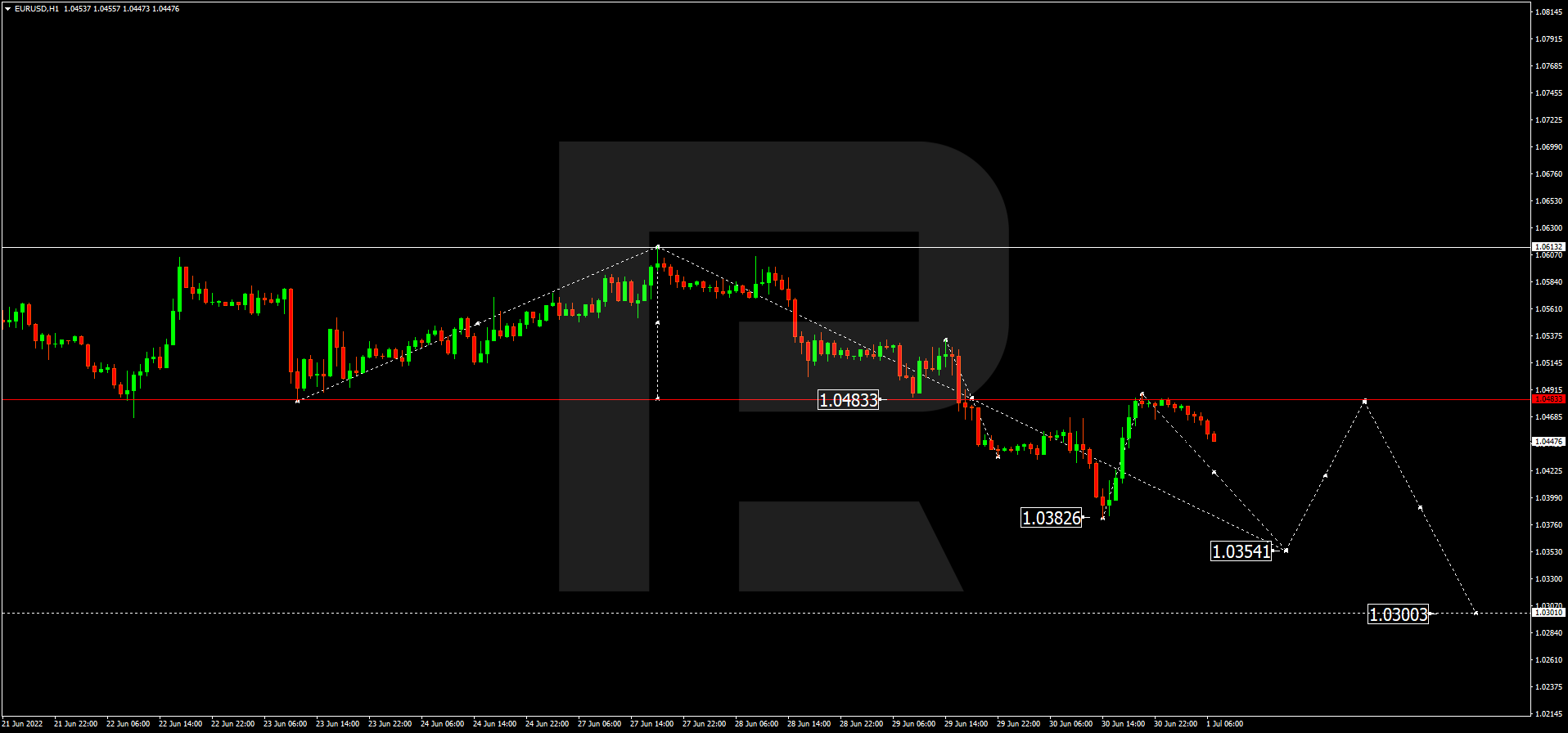

EUR/USD, “Euro vs US Dollar”

Having completed the descending wave at 1.0383 along with the correction up to 1.0484, EURUSD continues falling towards 1.0355. Later, the market may correct to return to 1.0484 and then resume trading downwards with the target at 1.0300.

