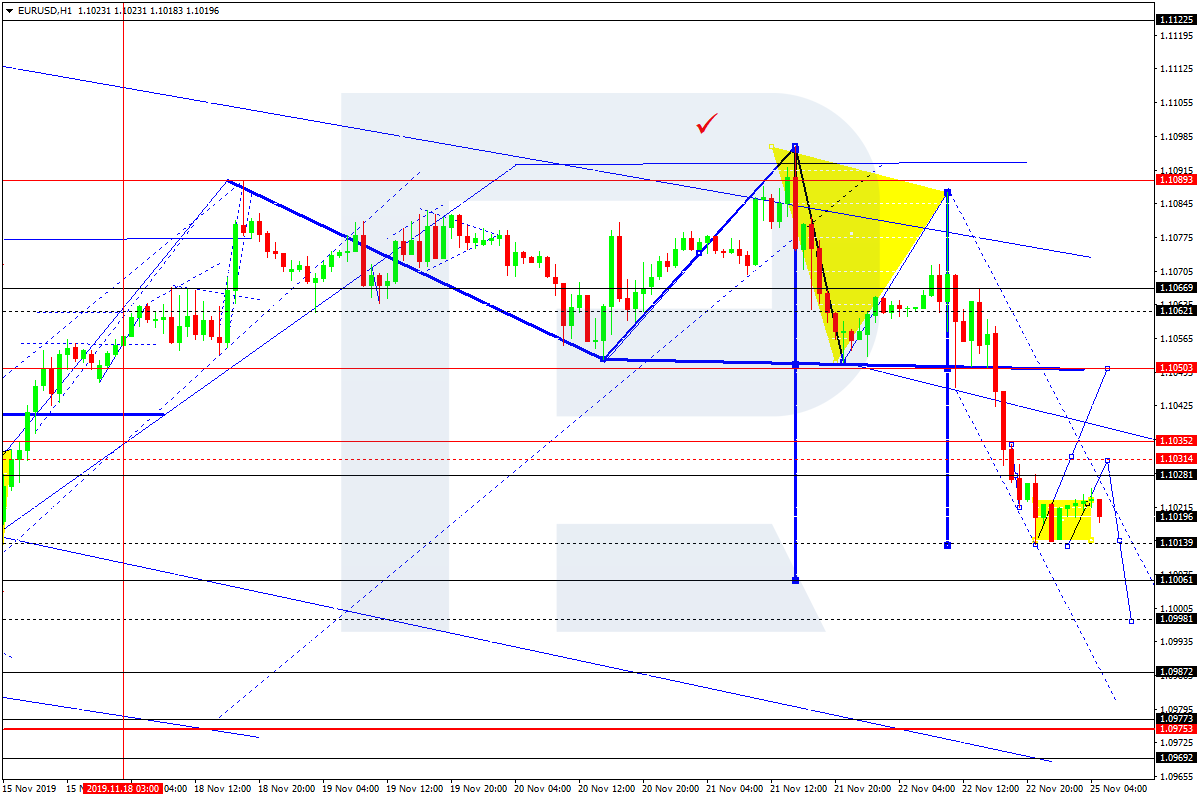

EUR/USD, “Euro vs US Dollar”

EUR/USD has reached the short-term target of another descending impulse at 1.1015; right now, it is consolidating around 1.1020. Possibly, today the pair may extend the structure towards 1.1012 and then start a new correction to reach 1.1030, at least. After that, the instrument may resume trading downwards with the predicted target at 1.0933.

