Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

EUR/USD made a corrective movement to 1.0566 and a link of decline to 1.0482. Amid the news, the market performed a rising impulse to 1.0599 and is correcting it today. A link of decline to 1.0522 is not excluded today. After the correction is over, a rising link to 1.0685 might be expected. This is a local target.

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD has made a declining movement to 1.2105.Amid the news, another rising impulse to 1.2260 followed. Practically, the market could extend the correction to 1.2370. This is a local target.

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY continues developing a consolidation range above 148.99. Today the pair could rise to 149.83. A breakout of this level might open the potential for a rise to 149.88. Next, a decline to 149.06 (with a test from above) and an increase to 150.88 could follow.

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF has demonstrated a link of growth to 0.9174. By now, it has also made a declining impulse to 0.9072. Practically, the market could extend the correction to 0.9024. This is a local target. Next, a rise to 0.9100 might follow.

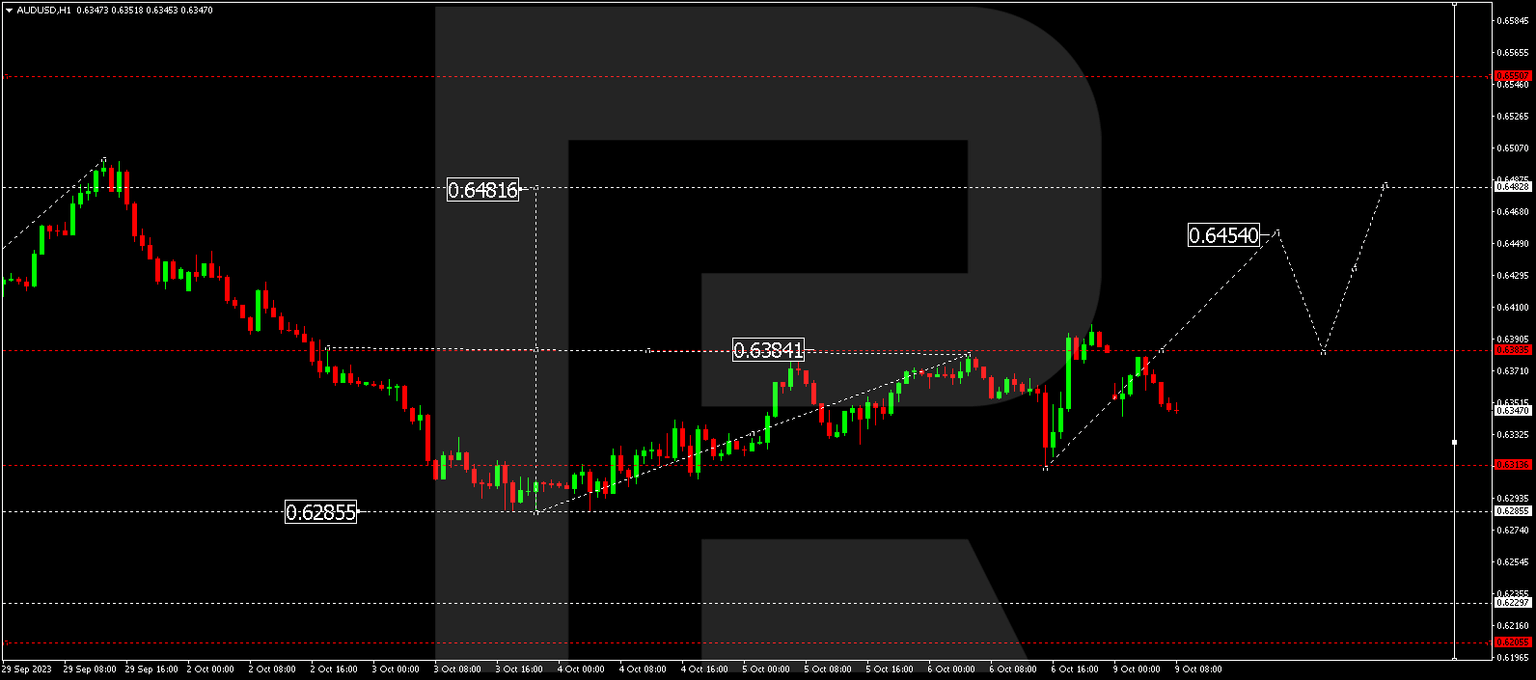

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD has made a declining link to 0.6313. By now, it has also performed a rising impulse to 0.6399. A link of correction to 0.6343 is not excluded. After it is over, the growth might continue to 0.6454. This is a local target.

Brent

Brent has corrected to 83.00. A rising impulse to 88.33 has followed today. Currently, the market is correcting to 86.00. Next, the rising link could continue to 89.20. After the price reaches this level, a link of decline to 86.00 might not be excluded, followed by a rise to 93.25, from where the trend could continue to 96.18. This is a local target.

XAU/USD, “Gold vs US Dollar”

Gold has completed a declining wave to 1810.48. Today the market is making a rising movement to 1856.17. After the price reaches this level, it might correct to 1833.00 and later grow to 1879.33. This is a local target.

S&P 500

The stock index has broken the 4271.0 level upwards and might now correct to 4370.0. After the correction is over, the declining wave could continue to 4200.0. This is a local target.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.