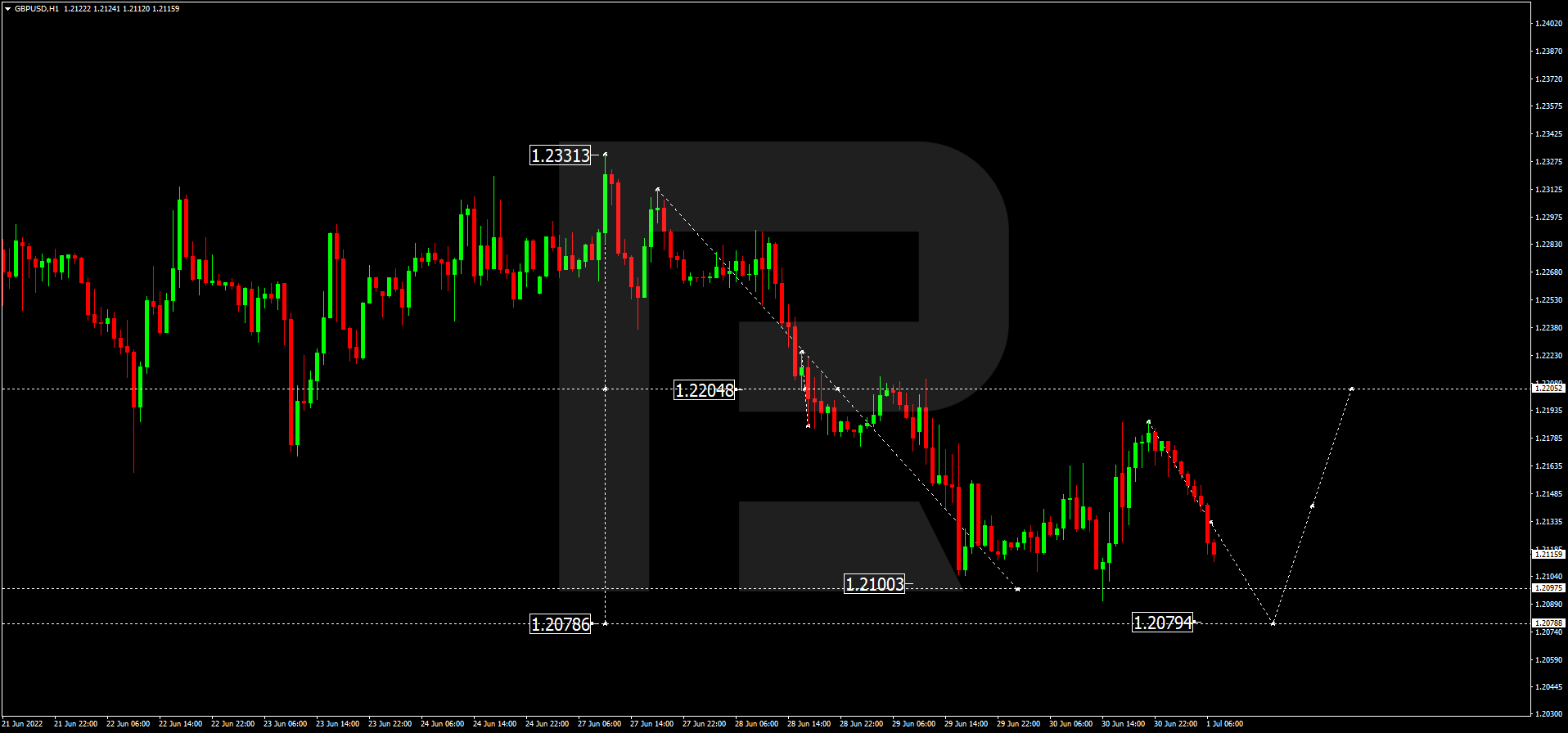

GBP/USD, “Great Britain Pound vs US Dollar”

After finishing the descending wave at 1.2100 along with the correction up to 1.2187, GBPUSD continues falling towards 1.2079 and may later correct up to 1.2200. After that, the instrument may start another decline with the target at 1.2000.

