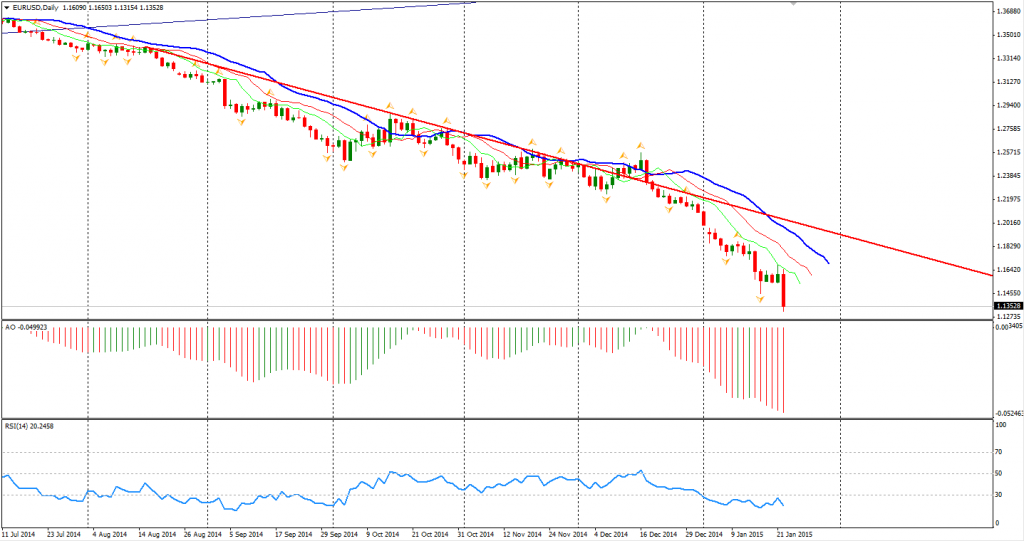

We have been expecting the result of this ECB decision for quite some time now. Many see this announced asset purchasing program as a chance to temporarily allow market participants to have some faith in that the ECB is serious on fighting deflation. The release though subdued the Euro down to a refreshed low below 1.1350 and pushed up the global stock markets. In fact, the Euro hit a 11 year low.

The total amount of the program is no less than 1.1 trillion Euro – 60 billion Euro per month, starting in March and until at least the end of September, 2016. Mr. Draghi emphasises that the program is open-ended like the QE3 of the US and will continue until the inflation level of Eurozone returns to 2%. As aforementioned, this QE was expected but the amount was actually twice as much as any prediction had set out. Traders now are mostly satisfied.

The falling Euro also helped the USD rise against other majors. A breakout just happened as I was writing this report. The Aussie Dollar slumped below its former mouth low of 0.8030 – finishing the over-a-month consolidation. The 0.8000 integer level is being tested and may not support the currency for long. The Australian Dollar still is the strongest currency among other commodity pairs. After NZDUSD broke the bottom of its three-month consolidation and the Bank of Canada just cut its interest rate, the Aussie Dollar won’t be able to defy gravity on its own. The next target may be 0.78 and 0.75.

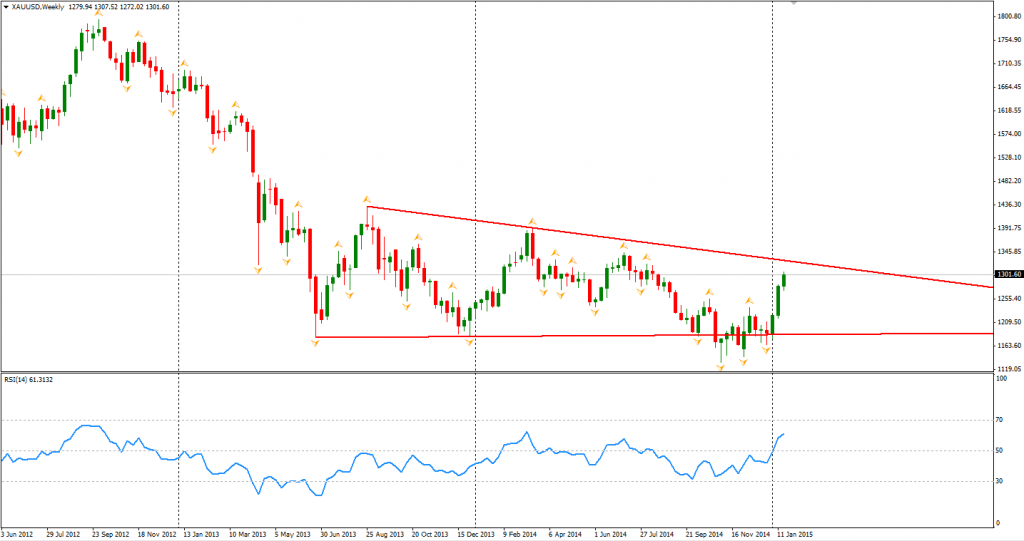

Gold prices surged to $1304 refreshing recent highs as the newly announced QE provided enough funds for the market. In the weekly chart, we can see a downward trendline connecting the highs of 2013 and 2014. The next target of gold may be this trendline and the price level is around $1325.

Stock markets were in a sea of green. The Shanghai Composite rose 0.59% to 3343. ASX 200 bounced 0.49% to 5420. The Nikkei Stock Average gained 0.28%. In European markets, the UK FTSE was up 1.02%, the German DAX gained 1.32% and the French CAC Index rose 1.52%. The US market closed inspired by QE as well. The S&P 500 closed 1.53% higher to 2063. The Dow gained 1.48% to 17813, and the Nasdaq Composite Index surged 1.78% to 4750.

On the data front, China HSBC Flash Manufacturing PMI will be released at 12:45 pm AEDST. PMIs of Euro area will also be out in this afternoon. UK retail sales will be at 8:30 AEDST and Canada CPI and retail sales will be at midnight.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.