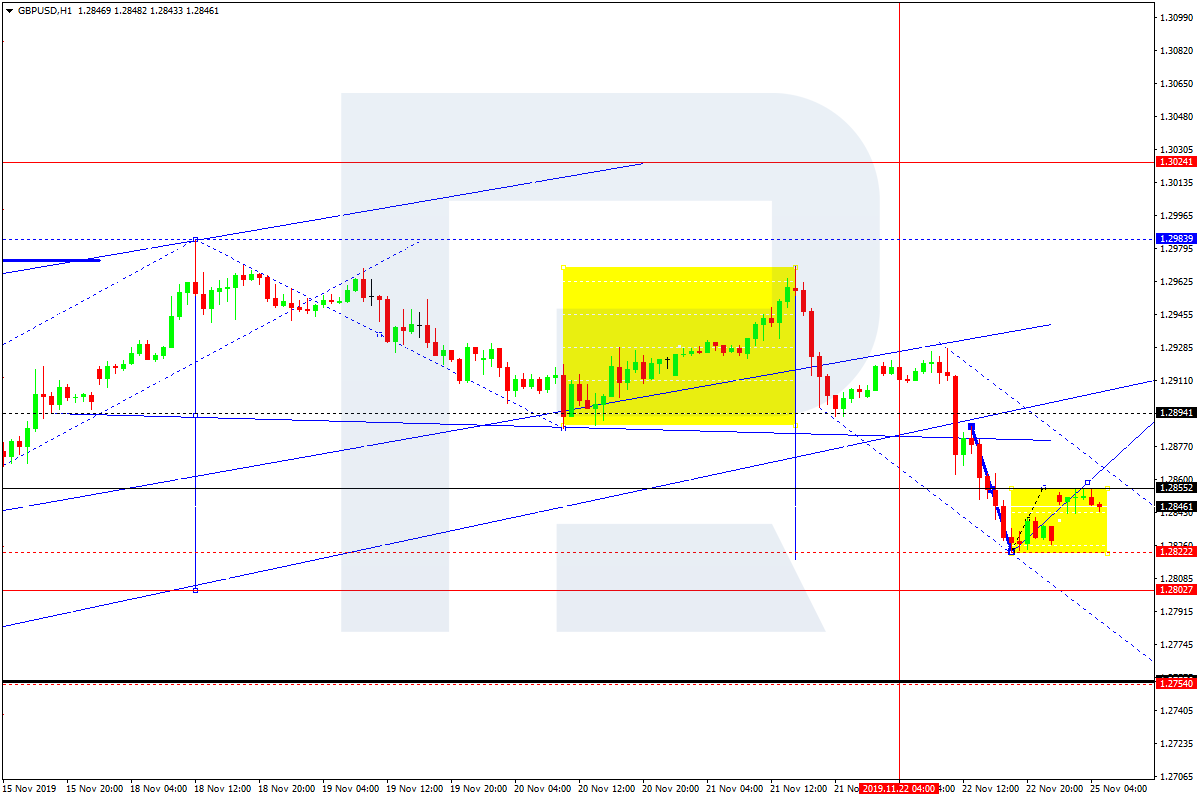

GBP/USD, “Great Britain Pound vs US Dollar”

GBP/USD continues forming the second descending impulse. Today, the pair may reach 1.2783 and then start another correction towards 1.2855, at least. Later, the market may form a new descending structure with the target at 1.2750.