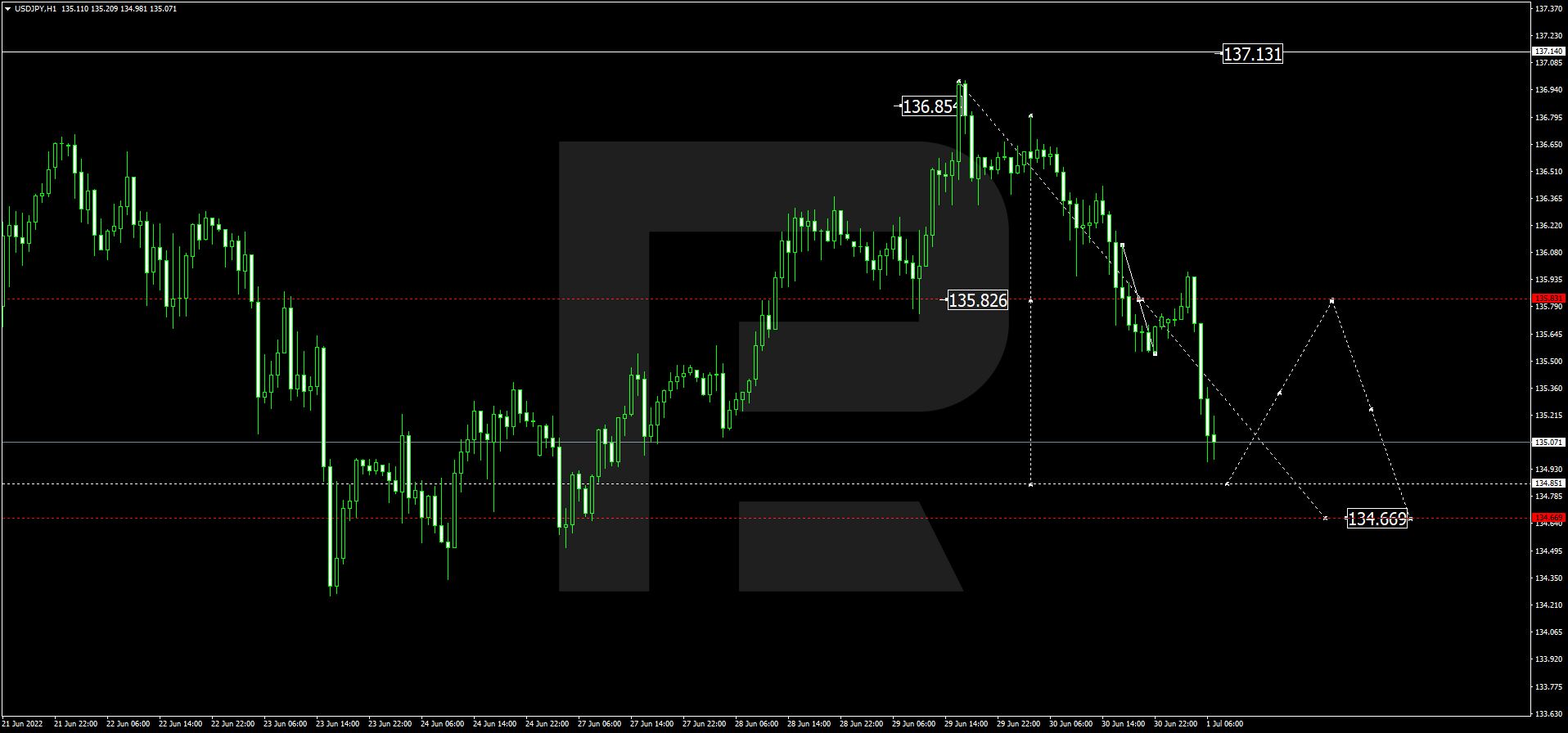

USD/JPY, “US Dollar vs Japanese Yen”

Having finished the descending wave at 135.83 and then forming a new consolidation range around this level, USDJPY has broken it to the downside and may later continue falling with the short-term target at 134.85. After that, the instrument may form one more ascending structure to return to 135.82 and then resume trading downwards to reach 134.66.

