Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The currency pair has completed a wave of decline to the 1.0674 level. Today the market is correcting this declining wave, with the correction possible to the 1.0727 level. After it is over, a decline to the 1.0666 level could follow.

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of decline to the 1.2368 level. Today the market is forming a correction to the 1.2455 level. When this correction is over, another structure of decline to the 1.2355 level could develop.

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair has completed a link of decline to the 139.25 level. Today the market has formed a link of growth to the 139.80 level and is currently forming a consolidation range around the 139.50 level. The range could expand to the 139.16 level, followed by growth to the 139.92 level.

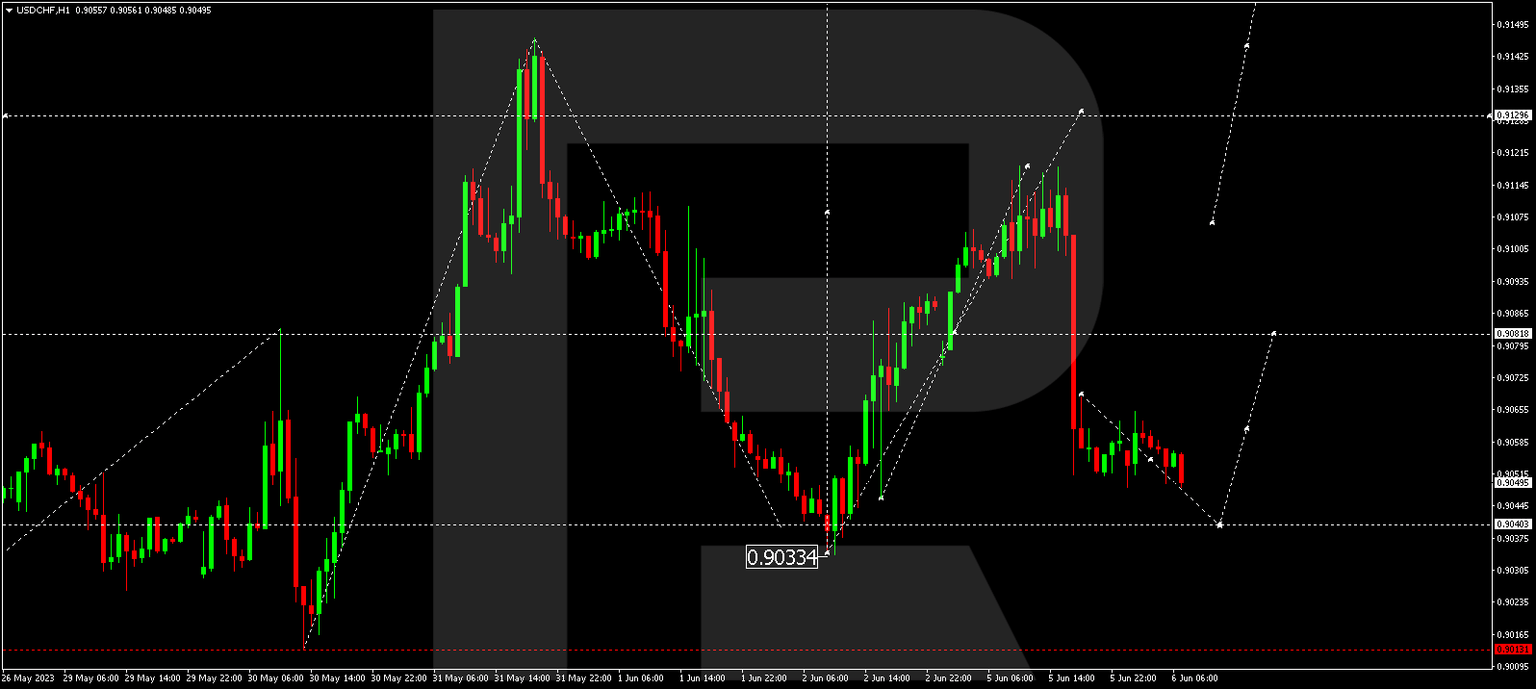

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair has completed a wave of growth to the 0.9119 level. Today a correction to the 0.9040 level could develop. Following the completion of the correction, a tie of growth to the 0.9080 level could start.

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair has completed a link of growth to the 0.6666 level. Today a consolidation range could develop around this level. With an exit downwards, a pattern of decline to the 0.6565 level could continue to develop. This is the first target.

Brent

Brent has completed a pattern of growth to the 78.08 level. Today the market has corrected to the 76.06 level, and a wave of growth to the 77.77 level is expected to start. A breakout of this level upwards will open the potential for growth to the 79.45 level with the prospect of trend continuation to the 80.08 level.

XAU/USD, “Gold vs US Dollar”

Gold has completed a structure of a declining wave to the 1938.30 level. Today the market is correcting to the 1968.00 level. After the correction is over, a new structure of decline to the 1931.40 level could start. This is the first target.

S&P 500

The stock index has completed a tie of growth to the 4300.0 level, followed by today’s impulse of decline to the 4269.0 level. A tie of correction to the 4285.4 level is currently being formed. When the correction is over, another pattern of decline to the 4229.6 level could develop with the prospect of trend continuation to the 4188.8 level. This is the first target.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.