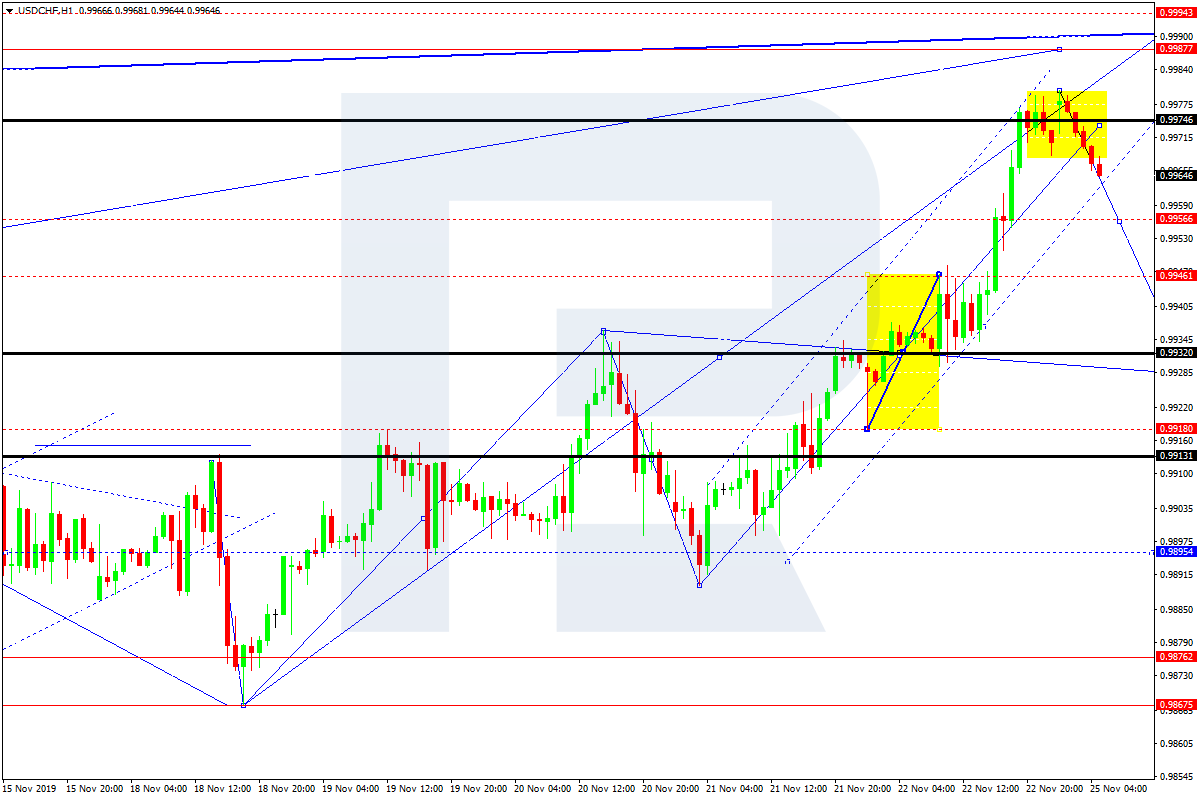

USD/CHF, “US Dollar vs Swiss Franc”

USD/CHF has reached the short-term upside target at 0.9975; right now, it is consolidating above 0.9968. possibly, the pair may break this level to the downside and start a new correction towards 0.955, at least. After that, the instrument may resume growing with the target at 0.9995.

