Forex technical analysis and forecast: Majors, equities and commodities

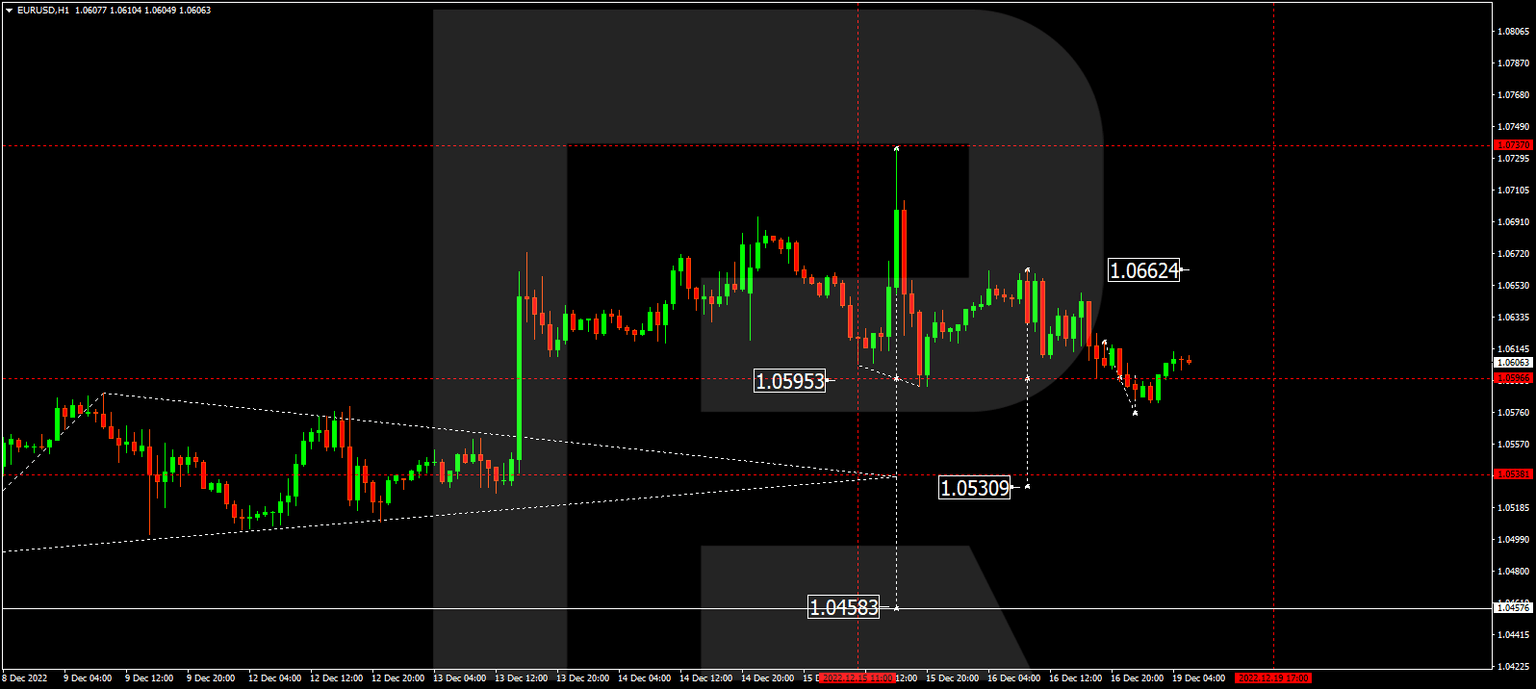

EUR/USD, “Euro vs US Dollar”

The currency pair has formed a declining impulse to 1.0596. Today the market is forming a consolidation range around this level. The range is expected to expand to 1.0573. Then growth to 1.0596 and a decline to 1.0530 should follow. The goal is local.

GBP/USD, “Great Britain Pound vs US Dollar”

The currency pair demonstrated a declining impulse to 1.2170. Today the market is forming a consolidation range around this level. A link of correction to 1.2316 is not excluded. After the correction is over, another structure of decline to 1.2020 may from. The goal is local.

