Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

EUR/USD continues to form a consolidation range around the 0.9790 level. An upside exit would open up the potential for a correction to 0.9873 with the prospect of an upside to 0.9966. An exit downwards would open up the potential to reach 0.9700.

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD continues to form a consolidation range around the 1.1300 level. With the exit from it upwards, we will consider the probability of continuation of correction to 1.1510. After the performance of this level, we expect the decline to 1.1330. Then the growth to the level of 1.1670.

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY is forming a consolidation range around 149.15. A move upwards from there would not exclude a wave extension to 150.10. A move downwards would open the potential to reach 147.90.

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF continues to develop a consolidation range around the 0.9922 level. With an exit upwards, we expect a rise to 1.0236. An exit to the downside will open the potential for a decline to 0.9700.

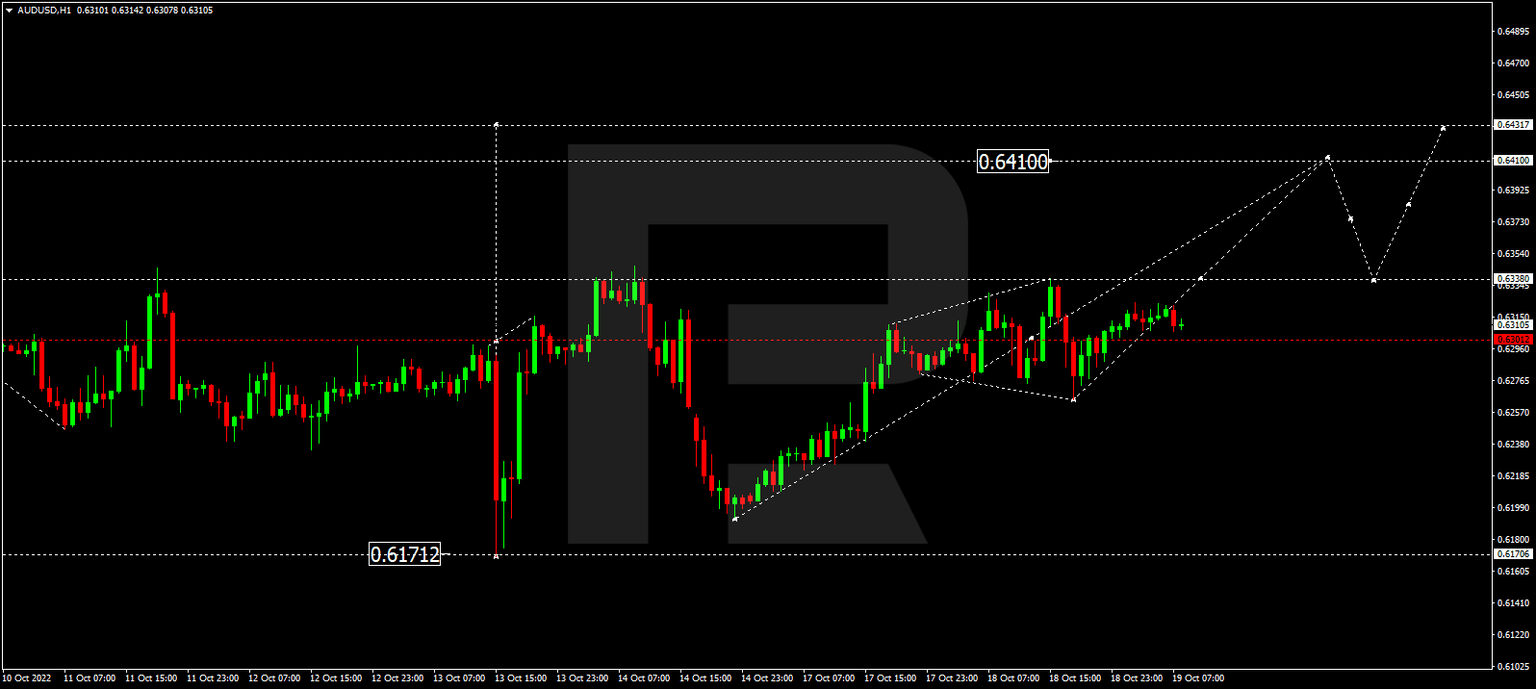

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD continues to develop a consolidation range around the 0.6300 level. An upside exit would open up the potential for growth to 0.6410. On the way down, a drop to 0.6200 is possible.