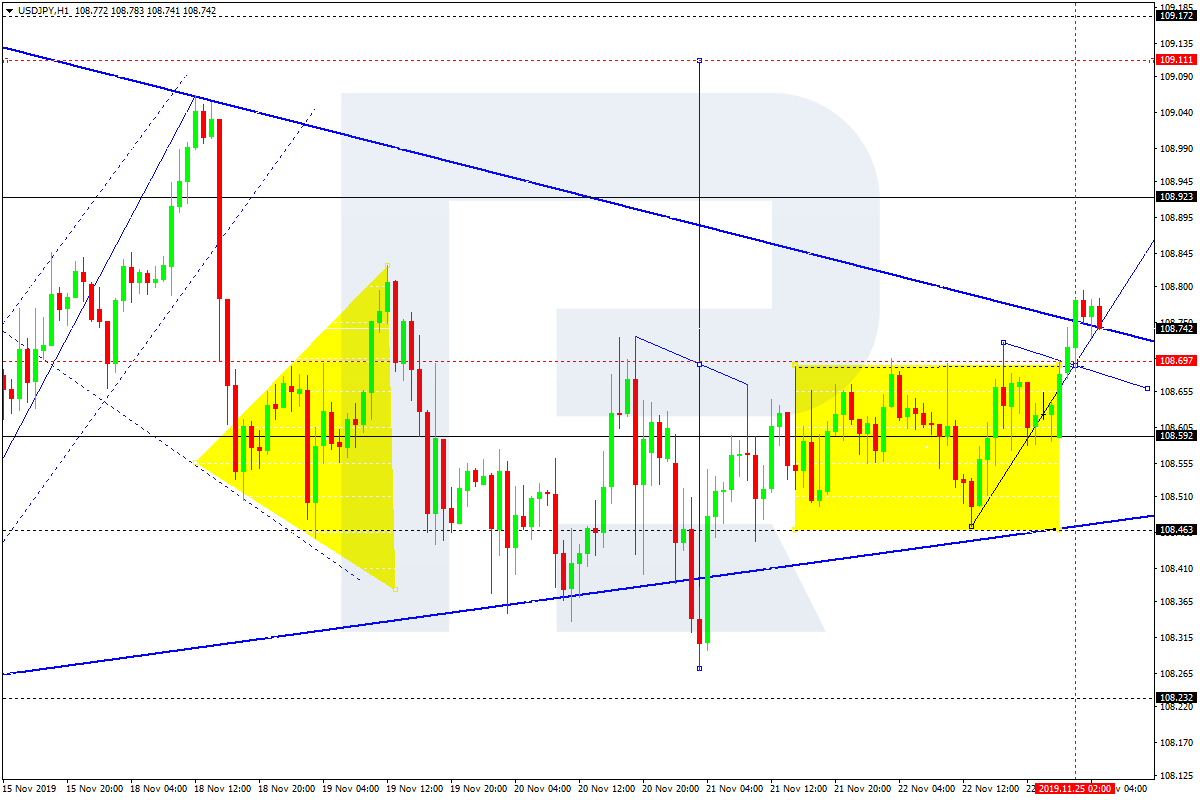

USD/JPY, “US Dollar vs Japanese Yen”

USD/JPY has broken 108.69 upwards. Possibly, the pair may choose an alternative scenario and continue the correction towards 108.93. According to the main scenario, the price is expected to continue trading inside the downtrend to reach 107.04.

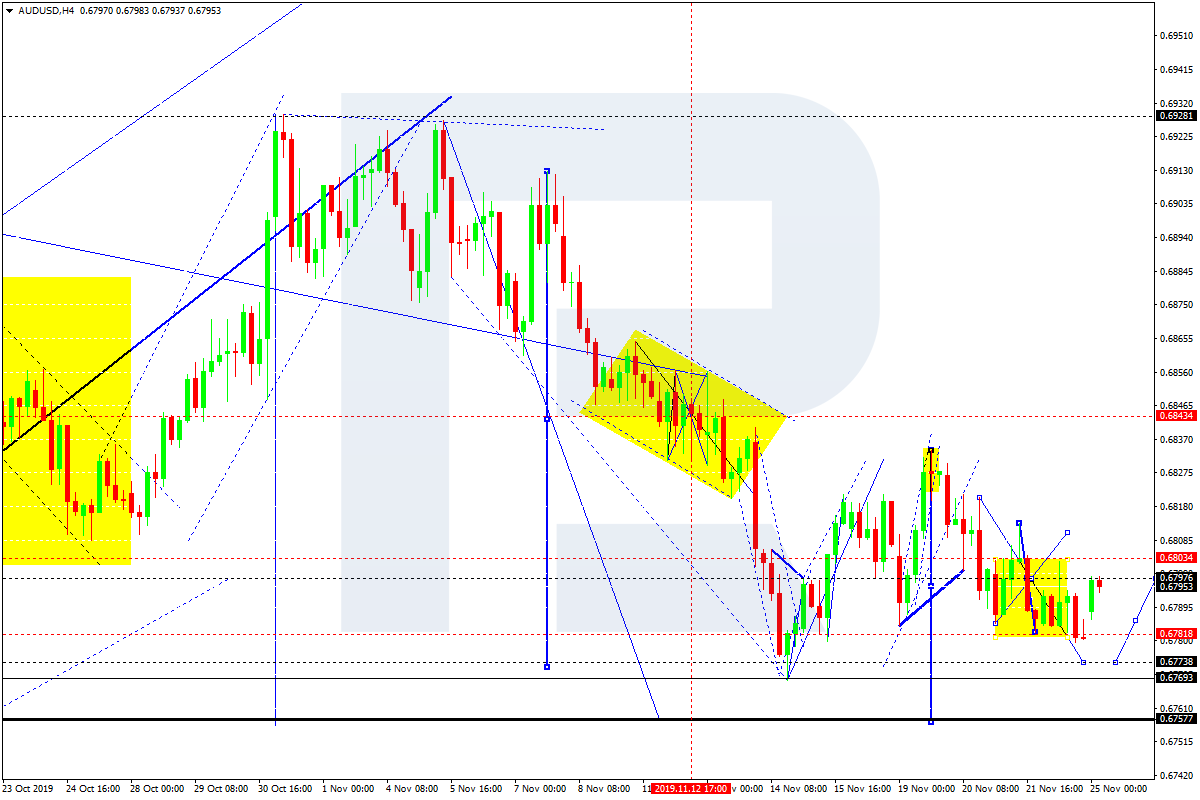

AUD/USD, “Australian Dollar vs US Dollar”

AUD/USD is consolidating around 0.6797 without any particular direction. The main scenario implies that the price may continue trading inside the downtrend with the target at 0.6773.

