Forex technical analysis and forecast: Majors, equities and commodities

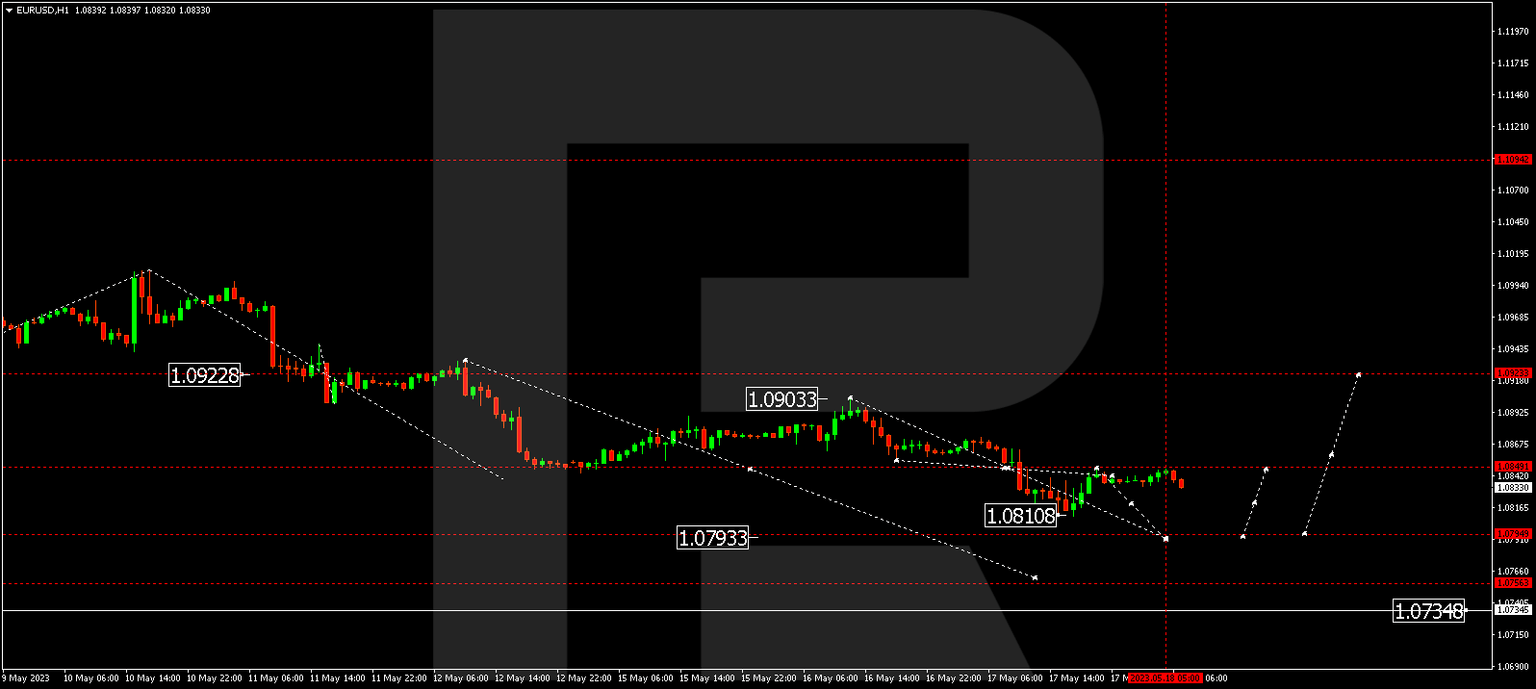

EUR/USD, “Euro vs US Dollar”

The currency pair has completed a wave of decline to 1.0810. Today the market is forming a wave of correction to 1.0849. After the correction is over, the pair might develop a wave of decline to 1.0795, from where the trend could continue to 1.0755.

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair has completed a wave of decline to 1.2420. Today the market is forming a wave of correction to 1.2500. After the quotes reach this level, the wave of decline could continue to 1.2400. Next, a rise to 1.2500 could follow.

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair has completed a wave of growth to 137.44. Today the market is forming a consolidation range around this level. With an escape from the range upwards, the potential for a rise to 138.38 could open. And if the price breaks the range downwards, a link of correction to 136.66 could follow. Next, an increase to 138.66 is expected.

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair has completed a correction to 0.8970. Today the growth could continue to 0.9054. This is a local target. After the price reaches this level, a correction to 0.8989 could follow. Next, a rise to 0.9105 is expected.

