Forex technical analysis and forecast: Majors, equities and commodities

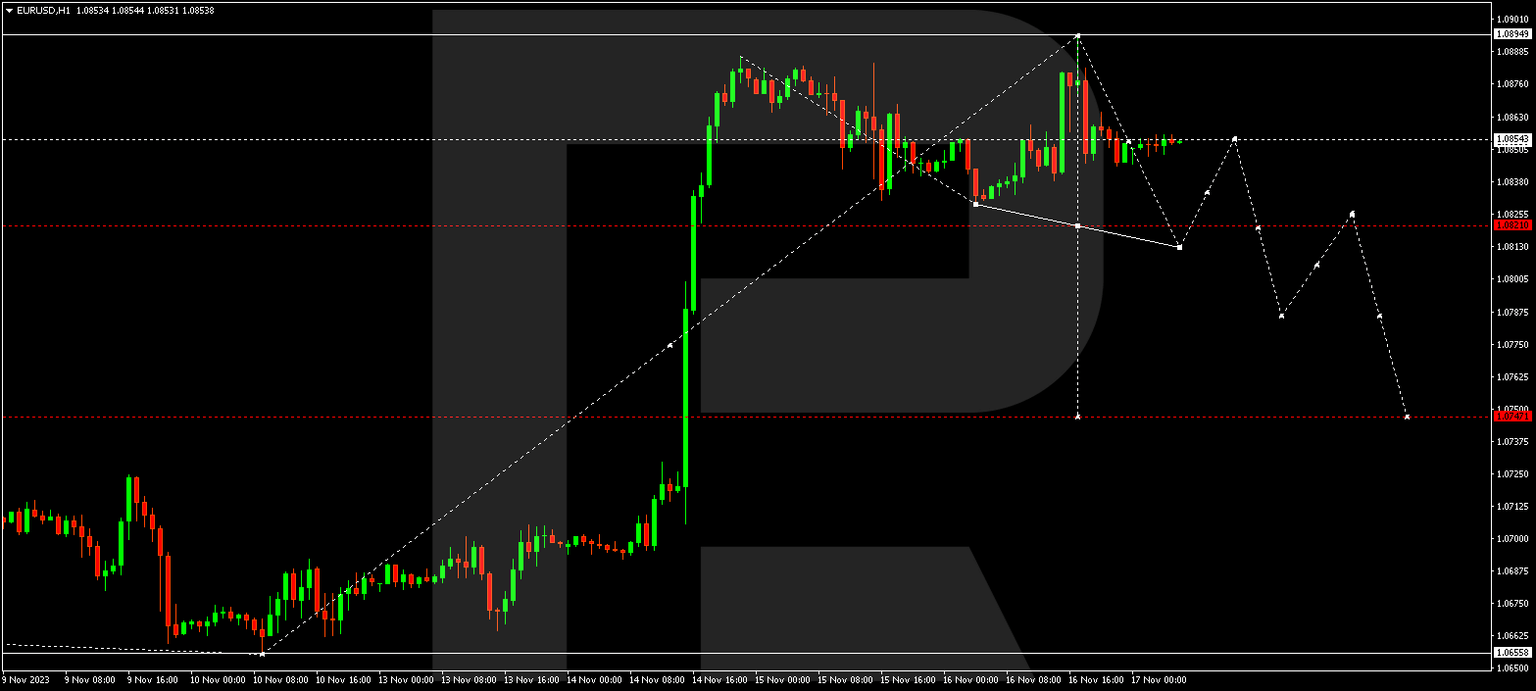

EUR/USD, “Euro vs US Dollar”

EUR/USD continues developing a consolidation range around 1.0855. The market has just extended the range to 1.0894. Today the range could drop to 1.0813. Next, a link of growth to 1.0855 could follow (with a test from below). Next, a decline to 1.0787 might form. This is a local target.