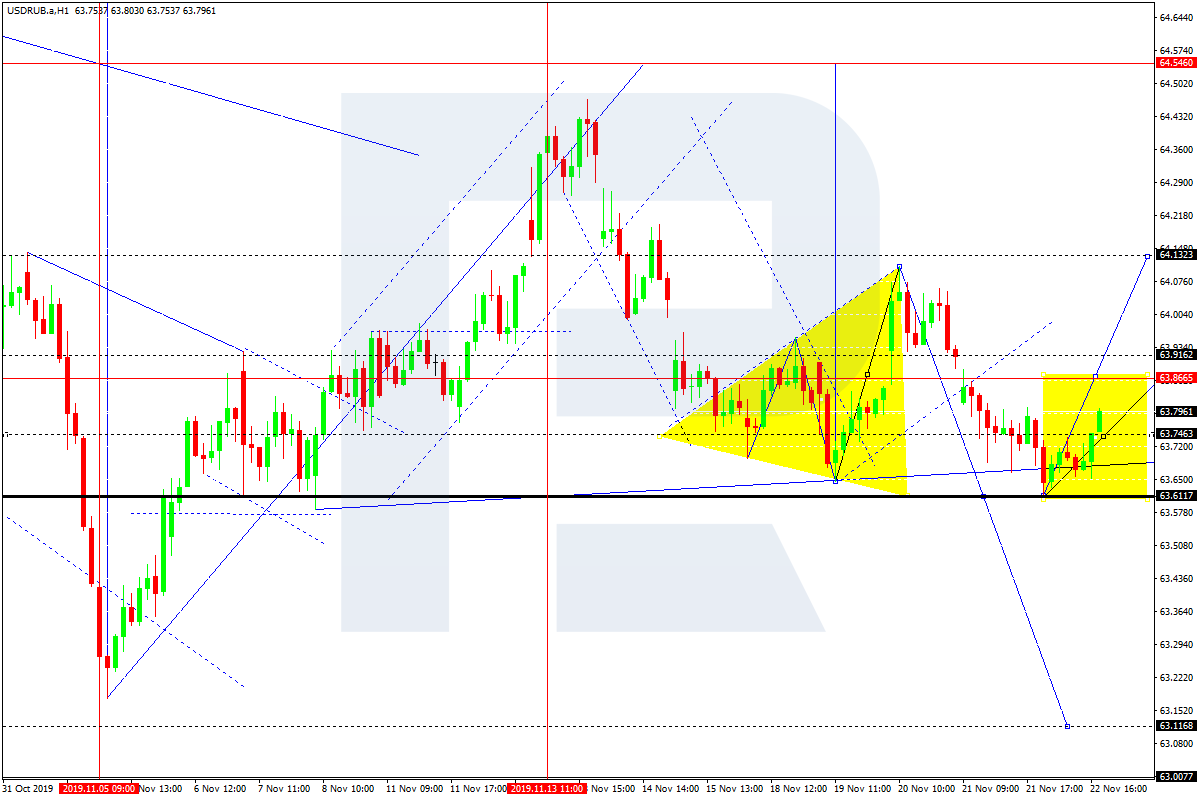

USD/RUB, “US Dollar vs Russian Ruble”

USD/RUB is consolidating around 63.73. Possibly, the pair may form one more ascending structure to reach 63.88. Later, the market may resume trading inside the downtrend with the target at 63.11.

