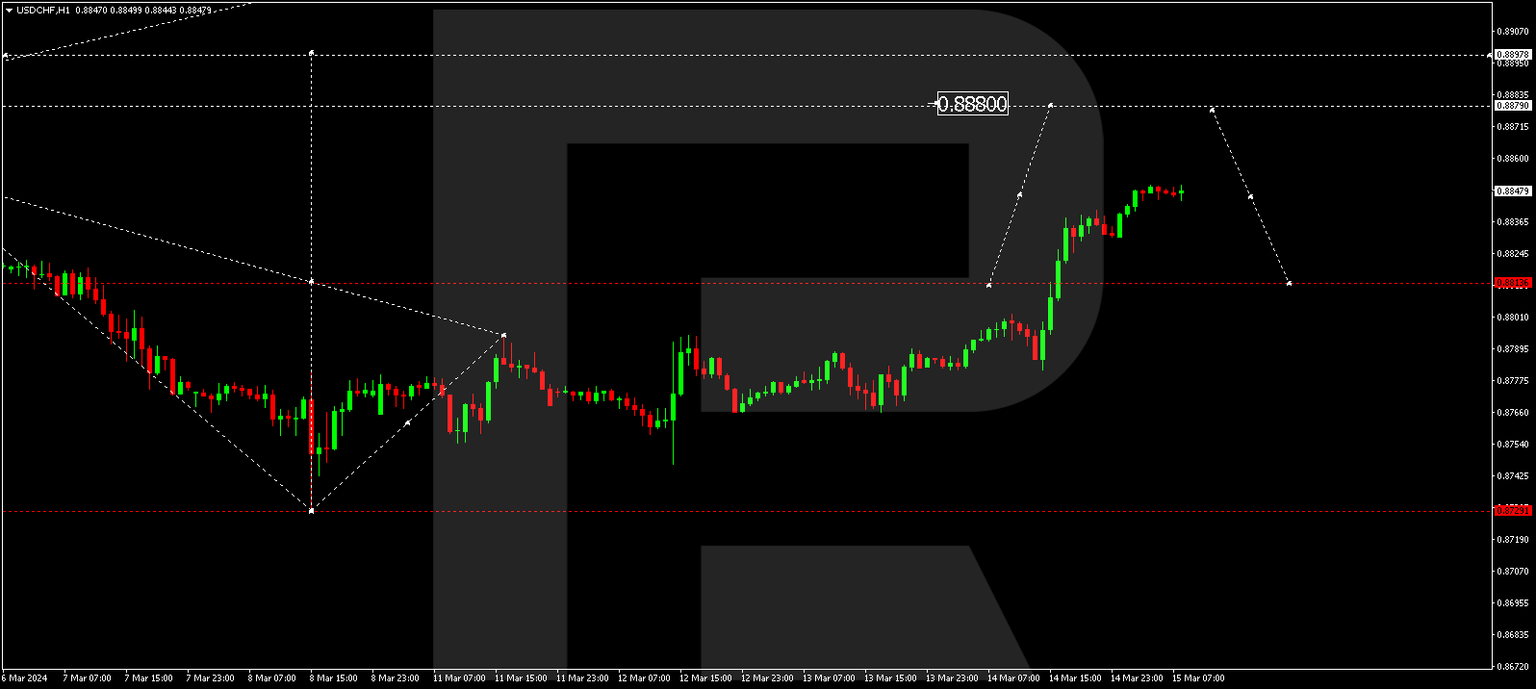

USD/CHF, “US Dollar vs Swiss Franc”

The USD/CHF pair has completed a growth wave to 0.8850. A consolidation range might form under this level today. Breaking the range downwards, the price could form a correction link to 0.8815, followed by a rise to 0.8880. This is a local target.

AUD/USD, “Australian Dollar vs US Dollar”

The AUD/USD pair has completed a decline wave to 0.6556. A consolidation range could form above this level today. With a downward escape from the range, the potential for a wave to 0.6506 might open. This is a local target.

