Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

EUR/USD has completed a structure of a wave to 1.0770. Today the market is forming a consolidation range above this level. Escaping the range upwards, the price might form a link of growth to 1.0810. Exiting the range downwards, it might open the potential for a wave to 1.0740, from where the trend could extend to 1.0700. This is a local target.

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD has completed a wave of decline to 1.2567. A consolidation range is forming above this level today. With an escape from the range upwards, a link of correction to 1.2640 could form. With an escape downwards, the potential for a movement to the 1.2520 level might open, from where the trend could continue to 1.2482. This is a local target.

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY has completed a structure of decline to 144.44 and an impulse of growth to 146.28. Today the market is forming a narrow consolidation range under this level. With an escape from the range downwards, a correction to the 145.37 level is not excluded. An escape upwards might open the potential for a rise to 147.30, from where the trend might continue to 148.10.

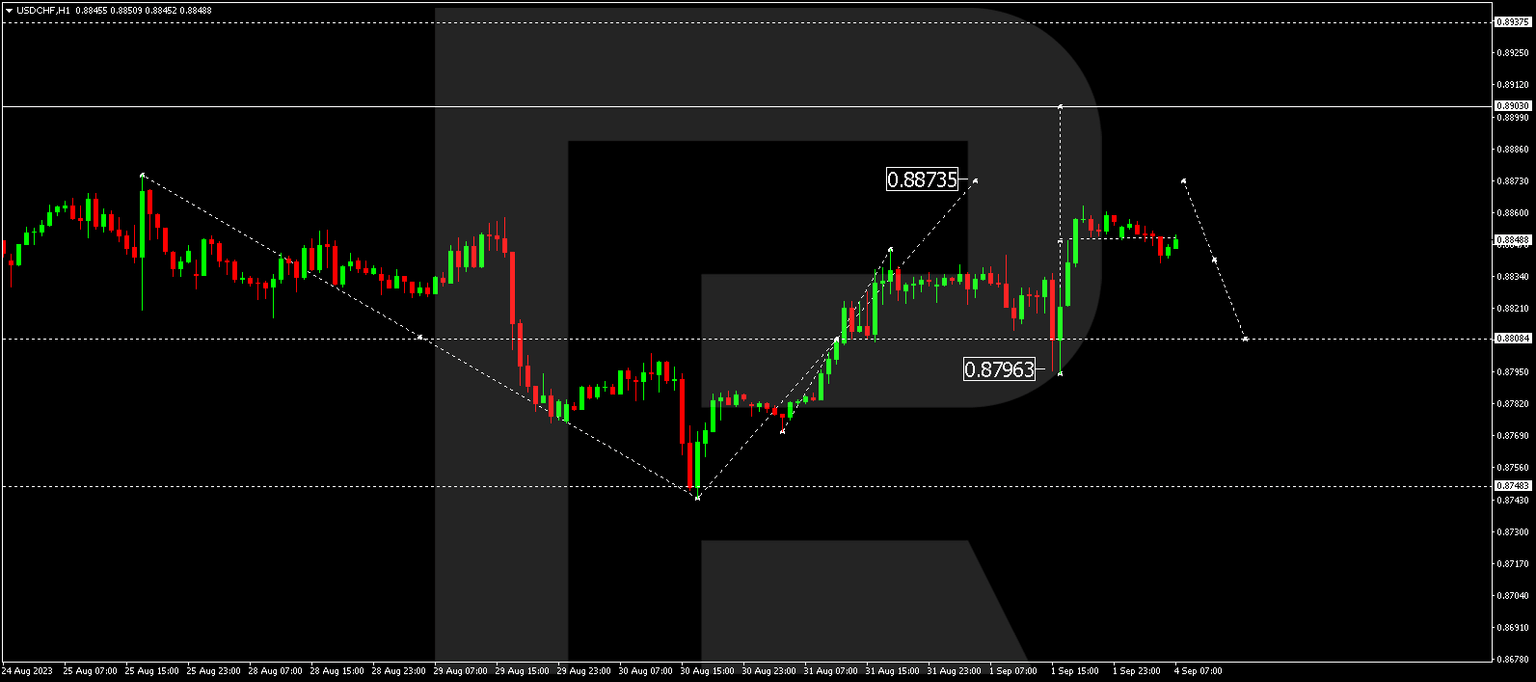

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF has performed a corrective wave to 0.8796 and an impulse of growth to 0.8862. A consolidation range might develop under this level today. With an escape from the range downwards, a link of correction to 0.8808 is not excluded. With an escape upwards, the potential for a wave to 0.8873 might open, from where the trend could continue to 0.8903. This is the first target.