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair continues forming a consolidation range around 0.6655. With an escape from the range downwards, the wave of decline could continue to 0.6600. Next, a link of growth to 0.6696 is expected.

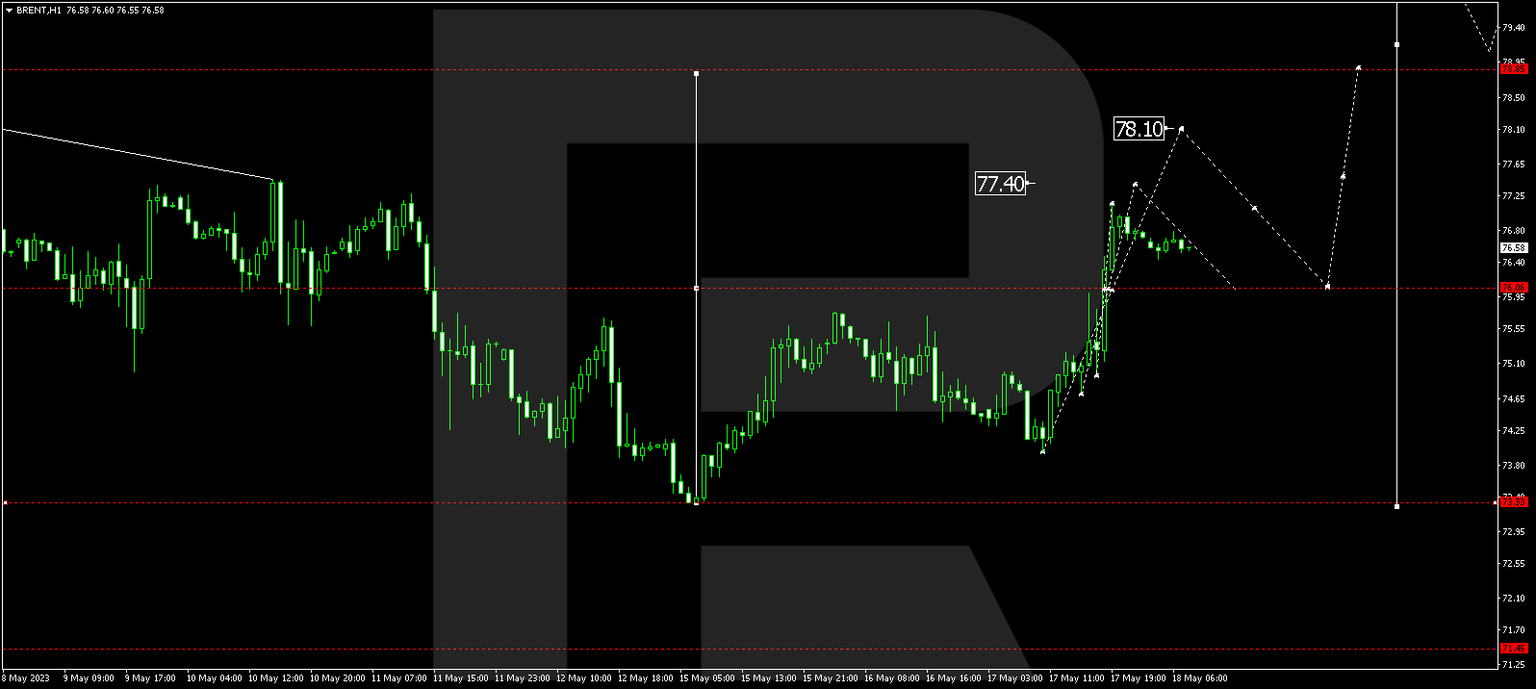

Brent

Brent has broken the level of 76.00 upwards. Practically, the potential for a rise to 78.10 is open. After the price reaches this level, a link of correction to 76.00 (a test from above) is expected. Next, an increase to 78.85 could follow, from where the trend might continue to 85.00.

XAU/USD, “Gold vs US Dollar”

Gold has completed a wave of decline to 1975.40. Today the market is forming a consolidation range above this level. Extension of the range to 1964.00 is not excluded. Next, corrective growth to 2011.00 could follow. After the price reaches this level, a new wave of decline to 1850.00 might be expected.

S&P 500

The stock index continues developing a consolidation range around 4133.0. Today the range might extend to 4171.1. Next, a decline to 4055.0 could follow. And if this level breaks downwards, the potential for a declining wave to 3900.0 might open.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.