Brent

Brent continues to develop a consolidation range around the 90.50 level. Today, we expect a rise to 92.20. After this level is reached, consider the possibility of a decline to 90.50. Further - growth to the level of 100.20. The target is the first one.

XAU/USD, “Gold vs US Dollar”

Gold forms a declining pattern towards 1642.60. Next, consider the start of the development of a rise to 1683.55. The target is the first one.

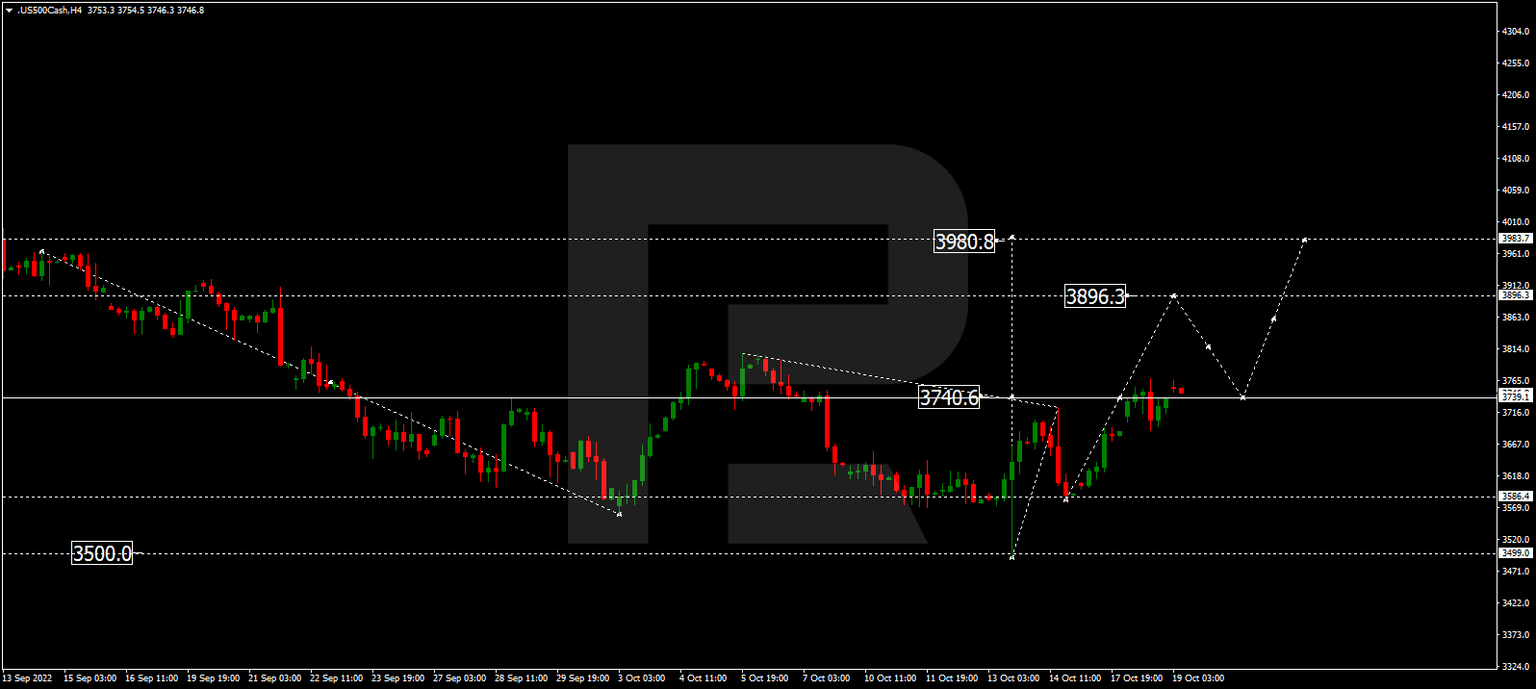

S&P 500

The S&P index continues to develop a consolidation range around 3739.0. We expect growth to 3896.3. After this level, a correction to 3740.0 is not excluded. Then - growth to the level of 3983.3.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.