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD has performed a corrective wave to 1.2454. A decline to 1.2376 might follow. And with a downward breakout of this level, the potential for a decline wave to 1.2294 might form. This is a local target.

USD/JPY, “US Dollar vs Japanese Yen”

The USD/JPY pair continues developing a consolidation range around 150.77. A decline to 150.15 is not excluded. Next, a ink of growth to 152.90 could begin. This is a local target.

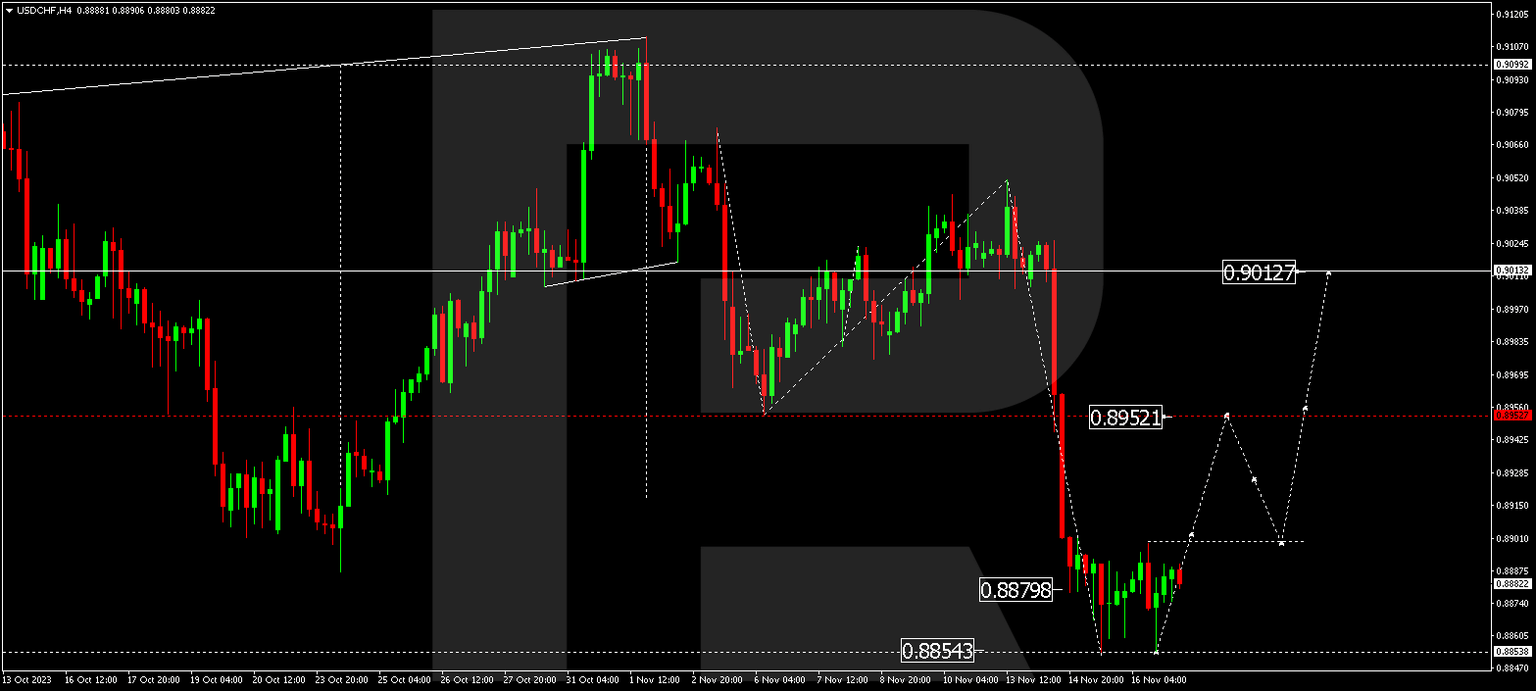

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF continues developing a consolidation range around 0.8880. A link of growth to 0.8952 could form today, from where the trend might continue to 0.9012.