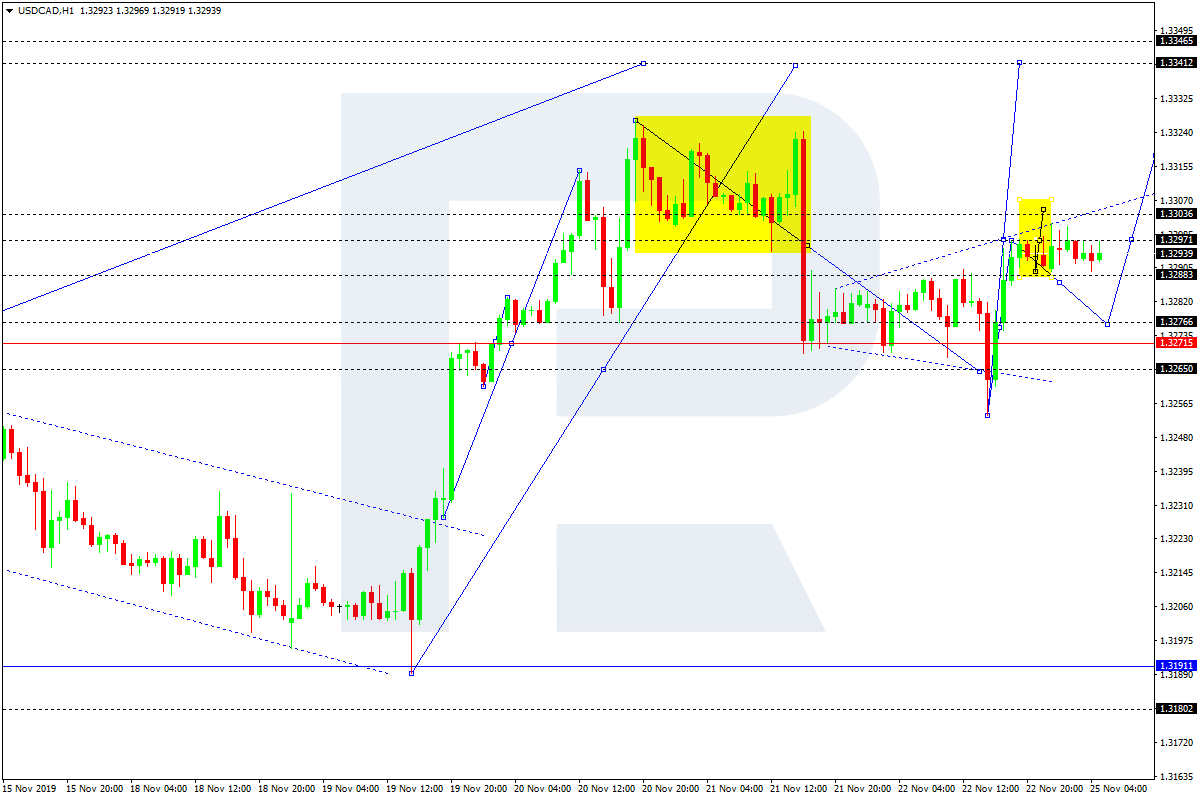

USD/CAD, “US Dollar vs Canadian Dollar”

USD/CAD has finished the ascending impulse towards 1.3297. Today, the pair may consolidate around this level. If later the price breaks this range to the downside at 1.3270, the market may resume falling towards 1.3220; if to the upside at 1.3303 – form one more ascending structure with the target at 1.3343.

