Even though the China Q3 beat market expectations, the 7.3% annual expansion is still a six-year low and lower than the official target of 7.5%. The fixed-asset investment rate increased by 16.1% for the first month from the previous year – the lowest since 2001. On the flip side, it provides some with comfort knowing that the external demand has quickened and the services sector has expanded in Q3. Beijing repeatedly stresses economic reform over short term stimulus as the priority for the government. Hence, China’s demand for commodities may stay weak in the near future.

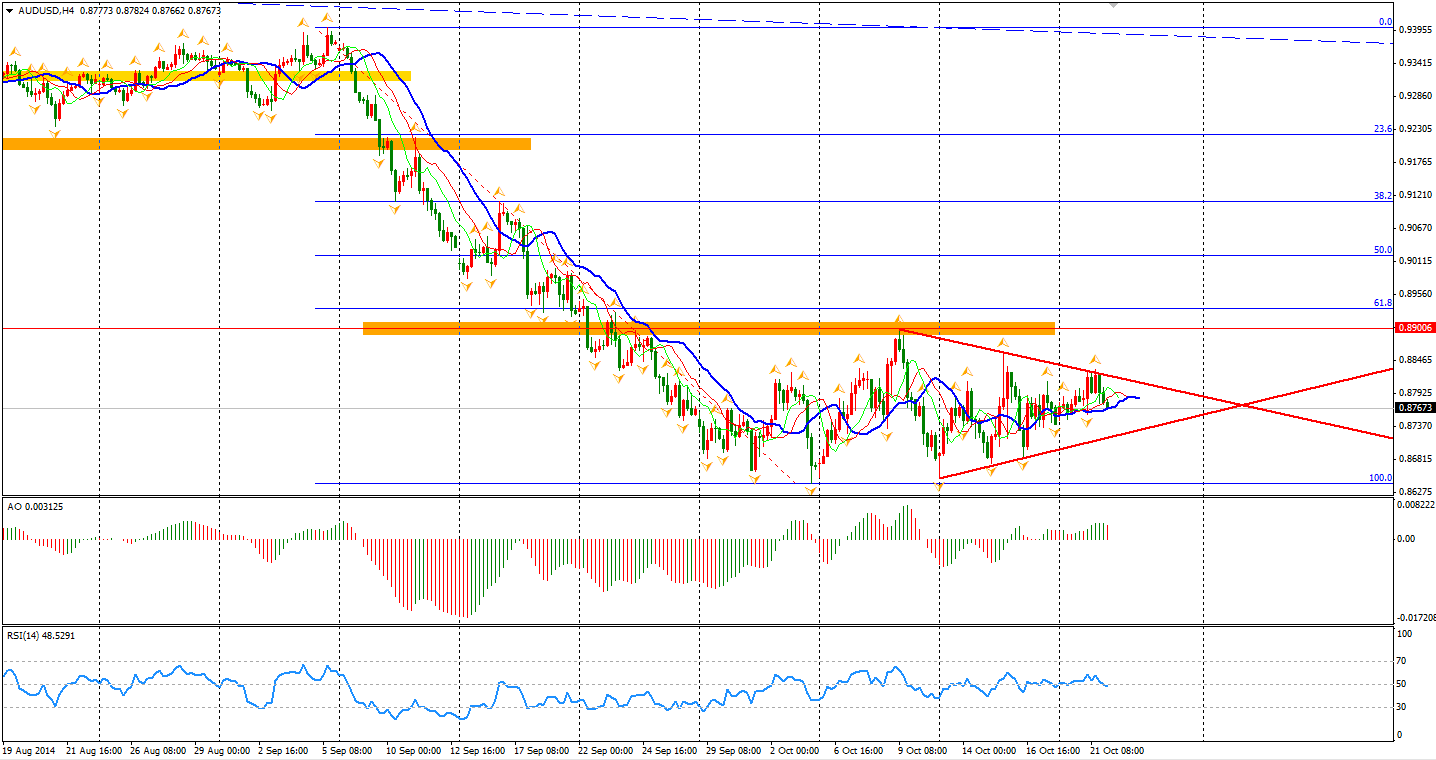

This is certainly not good news for Australia of which China is its largest trade partner. The Aussie Dollar is still in consolidation between 0.8650 and 0.89. In the 4-hour chart, a demand pattern is quite clear now, which we may see a breakout soon.

