Analysis for September 17th, 2014

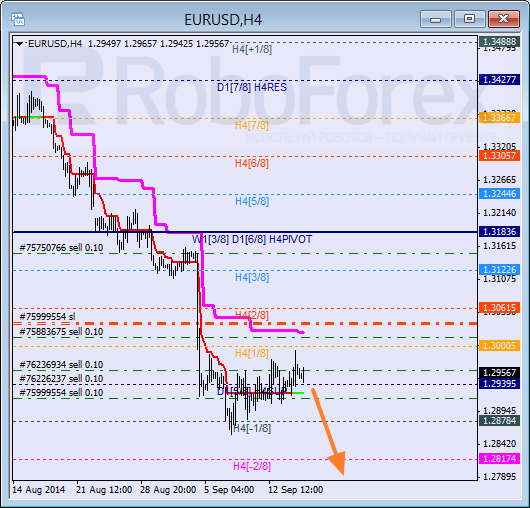

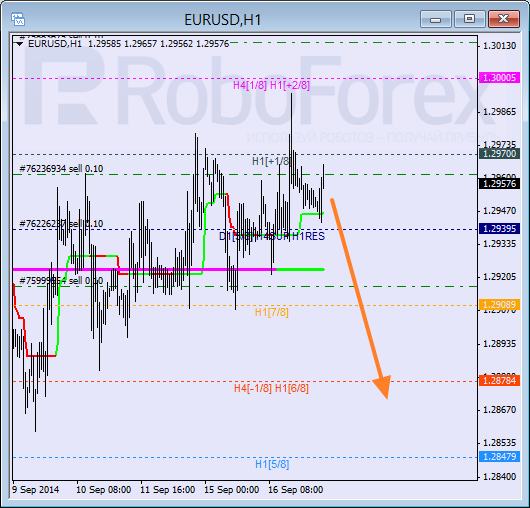

EUR USD, “Euro vs US Dollar”

Eurodollar is still consolidating. The price is trying to stay above the 0/8 level, which means that the current correction may continue. On the other hand, until the price breaks the 1/8 level, the main priority is continuation of a bearish trend.

At the H1 chart, the price is moving inside “overbought zone”. Considering that after making an unsuccessful attempt to break the +2/8 level, the price was able to stay below the +1/8 one, there is still a possibility that the downtrend may resume. I’m planning to increase my short position as soon as the market breaks Super Trends.

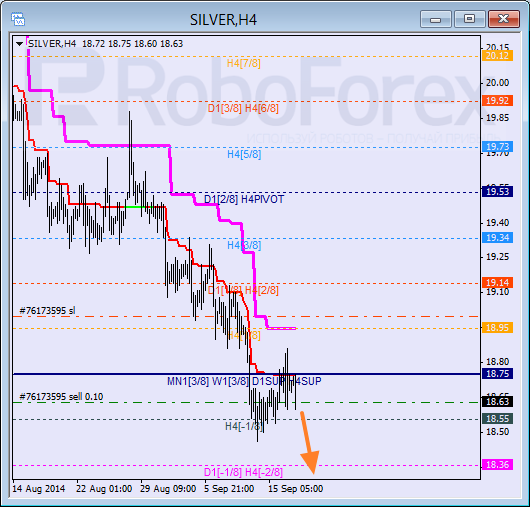

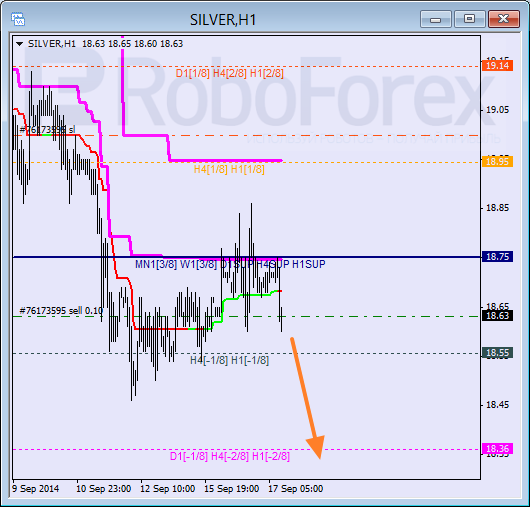

XAG USD, “Silver vs US Dollar”

After being supported by the 0/8 level and the H4 Super Trend, Silver is trying to start falling again. The first target for bears is at the -2/8 level. If later the market breaks it, the lines at the chart will be redrawn.

At the H1 chart, the price continues moving inside “oversold zone”; Super Trends are still influenced by “bearish cross”. I’m planning to move my stop to breakeven as soon as the price breaks the minimum.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.