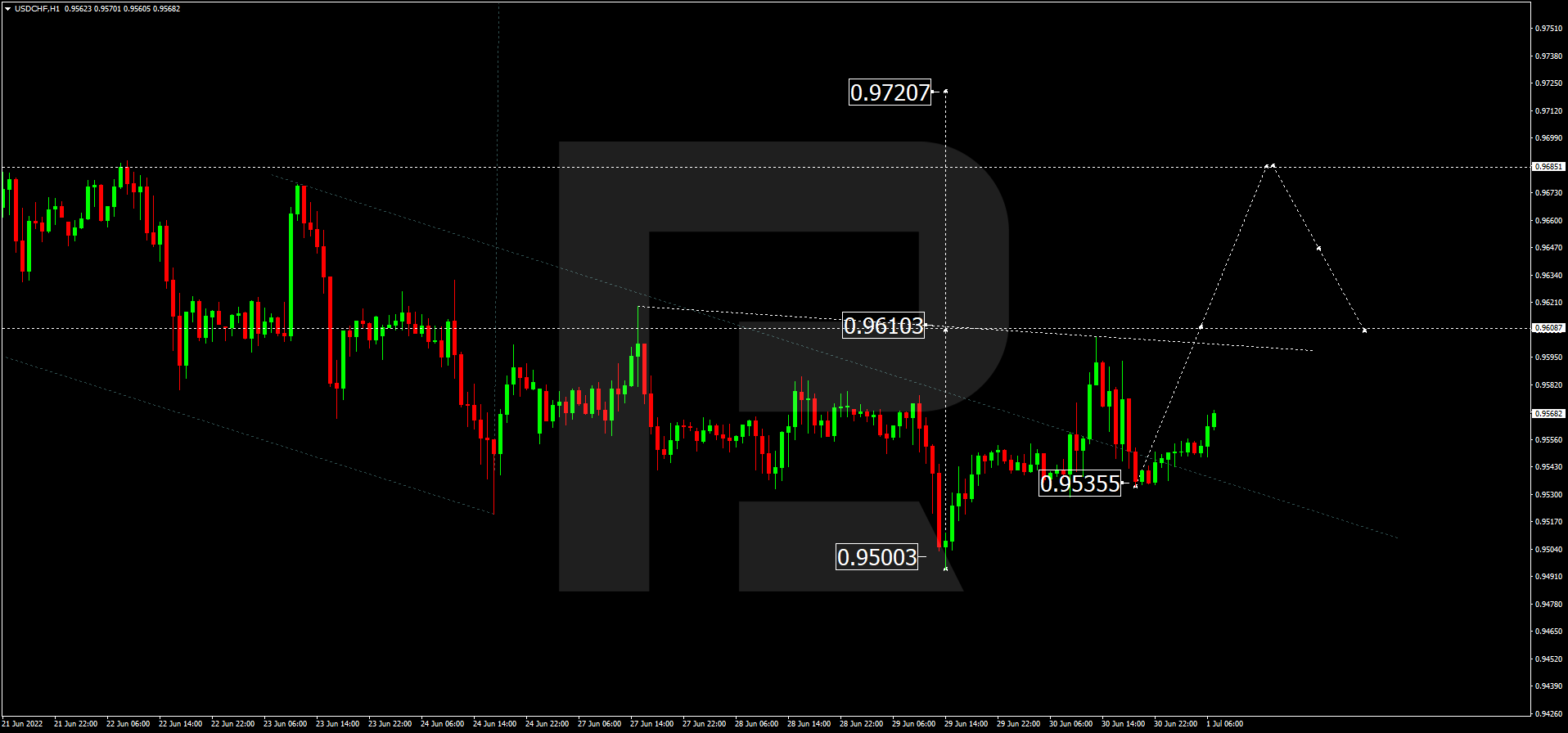

USD/CHF, “US Dollar vs Swiss Franc”

USDCHF has completed the ascending wave at 0.9600 along with the correction down to 0.9535; right now, it is growing towards 0.9610. After that, the instrument may break this level to the upside and then form one more ascending structure with the target at 0.9685.

