Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

EUR/USD continues developing a consolidation range around 1.0955. A growth link to 1.0980 is expected today. If this level breaks upwards, the potential for a rise to 1.1010 might open. This is a local target.

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD continues developing a consolidation range around 1.2727. A growth link to 1.2784 is expected today. If this level also breaks upwards, the potential for a wave to 1.2812 could open, so that the wave might extend to 1.2844. Next, a decline to 1.2690 could follow.

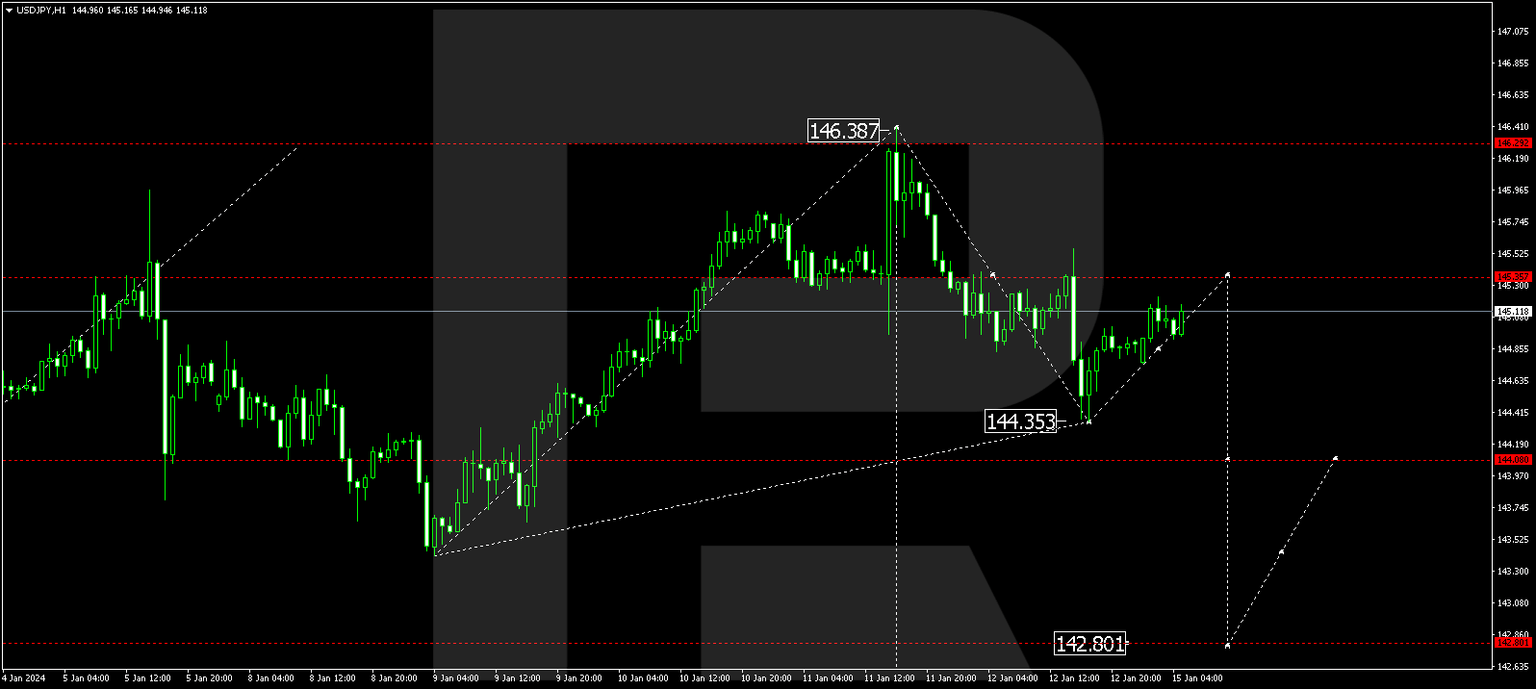

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY continues developing a growth wave to 145.35. Next, a decline link to 144.00 is expected. With a breakout of this level downwards, the potential for a wave down to 142.80 could open. This is a local target.

