Forex technical analysis and forecast: Majors, equities and commodities

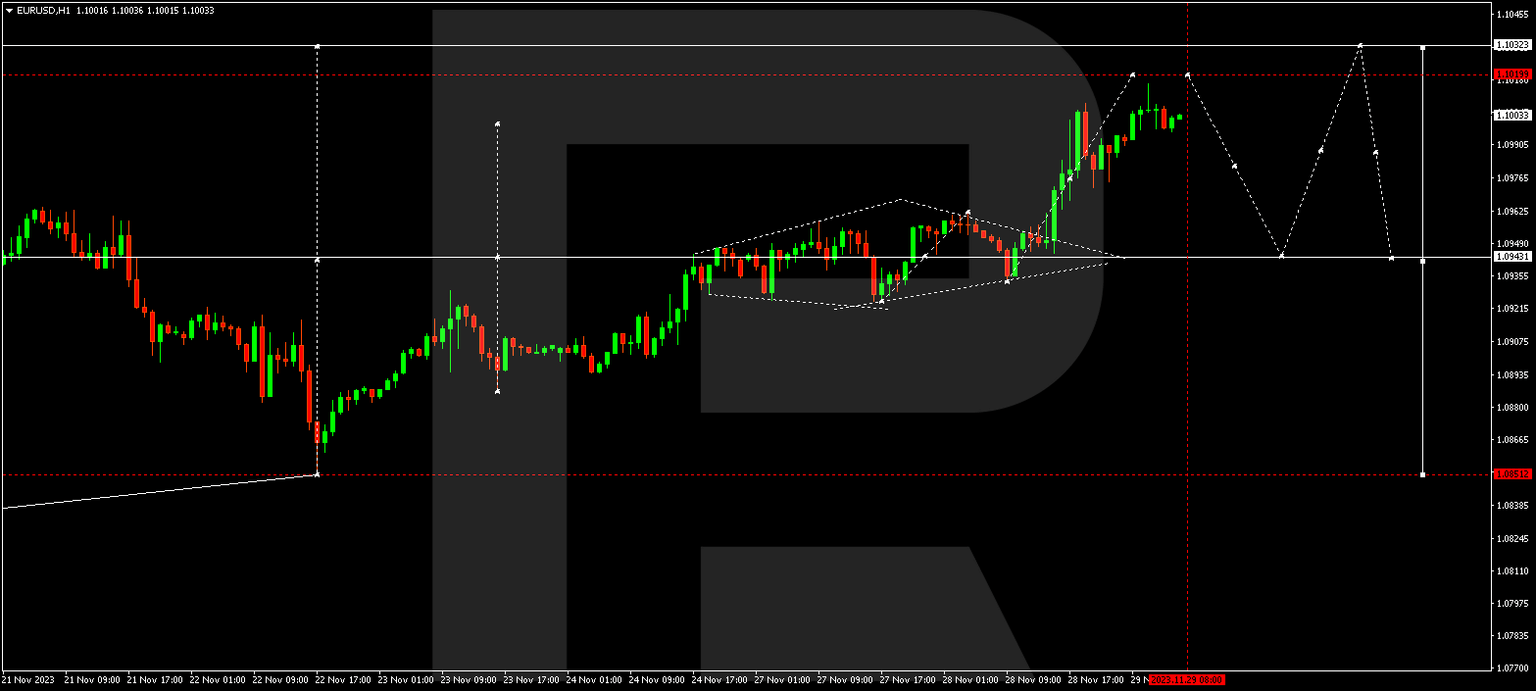

EUR/USD, “Euro vs US Dollar”

EUR/USD has formed a consolidation range around 1.0944 and, breaking it upwards, is forming a growth structure to 1.1020. After the price reaches this level, it might correct to 1.0944 (a test from above), subsequently climbing to 1.1033. It is worth noting that any rise is seen as a possible extension of the growth structure, and the market may abruptly continue the trend downwards at any moment.

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD has formed a narrow consolidation range around 1.2608 and, breaking it upwards, climbed to 1.2732. A link of correction to 1.2680 (a test from above) is not excluded today. Following the correction, the price might rise to 1.2764. Next, a decline wave to 1.2600 could start. This is the first target.

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY has corrected to 146.73. Today a consolidation range is expected to develop at the current lows. With an upward breakout, a growth wave to 148.20 could start. This is the first target.

