Forex technical analysis and forecast: Majors, equities and commodities

EUR/USD, “Euro vs US Dollar”

The pair completed a wave of correction to 1.0477. Today the market keeps developing a declining wave to 1.0400, and with a breakaway of this level downwards, a pathway to 1.0270 will open.

GBP/USD, “Great Britain Pound vs US Dollar”

The pair completed a wave of decline to 1.1932. Today a link of correction to 1.2010 is not excluded, followed by a decline to 1.1877.

USD/JPY, “US Dollar vs Japanese Yen”

The pair completed a wave of growth to 135.55 and a correction to 134.85. It might continue to 134.74. Then growth to 136.00 is expected with probable further growth to 136.36.

USD/CHF, “US Dollar vs Swiss Franc”

The pair completed a link of growth to 1.0000. Currently, there is a consolidation range forming above this level. The range might expand upwards to 1.0088, followed by a decline to 1.0000.

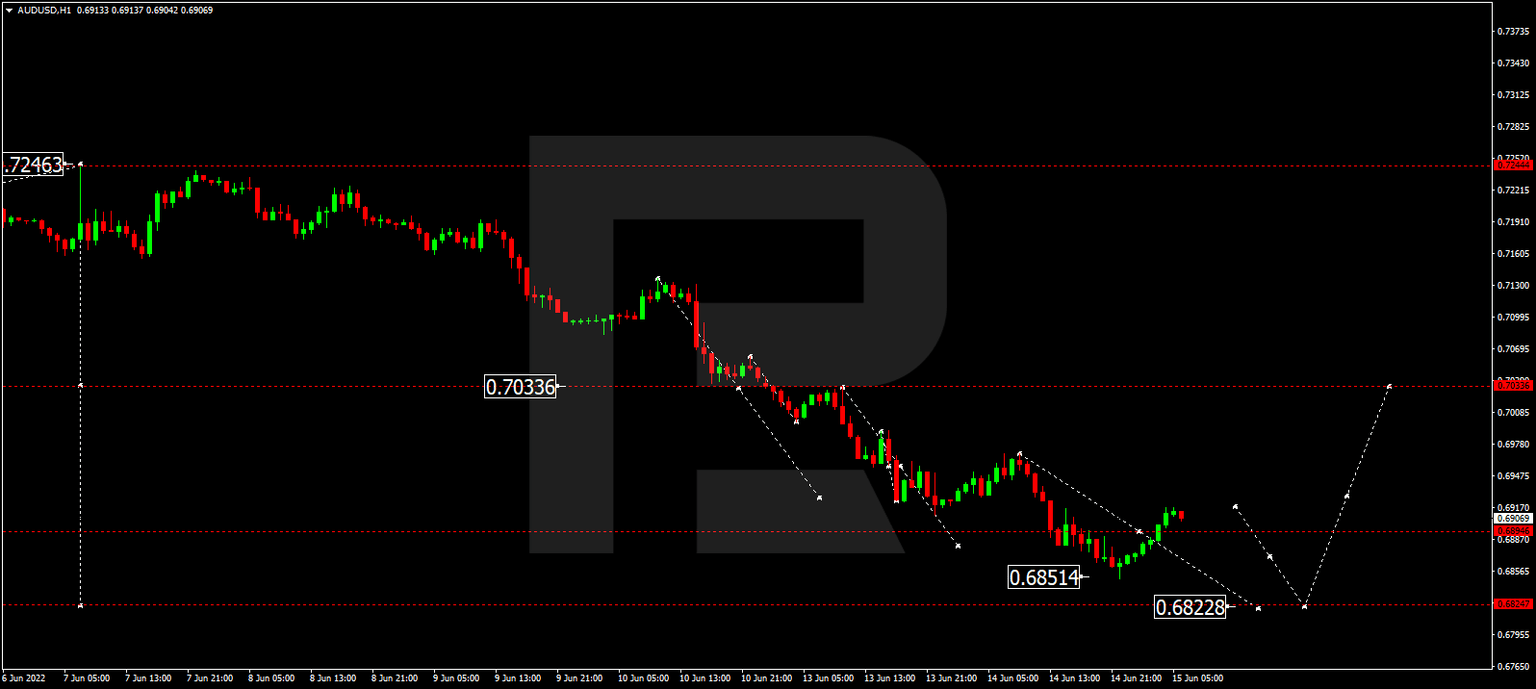

AUD/USD, “Australian Dollar vs US Dollar”

The currency pair performed a declining wave to 0.6850. Today a correction to 0.6917 has happened. Then a decline to 0.6822 can be expected.

Brent

Oil completed a link of growth to 126.19 and a correction to 120.00. Practically, the market has formed a consolidation range above 120.00. With an escape upwards, a pathway to 132.22 will open. With an escape downwards, a correction to 114.00 is not excluded.

XAU/USD, “Gold vs US Dollar”

Gold is developing a consolidation range around 1820.60. With an escape downwards, the declining wave will be able to continue to 1794.94 with a probability of extension to 1762.55. With an escape upwards, a correction to 1844.20 might develop, followed by a decline to 1762.55.

S&P 500

The stock index is forming a consolidation range under 3830.0. With an escape downwards, a pathway to 3470.0 will open. With an escape upwards, a link of correction to 3800.0 might develop, followed by a decline to 3111.0.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.