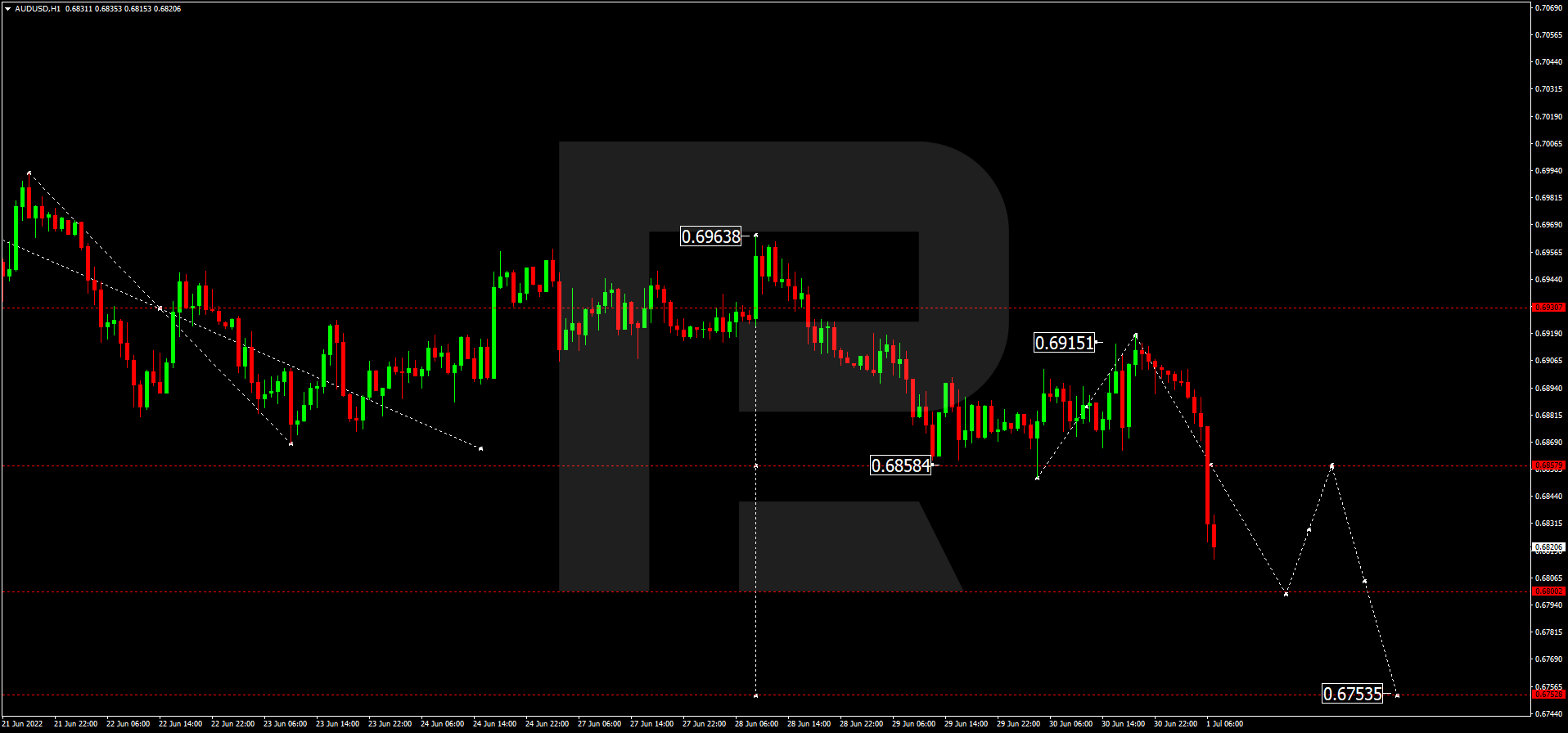

AUD/USD, “Australian Dollar vs US Dollar”

After finishing the descending wave at 0.6858 along with the correction up to 0.6915, AUDUSD is forming a new descending structure towards 0.6800. Later, the market may grow to return to 0.6858 and then resume trading downwards with the target at 0.6755.