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF has formed a consolidation range around 0.8813 and, breaking it downwards, completed a decline wave, reaching 0.8757. Today a link of decline to 0.8753 is not excluded, followed by an upward movement to 0.8830. This is the first target.

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD has formed a consolidation range around 0.6608 and, breaking it upwards, completed a wave, reaching 0.6673. A link of correction to 0.6611 could follow today. Once the price hits this level, it might rise to 0.6695.

Brent

Brent has received support at 79.79 and completed a growth impulse to 82.00. It might consolidate below this level today. An upward breakout will open the potential for growth to 83.80, from where the trend could continue to 88.20. This is a local target.

XAU/USD, “Gold vs US Dollar”

Gold has formed a consolidation range around 2011.55 and, breaking it upwards, climbed to 2051.88. A link of correction to 2011.55 is expected today. Subsequently, the price could rise to 2033.00.

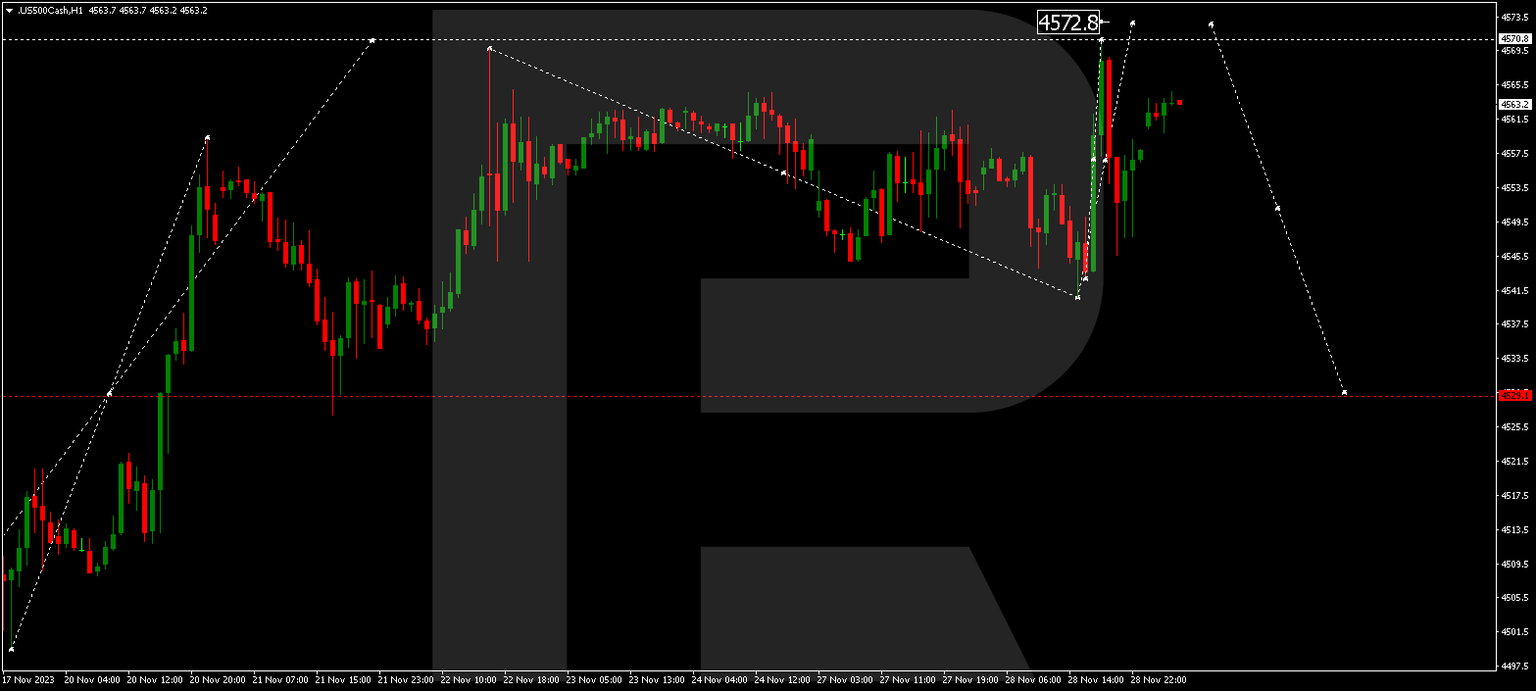

S&P 500

The stock index has completed a link of growth to 4570.0 and corrected to 4545.0. A link of growth to 4572.0 could form today, followed by a downward movement to 4530.0. This is the first target.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.