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD continues developing a consolidation range around 0.6475. Escaping it downwards, the price could start a new wave of decline to 0.6373, from where the trend could extend to 0.6300. This is a local target.

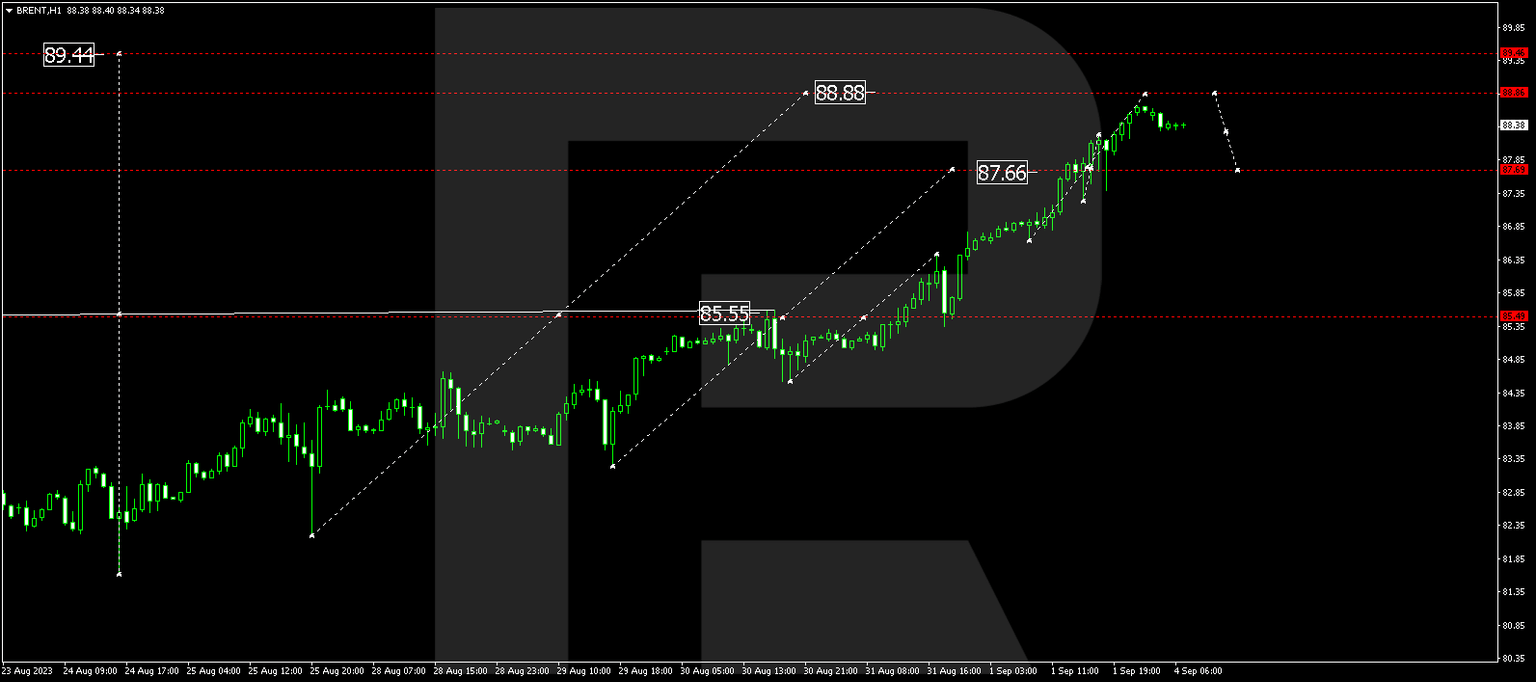

Brent

Brent has broken the 87.66 level upwards. Today it has formed a link of growth to 88.66. A link of decline to 87.66 is not excluded (with a test from above). Next, a rise to 88.88 looks possible, from where the trend might continue to 89.44. This is a local target.

XAU/USD, “Gold vs US Dollar”

Gold continues developing a consolidation range around 1945.70. At the moment, the market extended the range to 1934.34. A link of growth to 1945.70 is expected today (with a test from below). Next, a decline to 1924.14 might follow, from where the wave could extend to 1917.22. This is the first target.

S&P 500

The stock index continues forming a consolidation range around 4522.0. At the moment, an impulse of decline to 4500.8 happened alongside a link of correction to 4521.5 (with a test from below). Next, a decline to 4480.0 could follow, from where the trend might continue to 4458.0. This is the first target.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.