Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The currency pair has finished correcting to 1.0659. Today a consolidation range might form under this level. With an escape downwards, a new wave of decline to 1.0610 should start. With a breakaway of this level, a pathway to 1.0560 will open, followed by a correction to 1.0600 (a test from below). Then a decline to 1.0460 should follow. The goal is first.

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair continues developing a consolidation range around 1.2050. Today a link of growth to 1.2110 is not excluded. After this level is reached, the quotes may go down to 1.1940, then correct to 1.2140, and then fall to 1.1850. The goal is first.

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair continues extending the consolidation range to 133.43. After this level is reached, a decline to 131.00 is expected. And with a breakaway of this level downwards, a pathway to 129,00 will open. The goal is first.

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair continues correcting to 0.9292. After this level is reached, growth to 0.9364 should begin. The goal is first. Then a decline to 0.9292 and growth to 0.9400 should follow.

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair has completed a wave of growth to 0.6755. Today a new wave of decline to 0.6626 should start from where the trend might continue to 0.6500.

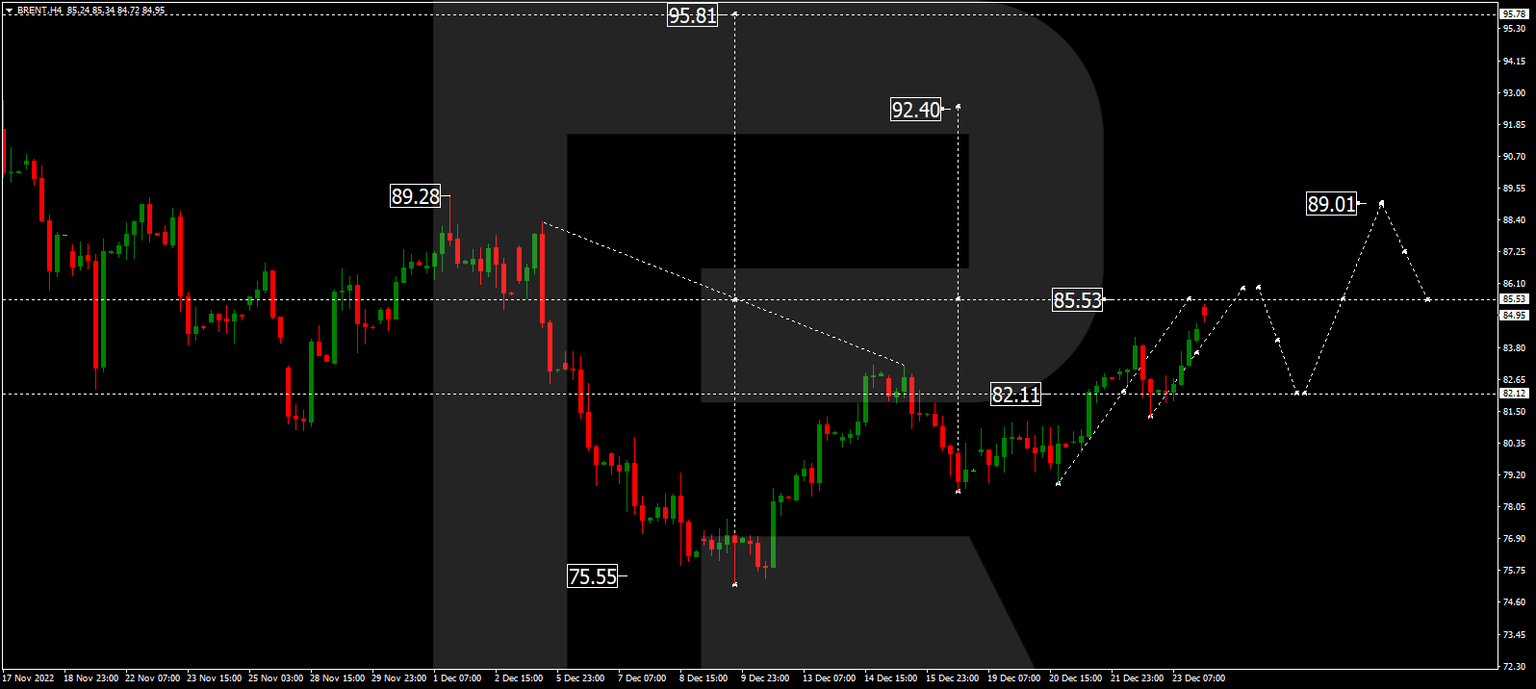

Brent

Oil continues a wave of growth to 86.00. After this level is reached, a correction to 82.55 might start. After this level is reached, a link of growth to 89.00 might follow, from where the trend might continue to 92.40. The goal is local.