Brent

Brent has completed a growth wave to 85.17. A consolidation range could form under this level today. With an upward escape from the range, a growth link to 85.55 is expected, from which level the trend might continue to 86.66. This is the first target.

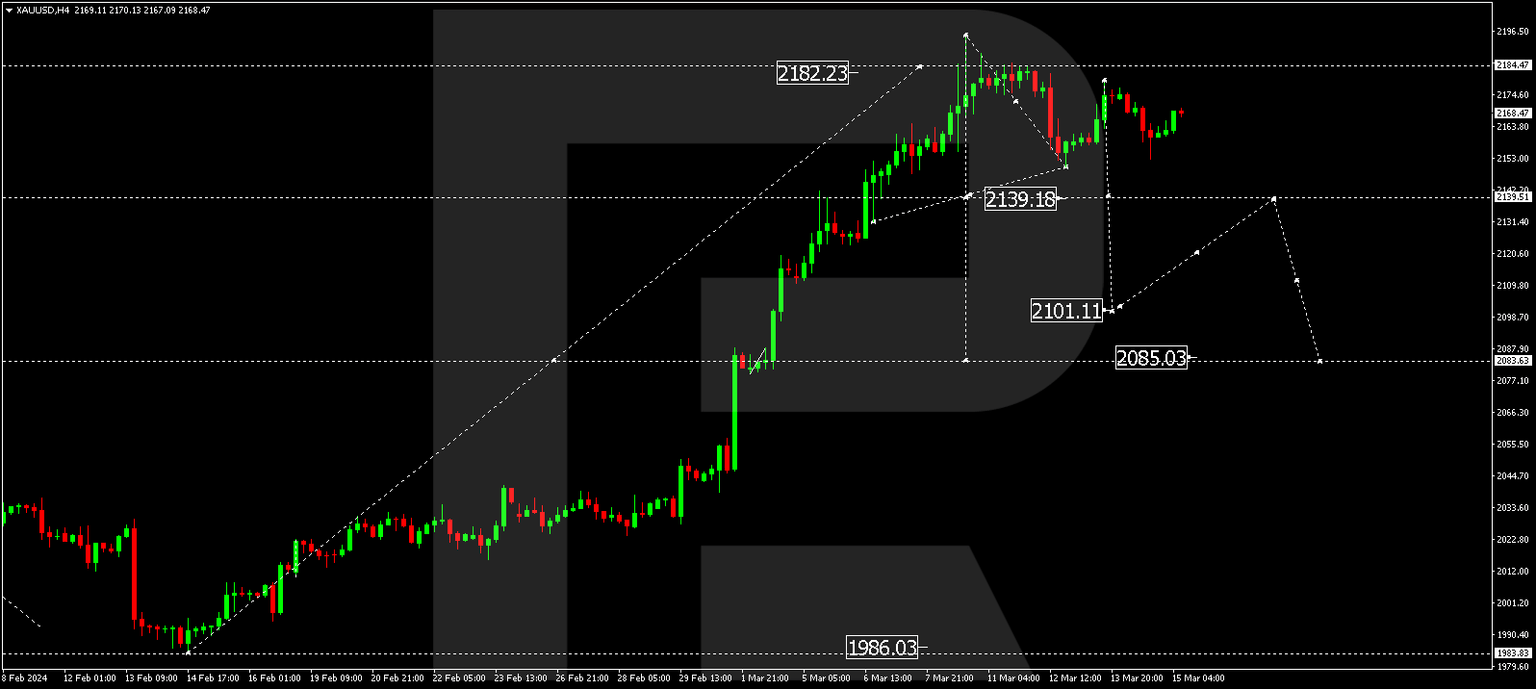

XAU/USD, “Gold vs US Dollar”

Gold continues forming a consolidation range around 2172.33. A further decline to 2139.20 is expected. If this level breaks, the potential for a wave to 2101.11 could open. This is a local target.