AUD/USD, “Australian Dollar vs US Dollar”

The AUD/USD pair continues developing a decline wave to 0.6444. This is the first target. After the price reaches this level, a link of correction to 0.6494 is not excluded, followed by a decline to 0.6340.

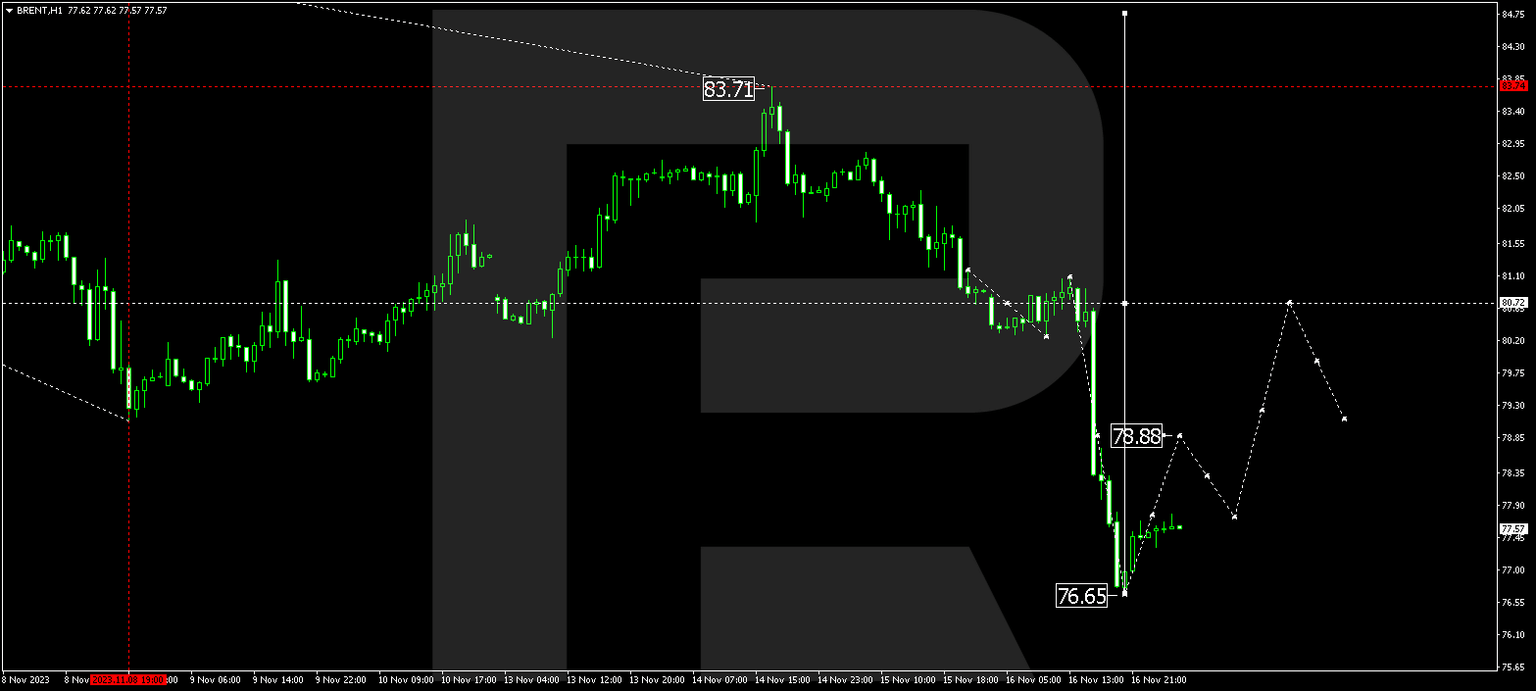

Brent

Brent continues developing a correction. It has just completed a declining structure to 76.66. A consolidation range might form around this level today. With an escape from the range upwards, a new wave of growth to 84.10 could begin. This is the first target.

