Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

EUR/USD has formed a wide consolidation range around 1.0680. Amid the news, the market broke the range upwards and hit a local correction target of 1.0886. Today a consolidation range is expected to form below this level. Breaking it downwards, the price could start a downward movement to 1.0755 minimum. At maximum, it could fall to 1.0680 (a test from above). Next, another structure of growth targeting 1.0915 could develop.

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD has formed a consolidation range around 1.2291 and, breaking it upwards, reached the growth target of 1.2503. Today the market is forming a consolidation range below this level. A downward breakout is expected with the downward momentum continuing to 1.2291.

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY has completed a decline wave, reaching 150.15. Today a link of growth to 150.95 is expected (a test from below). Next, another decline wave to 150.00 could develop, followed by growth to 152.07.

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF has completed a decline wave, reaching 0.8880. Today the market is forming a consolidation range around this level. The price is expected to break the range upwards and continue its upward movement to 0.9013. This is the first target.

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD has completed a link of growth to 0.6511. Today a decline wave targeting 0.6435 is expected to start. Upward momentum to 0.6537 could develop next.

Brent

Brent has completed a growth wave, reaching 83.71, and corrected today to 82.00. Next, a new growth wave to 84.92 could start. This is the first target. After the price hits this level, it could decline to 83.33 and then rise to 87.00.

XAU/USD, “Gold vs US Dollar”

Gold has corrected to 1970.90. Today a consolidation range is expected to form below this level. With a downward breakout, a new decline wave targeting 1922.75 could start. This is the first target.

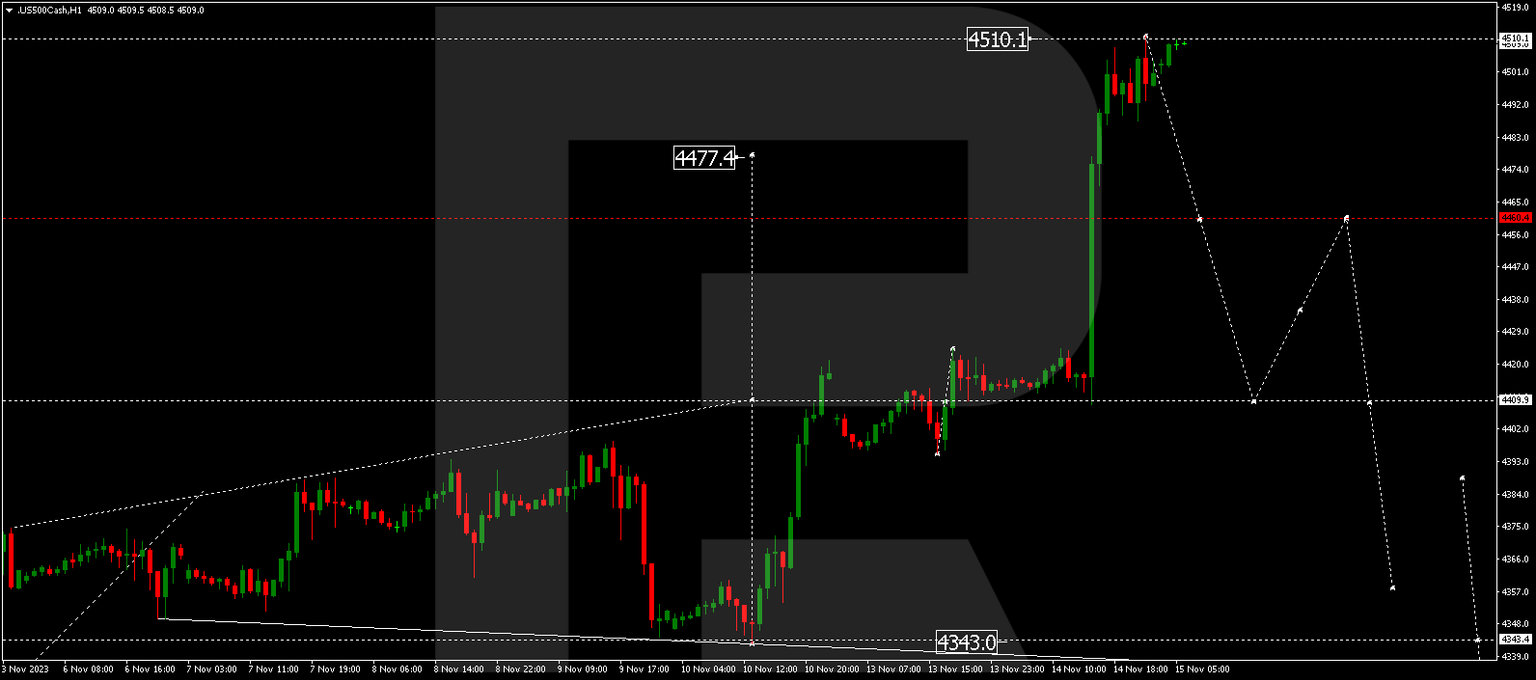

S&P 500

The stock index has formed a consolidation range around 4410.0. Breaking it upwards, the price rose to 4510.0. Today the market is forming a consolidation range below this level. The price could decline to 4410.0. This is the first target.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.