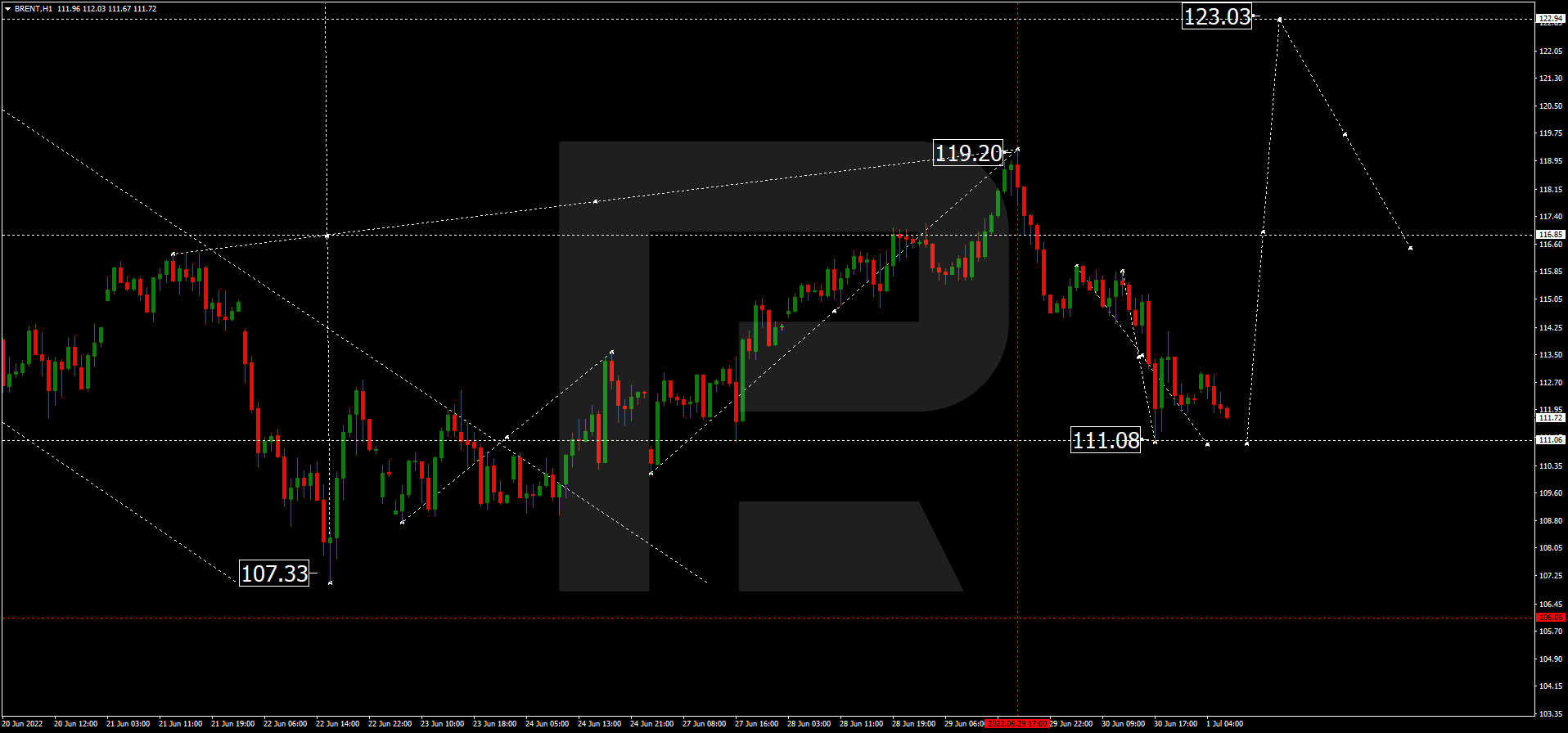

Brent

Brent is still correcting down to 110.00. After that, the instrument may start another growth with the target at 116.85 or even extend this structure up to 123.00.