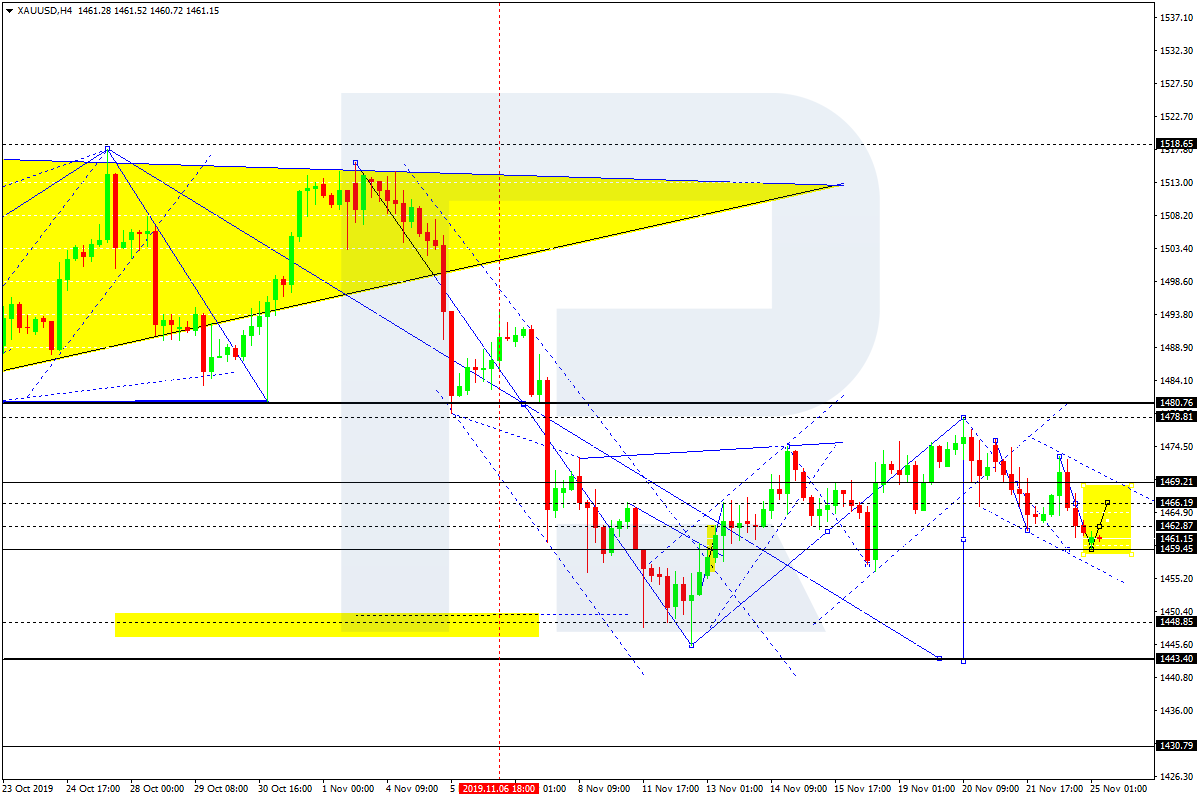

XAU/USD, “Gold vs US Dollar”

Gold has completed the descending impulse at 1459.60. Possibly, today the pair may consolidate around 1463.00. After that, the instrument may break 1459.50 and continue trading inside the downtrend with the target at 1444.00.