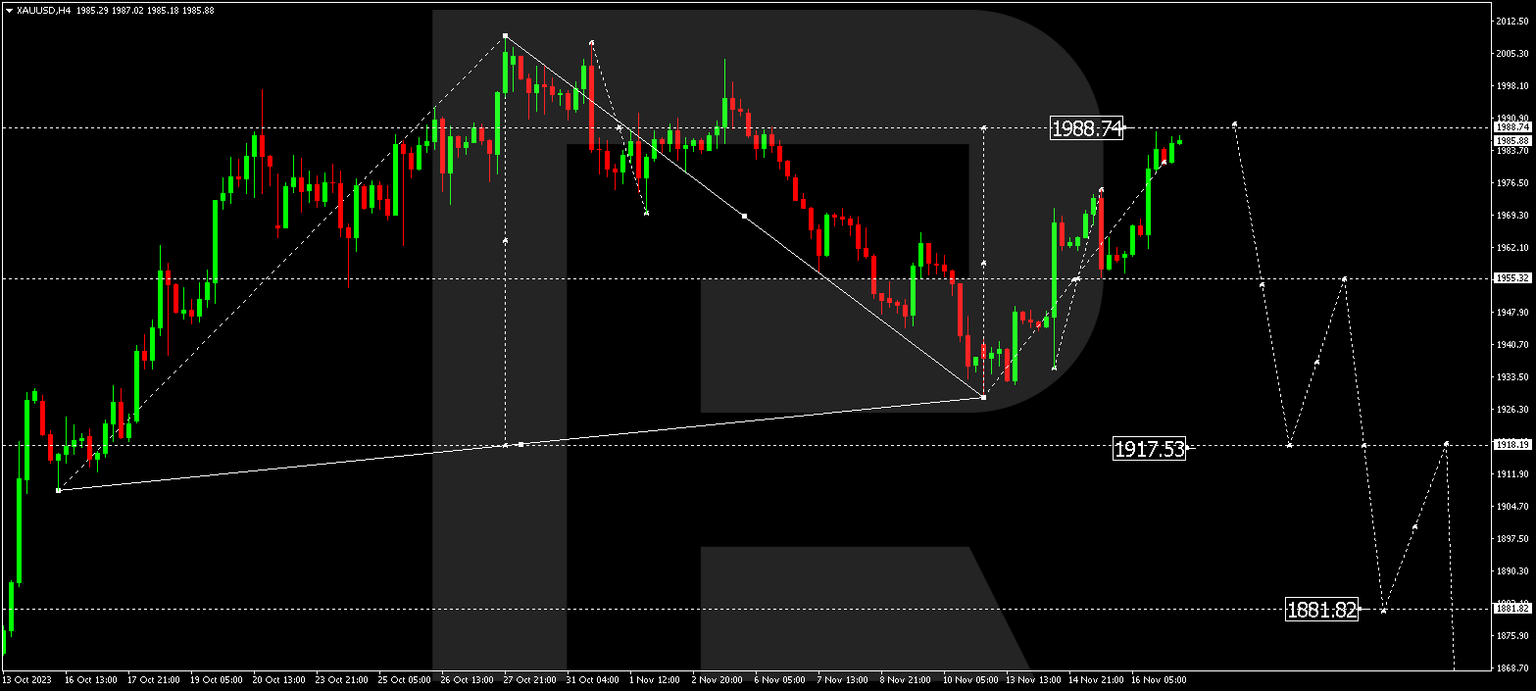

XAU/USD, “Gold vs US Dollar”

Gold has formed a consolidation range around 1955.30. With an escape from the range upwards, the correction could continue to 1988.74. After it is over, a new decline wave to 1918.20 could start. This is a local target.

S&P 500

The stock index continues forming a consolidation range around 4510.0. The range might then extend to 4532.3, after which the quotes might drop to 4532.3. With a breakout of this level downwards, the potential for a wave to 4450.0 might open. This is a local target.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.