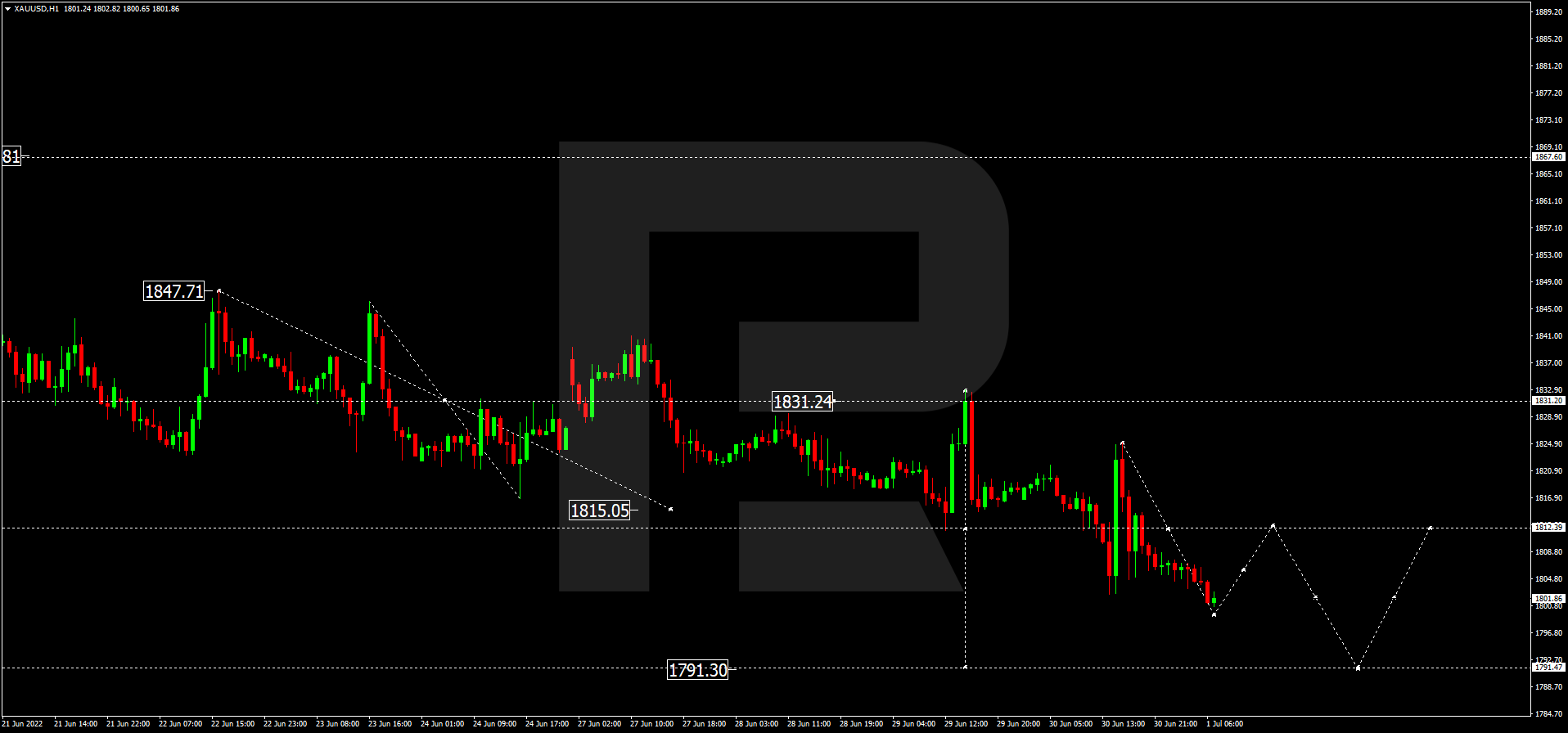

XAU/USD, “Gold vs US Dollar”

Gold is falling towards 1799.40. Later, the market may grow to reach 1812.40 and then resume trading downwards with the target at 1791.30.

