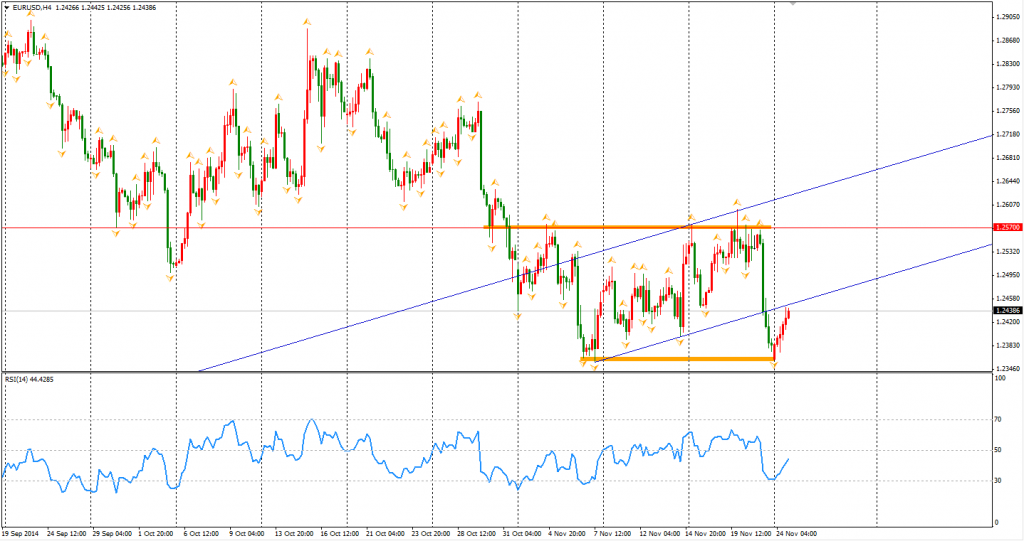

The upbeat German business confidence assisted in a Euro rebound against the dollar away from its month’s low. The business climate index rose for the first time in seven months to 104.7. It gives some hope to the Eurozone against other weak data. The Euro Dollar was around 1.2440 this morning – still weak considering the slump of last Friday. Traders can keep their bearish view on Euro as long as it remains below the lower boundary of the flag pattern.

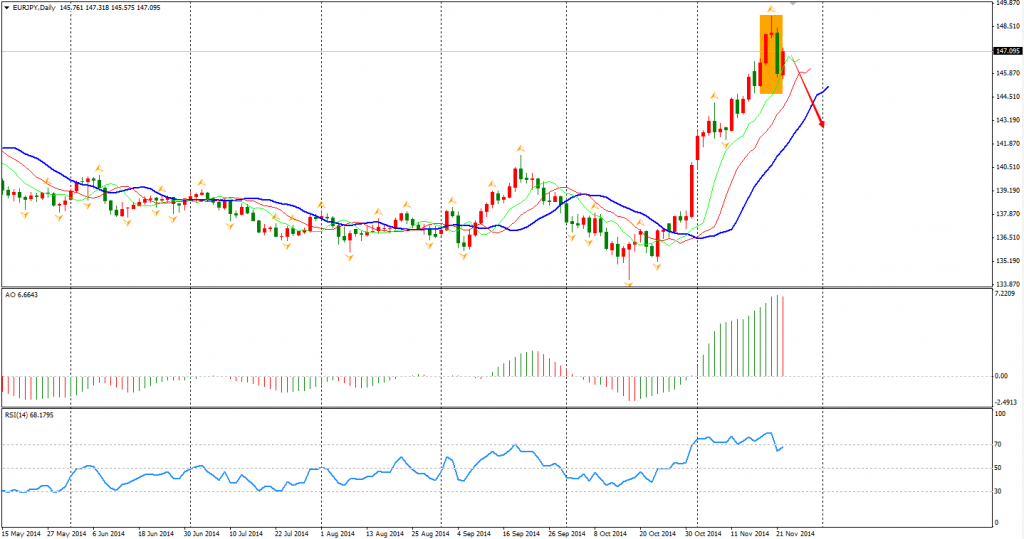

We can also see some trading opportunities in the Euro crosses. EURJPY for instance, left an evening star in the daily chart on last Friday and a doji in the weekly chart. Considering the Dollar Yen has been close to the 120 level and the Euro is expected to be under pressure from ECB’s further easing, the Euro Yen may fall in the mid-term.

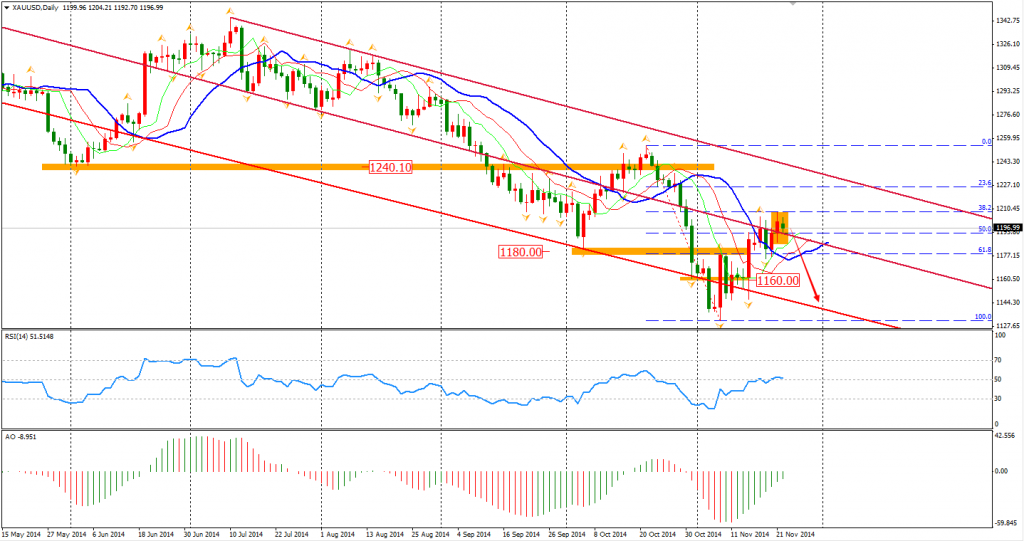

Traders maintain their doubts for the next move of gold price as gold closed as a harami in the daily chart. Some hedge funds added their wagers on a bullishness after China joined Japan and Eurozone in the team of monetary easing. However, other participants are still keeping their bearish bets as the Fed is heading to rate hike and demands from China and India are weak compared with last year. The Harami pattern may imply that the rebound is over.

Most Asian stock markets closed higher after the China rate cut. The Shanghai Composite surged 1.85% to a 3-year high of 2533. The ASX 200 also advanced 1.08% to 5362. In the European stock markets, the UK FTSE was down 0.31%, the German DAX rose 0.54% and the French CAC Index gained 0.49%. The US market kept climbing. The S&P 500 gained 0.29% to 2069. The Dow rose 0.05% to 17818, and the Nasdaq Composite Index rose 0.88% to 4754.

On the data front, BOJ Governor Kuroda will speak at 12:00 AEDST. Canada Retail Sales and US Prelim GDP will be released at 0:30 AEDST.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.