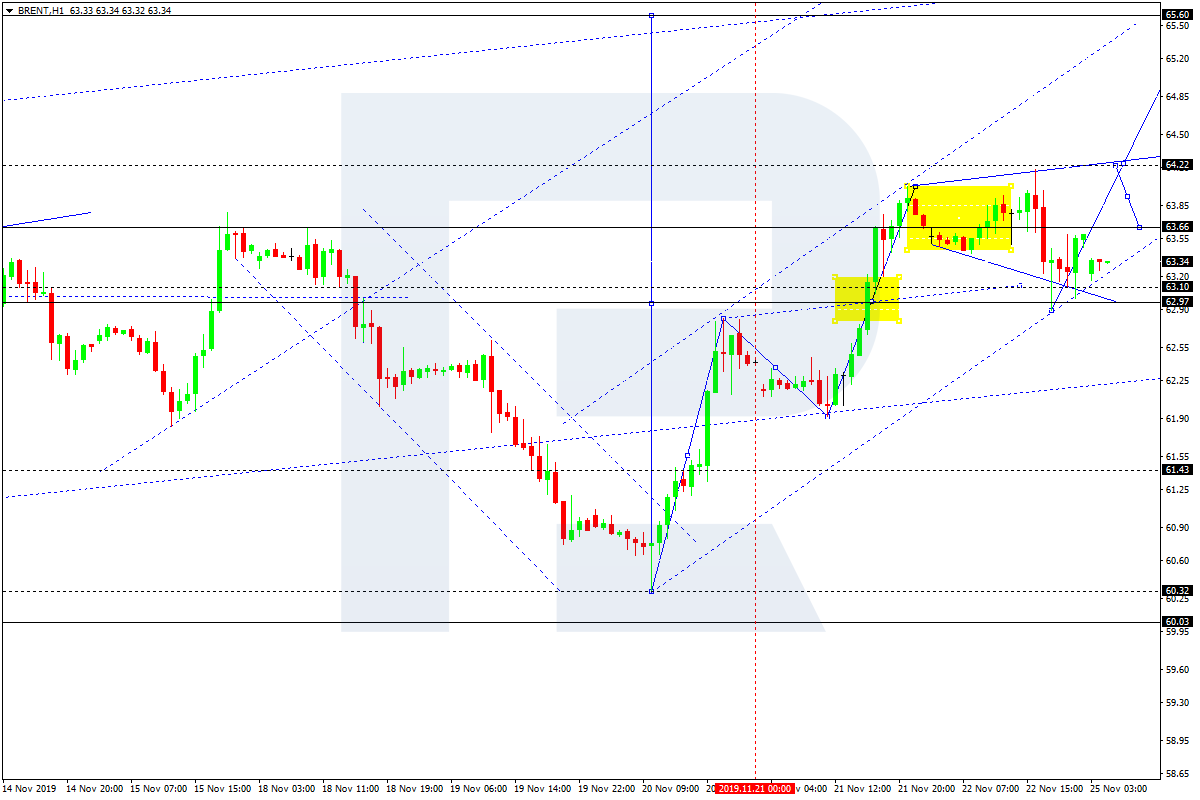

BRENT

Brent has finished the correction towards 63.00; right now, it is still trading upwards to reach 63.66. Later, the market may break this level and continue growing with the first target at 65.50.

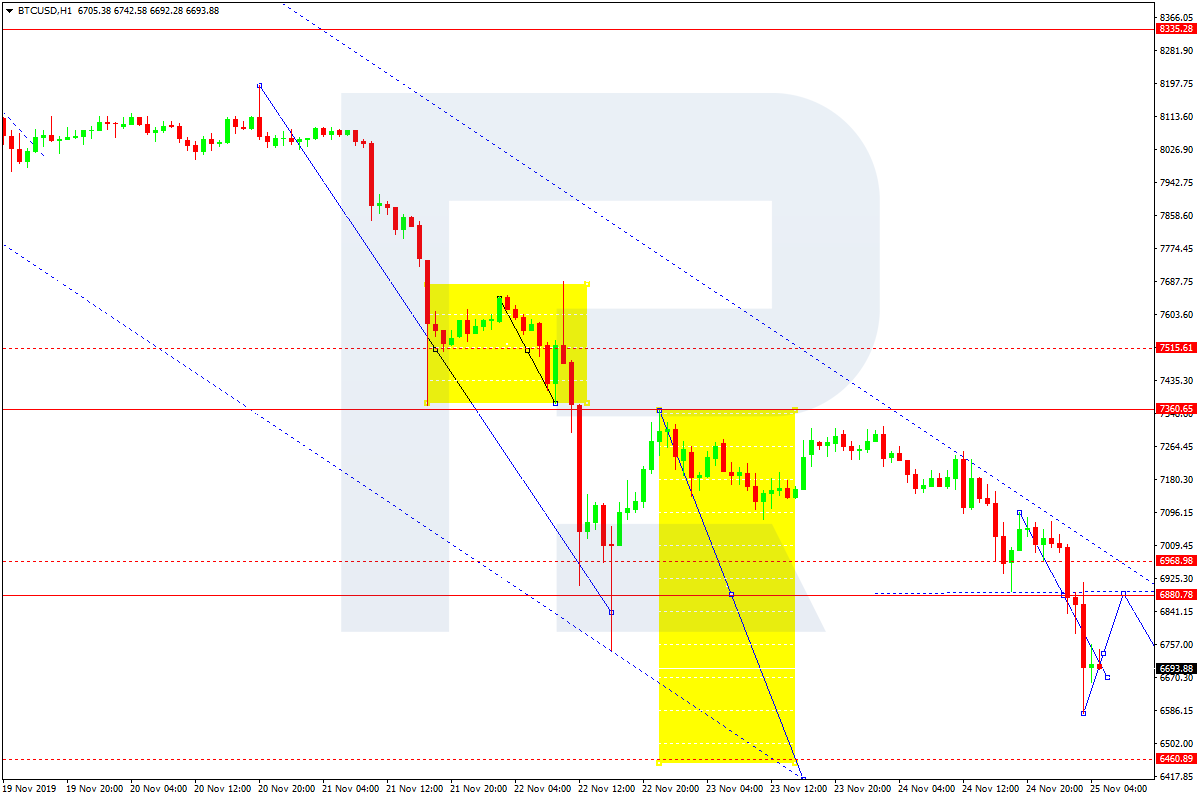

BTC/USD, “Bitcoin vs US Dollar”

After failing to form a new ascending impulse from 7500.00, BTC/USD has broken 7350.00 to the downside to continue the downtrend with the target at 6400.00. Today, the pair may reach 6464.00 and then form one more ascending structure towards 6888.00. Later, the market may resume trading downwards to reach the above-mentioned target.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.