Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The currency pair has completed a wave of decline to 1.0701 and a link of correction to 1.0732. Today the market is consolidating around this level. The consolidation range is expected to extend to 1.0744. Next, a decline to 1.0732 (a test from above) and a rise to 1.0760 are expected.

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of growth to 1.2394 and a link of decline to 1.2320. Today the market has formed a consolidation range around 1.2350. The range is expected to extend upwards to 1.2377. Next, a decline to 1.2288 is likely to follow.

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair formed a consolidation range around 140.20, escaped it upwards, and demonstrated a structure of growth to 140.88. Today the market has started developing a wave of decline to 140.20. If the price breaks the range downwards, the potential for a decline to 139.53 could open. With an escape from the range upwards, a structure of growth could develop to 141.64.

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair continues developing a consolidation range around 0.9045. Today it might drop to 0.9022. Next, a wave of growth to 0.9073 could begin. And if this level also breaks, the potential for a wave to 0.9111 could open.

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair is forming a consolidation range around 0.6525. A link of growth to 0.6555 is expected today. Next, a decline to 0.6525 (a test from above) and growth to 0.6570 are expected.

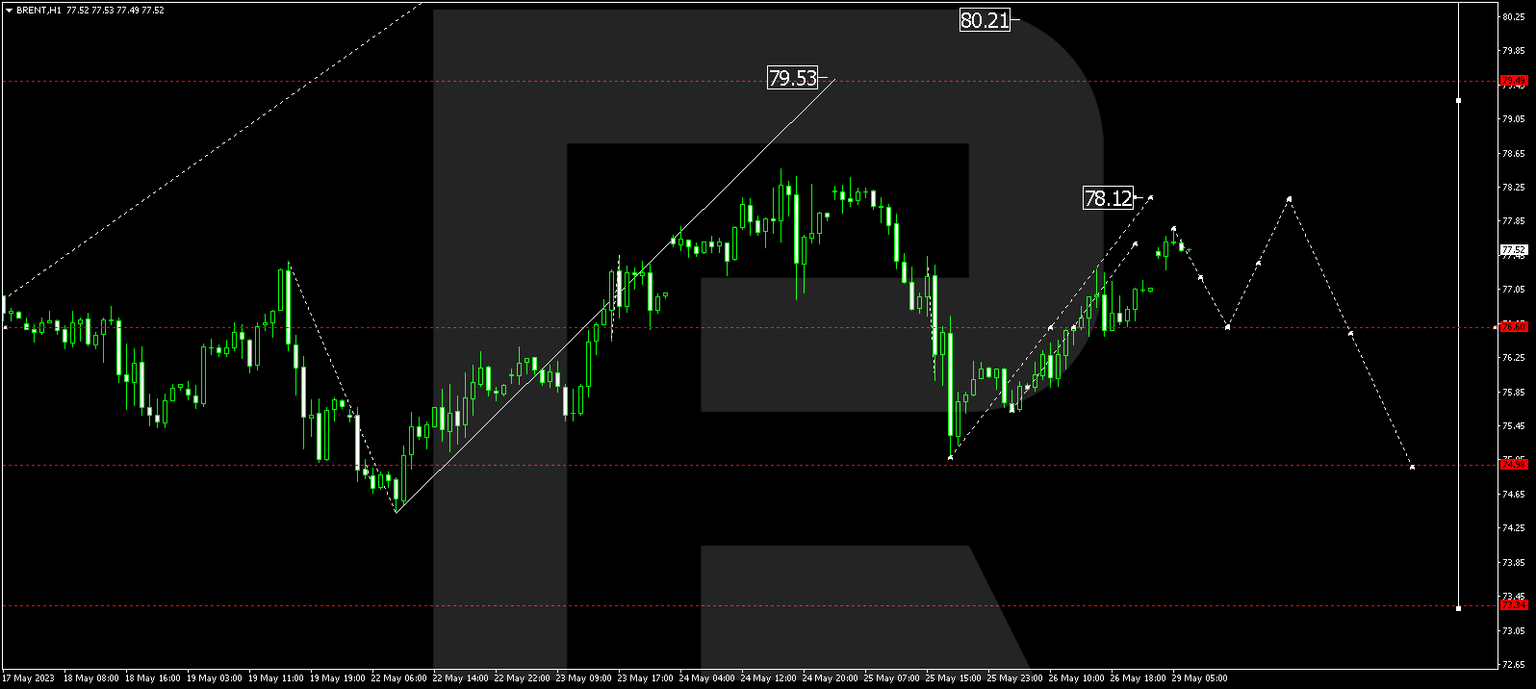

Brent

Brent formed a consolidation range around 76.76, escaped it upwards, and completed a link of growth to 77.77. Today it might decline correcting to 76.60 (a test from above). Next, a structure of growth to 78.12 is expected. And next, a decline to 75.00 is not excluded.

XAU/USD, “Gold vs US Dollar”

Gold is forming a consolidation range around 1944.44. A link of growth could develop to 1950.77. Next, a new structure of decline to 1936.80 is expected. And if this level also breaks downwards, the potential for a wave to 1923.25 could open.

S&P 500

The stock index has broken the level of 4187.0 upwards and continues developing a wave of growth to 4236.2. After the quotes reach this level, a decline to 4187.0 could follow (a test from above). Next, a new structure of growth to 4267.5 could develop.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.