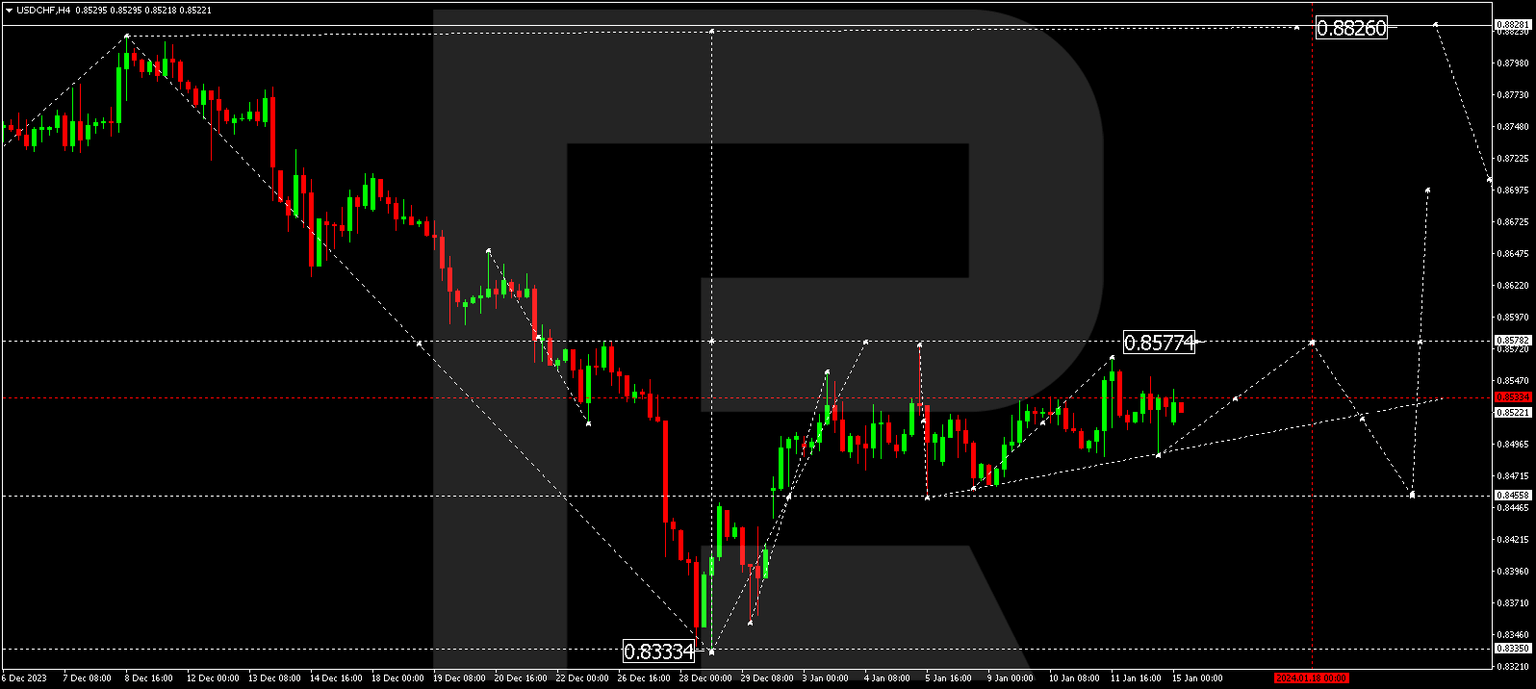

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF continues developing a consolidation range around 0.8530. Today it is expected to extend upwards to 0.8577. This is the first target. Next, a correction to 0.8458 might start.

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD continues developing a consolidation range around 0.6682. A link of decline to 0.6640 might form today. This is a local target.

Brent

Brent has completed a correction link to 78.03. Today the growth wave might extend to 81.70, from where the trend might extend to 82.82. This is a local target. Next, a decline to 79.10 is expected (a test from above), followed by a rise to 84.00.

XAU/USD, “Gold vs US Dollar”

Gold continues developing a growth wave to 2071.45. Once this level is reached, a correction link to 2050.00 is not excluded. Next, a growth link to 2131.78 is expected.

S&P 500

The stock index continues developing a consolidation range around 4770.0. Today the price could drop to 4738.0, followed by a rise to 4770.0 (a test from below). After that, the quotes could drop to 4704.0. This is a local target.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.