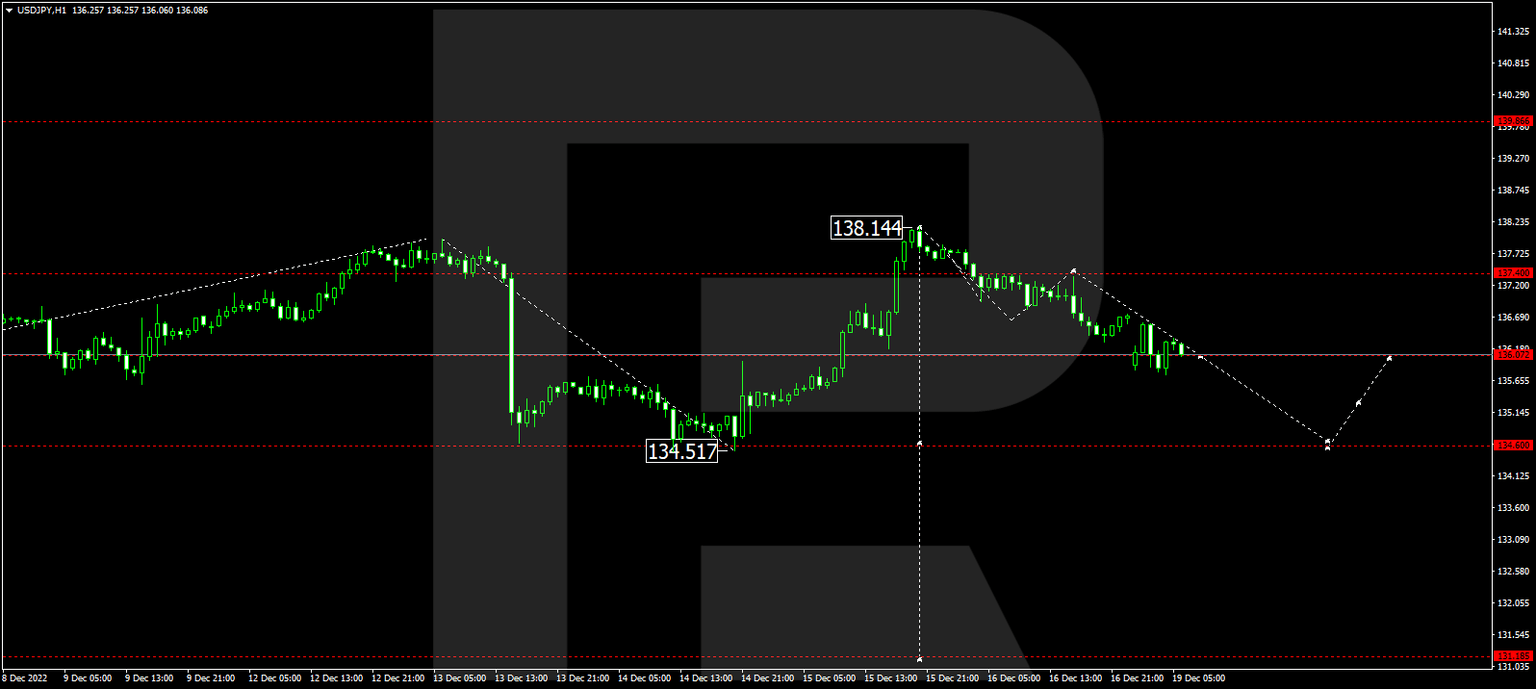

USD/JPY, “US Dollar vs Japanese Yen”

The currency pair demonstrated a structure of decline to 136.06. At the moment, the market is forming a consolidation range around this level. A decline to 134.60 is expected. The goal is local.

USD/CHF, “US Dollar vs Swiss Franc”

The currency pair demonstrated an impulse of growth to 0.9345. Today a link of correction to 0.9304 is not excluded. After the correction is over, a wave of growth to 0.9355 should begin, from where the wave should continue to 0.9390. The goal is first.

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair demonstrated a second impulse of decline to 0.6677. Today the market is forming a consolidation range around this level. The range is expected to expand to 0.6660. Then growth to 0.6700 and a decline to 0.6555 should follow. The goal is local.