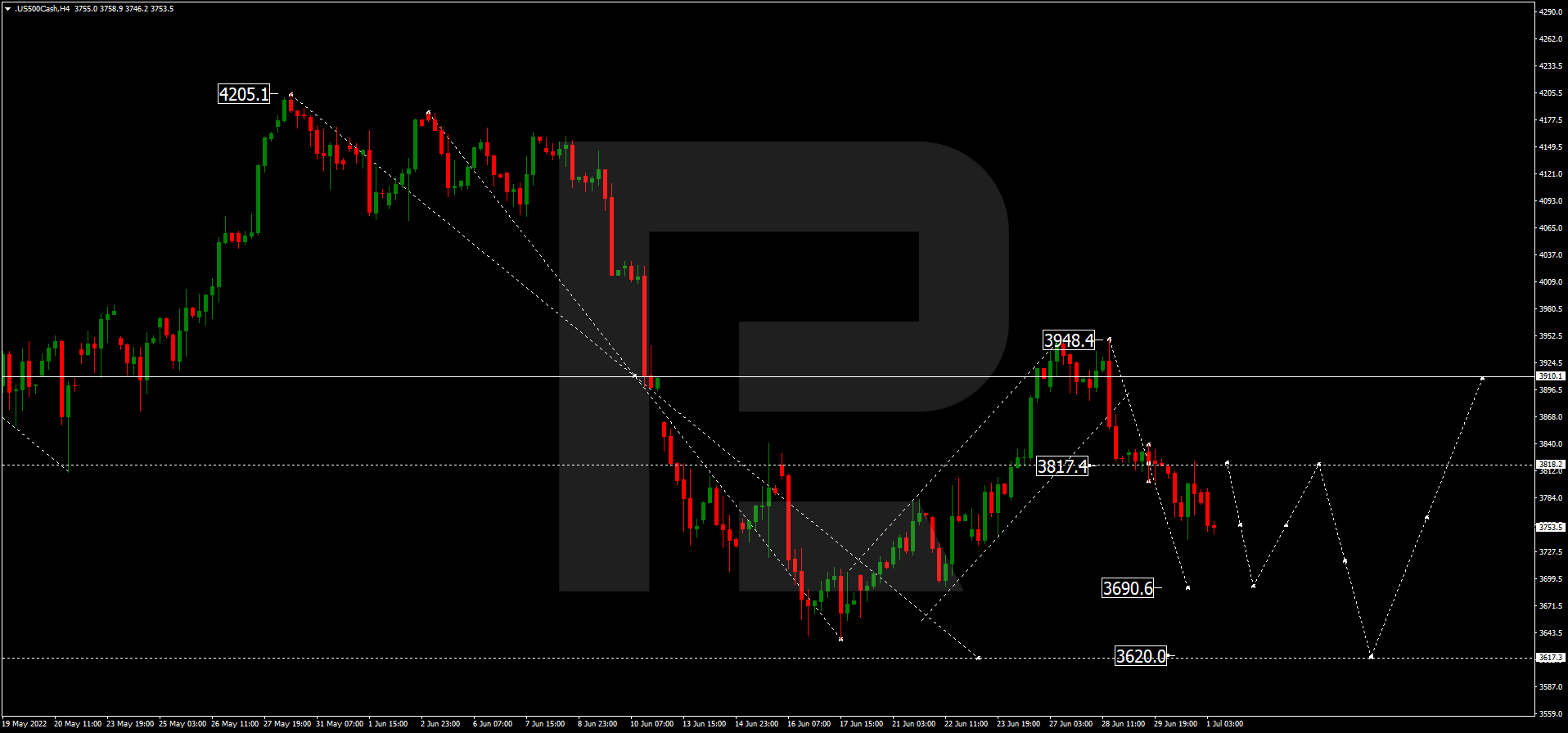

S&P 500

The S&P index is still falling towards 3690.0. After that, the instrument may correct up to 3817.5 and then form a new descending wave with the target at 3620.0.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

Gold moves to record highs past $3,340

Gold now gathers extra steam and advances beyond the $3,340 mark per troy ounce on Wednesday, hitting all-time highs amid ongoing worries over escalating US-China trade tensions, a weaker US Dollar and lack of news from Powell's speech.

AUD/USD: Upside now refocuses the 200-day SMA

AUD/USD advanced for the sixth consecutive daily advance, picking up extra upside impulse on the back of the continuation of the sell-off in the US Dollar. Next on tap for the Aussie now emerges the yearly peak above 0.6400 prior to the key 200-day SMA.

EUR/USD looks to retest its 2025 highs

EUR/USD reversed two consecutive daily retracements and revisited the key 1.1400 neighbourhood as the selling bias in the Greenback gathered extra pace, always against the backdrop of rising uncertainty surrounding US yields. Chief Powell, in the meantime, delivered a neutral message in his discussion over the economic outlook.

Bitcoin held steady as US reveals China faces up to 245% tariffs

Bitcoin (BTC) witnessed little pressure on Wednesday despite the Chinese government selling off parts of its confiscated cryptocurrency holdings.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.