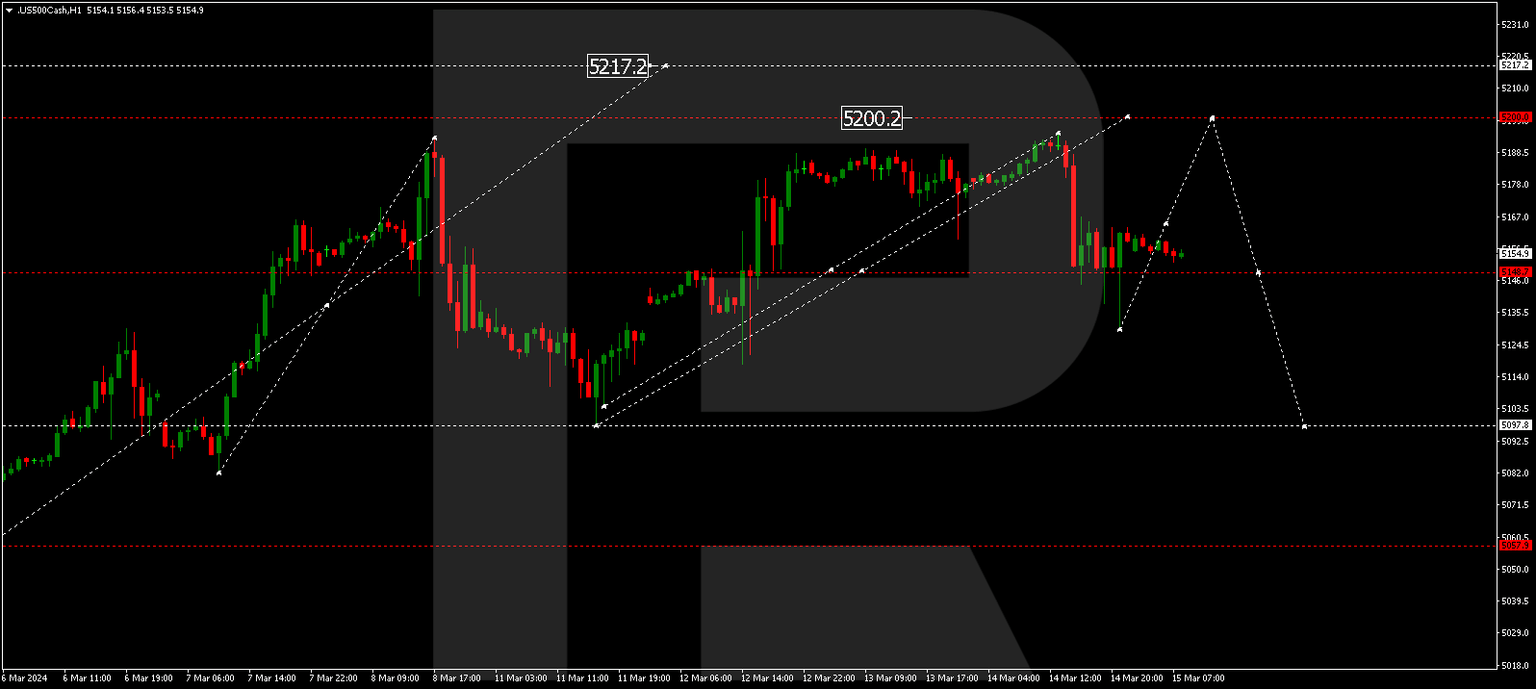

S&P 500

The stock index continues forming a consolidation range around 5148.0 without any obvious trend. Today the range could expand to 5200.0. Once this level is reached, a decline wave to 5100.0 might begin. Next, a growth link to 5148.0 (testing from below) could follow. And next, a decline wave to 5055.0 is expected to start.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.