Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The EUR/USD pair has completed a declining momentum at 1.0860 and a correction to 1.0868. Today the market is making a movement within a decline wave to 1.0790. After the price reaches this level, a rising link to 1.0829 is not excluded (with a test from below). Next, a decline to 1.0770 might follow. This is the first target.

GBP/USD, “Great Britain Pound vs US Dollar”

The GBP/USD pair has completed a decline momentum to 1.2424. A consolidation range has formed around this level today. With an escape downwards, the trend might extend to 1.2345. This is the first target.

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY has completed a wave of decline to 150.04. A rising momentum to 151.23 has been performed today. At the moment, a consolidation range is forming around this level. With an escape upwards, the potential for a rising wave to 152.20 could open.

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF has completed a decline wave to 0.8855. Today the market is forming a consolidation range above this level. An escape from the range upwards and extension of the wave to 0.9013 is expected. This is the first target.

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD has completed a decline momentum to 0.6484 and a correction to 0.6530. Today the market extends the decline wave to 0.6433. Next, a link of correction to 0.6480 is not excluded.

Brent

Brent has completed a consolidation range around 81.77 and extends a wave of decline to 79.79 with an escape from the range downwards. After the price reaches this level, a new wave of growth to 83.70 could start, from where the trend might continue to 85.33. This is a local target.

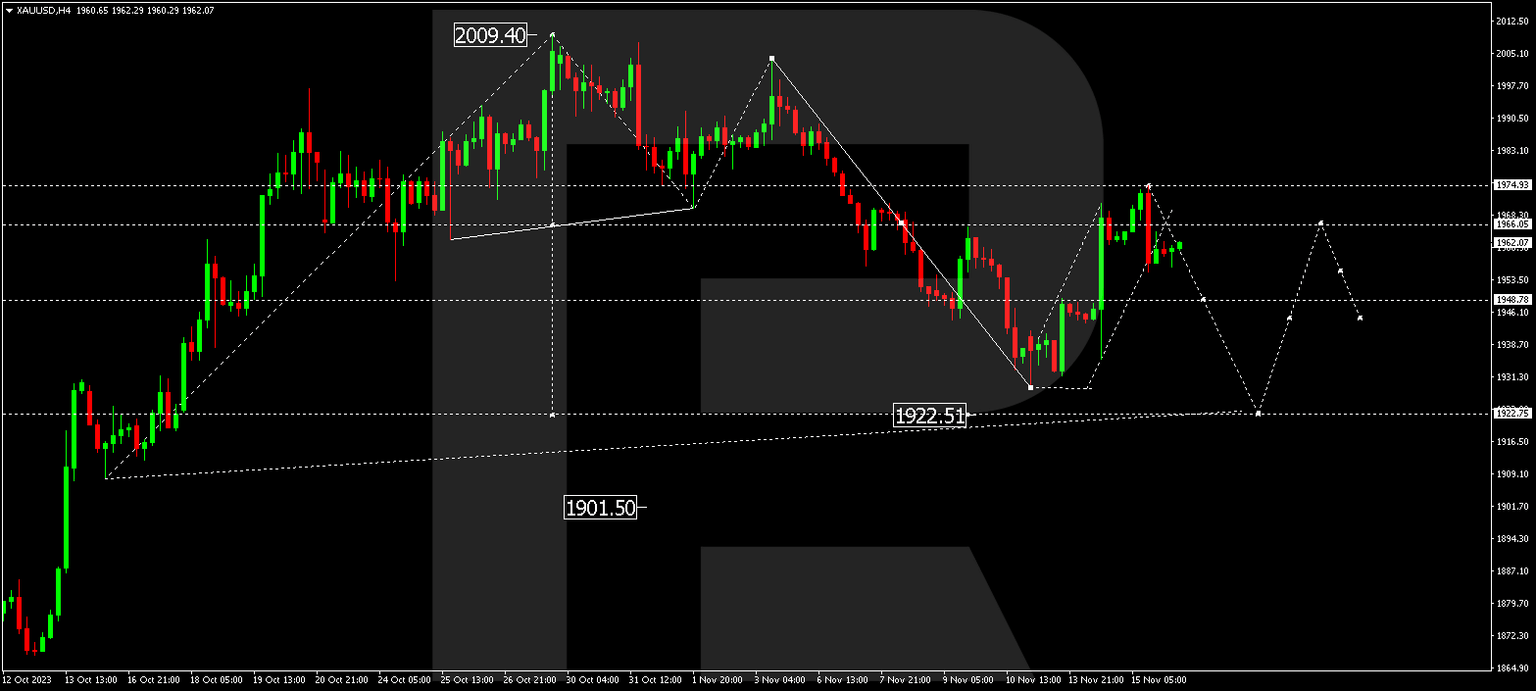

XAU/USD, “Gold vs US Dollar”

Gold has formed a decline momentum to 1955.40. A link of correction to 1966.00 is not excluded. Next, a decline wave to 1948.00 is expected, from where the trend could continue to 1922.75.

S&P 500

The stock index has formed a decline momentum to 4499.0. A link of correction to 4510.0 is expected today. Next, a new decline movement to 4470.0 is expected, from where the trend might continue to 4455.0. This is the first target.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.