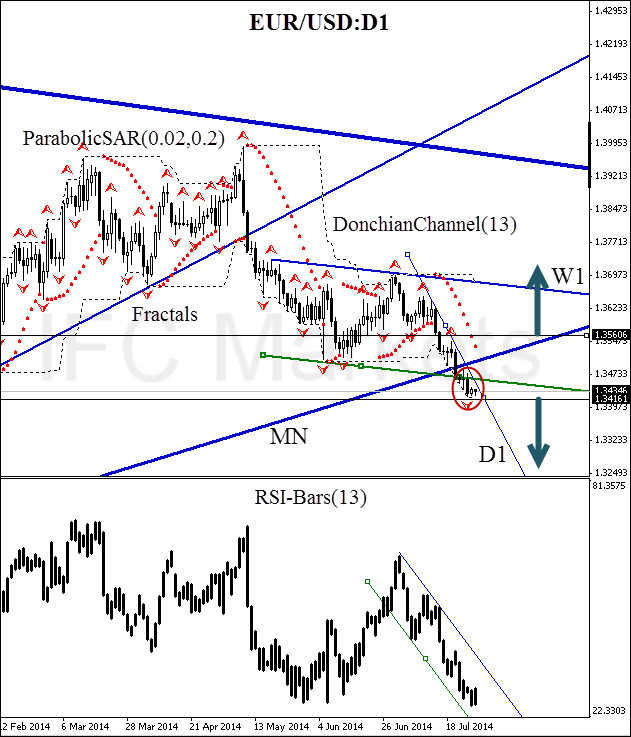

Good afternoon, dear traders. Here we consider the EUR/USD behavior on the daily chart. At the moment we can observe that the price broke the monthly trend line and is descending into the red zone. The weekly resistance was also broken, i.e. the movement is considerably accelerating. At the same time the DonchianChannel breach and the ParabolicSAR reversal occurred. Thus, there is a high probability of a new bearish momentum birth, especially that the RSI-Bars leading oscillator continues to slump in a narrow channel without significant corrections.

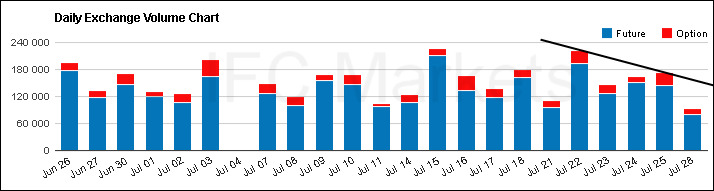

The only alarming factor is the low trading volumes. The daily volumes of the USD/CAD futures and options traded on the Chicago Mercantile Exchange are presented on the chart below. Both instruments are derivatives, and can be used to assess trends of the Forex spot market. We can see that the downtrend break is not observed yet. Thus, trading volumes do not confirm the bearish confidence, and it is possibly a disturbing signal of false breach. For conservative traders it is recommended to wait for a situation where the number of requests on futures and options exceeds 180,000. You can monitor trading volumes for this currency pair by clickinghere.

Right after that a pending sell order on euro can be opened starting from the key level at 1.34161. This support is confirmed by the 30-day DonchianChannel lower border and the fractal. It is reasonable to place the risk limitation at 1.35606, intensified by the parabolic and bearish trend line. Unlikely, but possible, that this breach might be false and the downward momentum will eventually be weakened, especially that there are low trading volumes observed. In this case, we expect a price rebound in the monthly trend channel area. Long position can be opened above the resistance at 1.35606. After position opening, Trailing Stop is to be moved after the ParabolicSAR values, near the next fractal trough (long position), or peak (short position). Thus, we are changing the probable profit/loss ratio to the breakeven point.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.