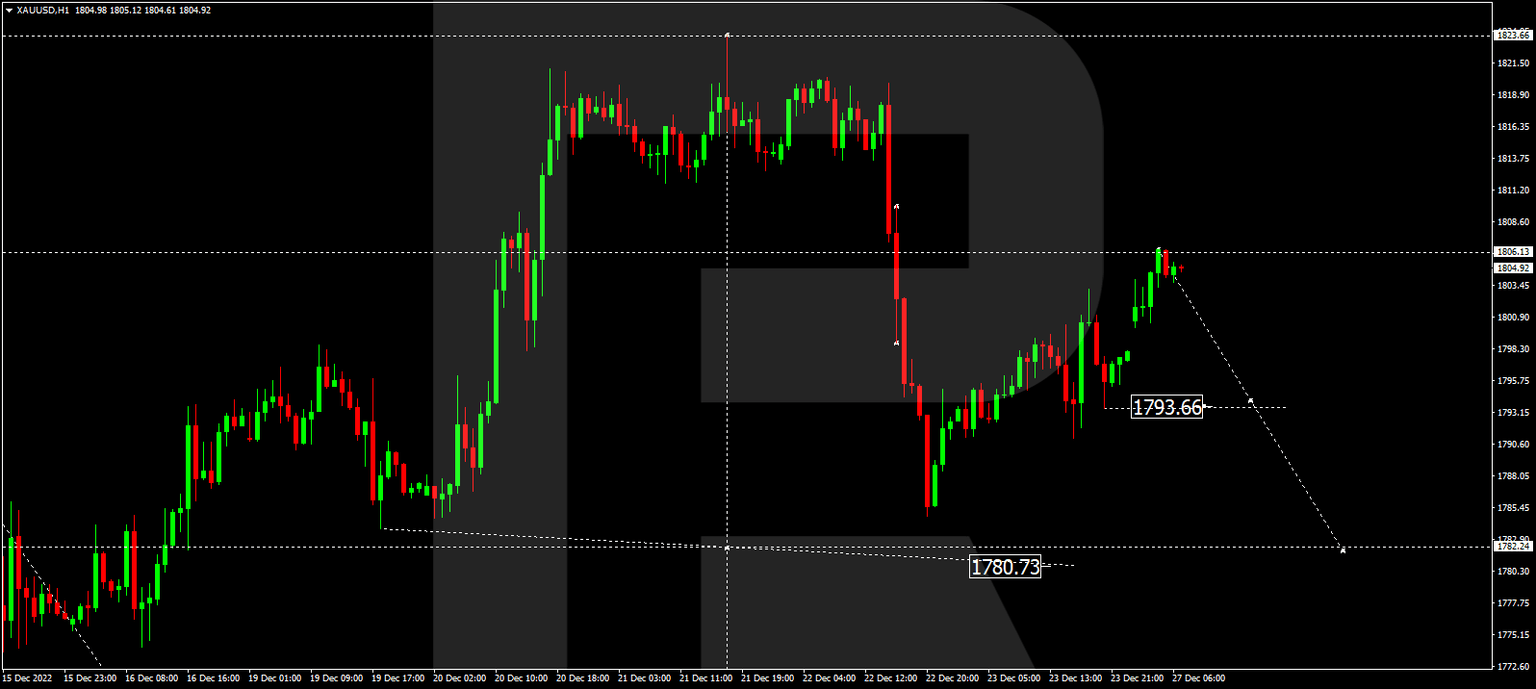

XAU/USD, “Gold vs US Dollar”

Gold has completed a wave of growth to 1806.10. Today the market is forming a consolidation range under this level. A decline ti 1793.70 is expected, from where the trend might continue to 1770.00.

S&P 500

The stock index has escaped a consolidation range upwards and suggests a correction to 3894.4. After this level is reached, a wave of decline to 3732.0 should start. The goal is local.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.