Brent

Crude oil completed a wave of correction to 78.78. Today a structure of growth to 83.38 should develop. With a breakaway of this level, a pathway to 92.55 will open. The goal is local.

XAU/USD, “Gold vs US Dollar”

Gold completed a wave of correction to 1796.25. The whole structure is interpreted as a consolidation range around 1784.50. Today a new structure of decline to 1775.75 should form. With a breakaway of this level, a pathway down to 1756.56 will open. The goal is local.

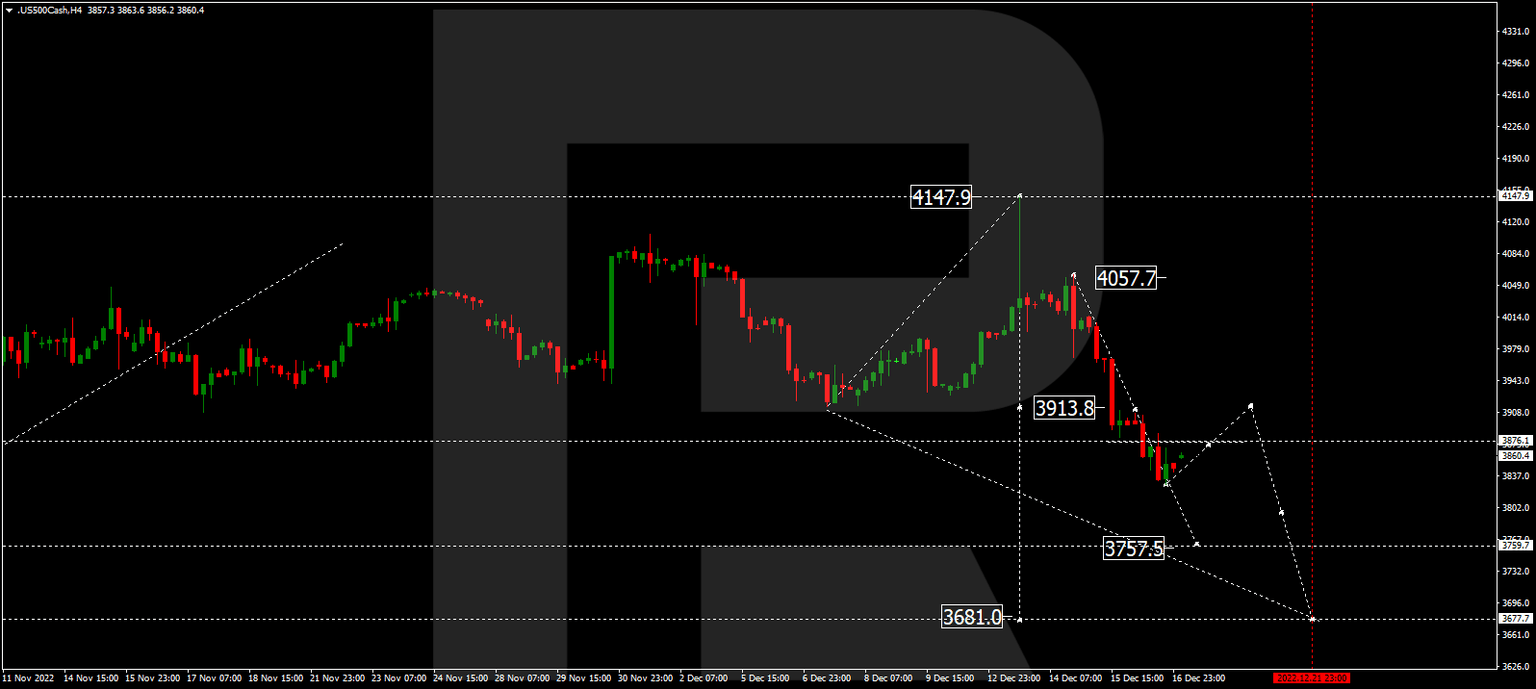

S&P 500

The stock index continues forming a consolidation range around 3876.0. With an escape from the range downwards, a pathway to 3757.5 will open. Then growth to 3876.0 and a decline to 3681.0 should be expected. The goal is first.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.