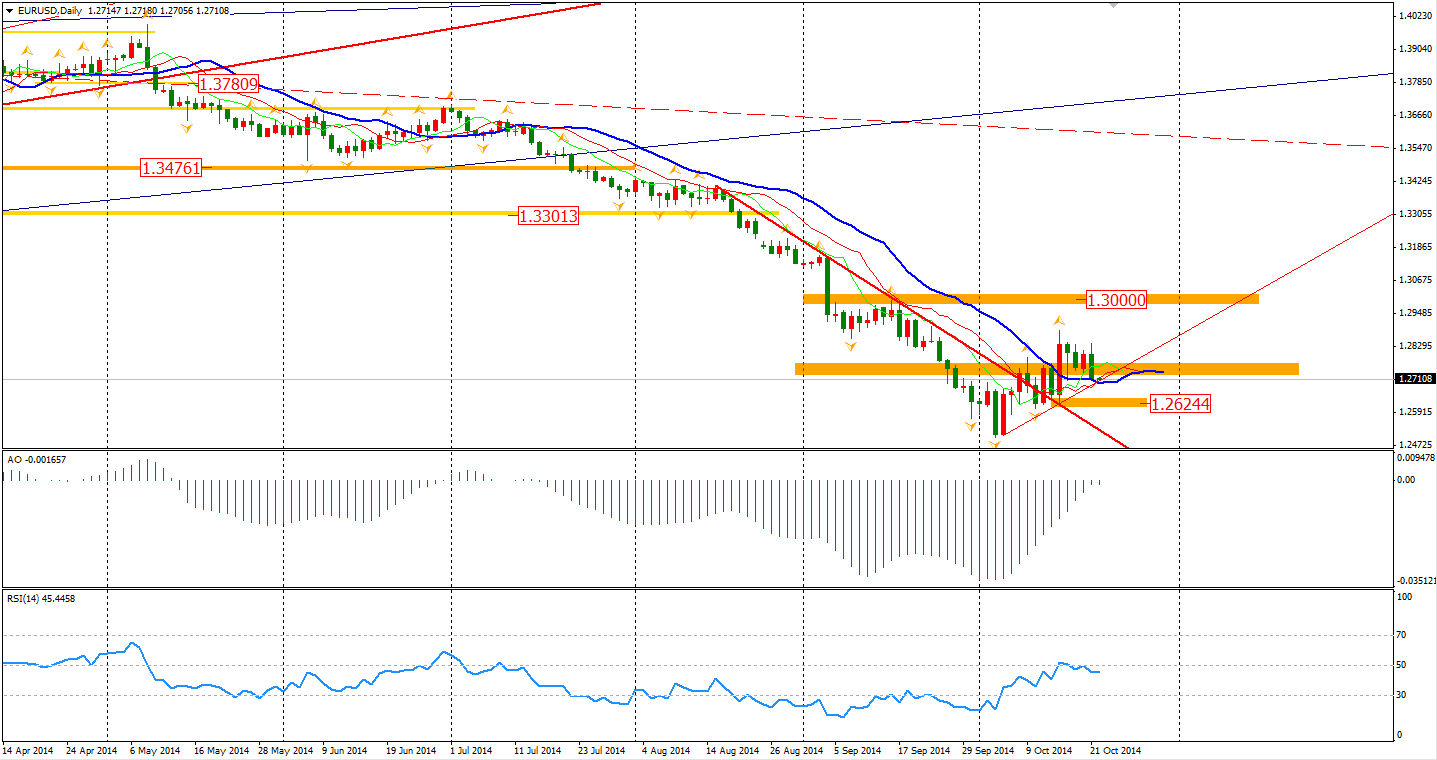

The Euro also fell against the Dollar yesterday, breaking the 1.2740 support and fell to 1.27 again. The breakout is not a good sign for the bulls and may imply that this round of rebound is over. The next support will be last Wednesday’s low of 1.2624, of which, if broken may confirm that the bearishness has come back.

The Asian stock markets fell across the board on Tuesday on the China GDP data. The Shanghai Composite lost 0.72% to 2339. ASX 200 gained 0.11% to 5325. The Nikkei Stock Average fell 2.03% as an adjustment of Monday’s surge. In European stock markets, the UK FTSE was up 1.68%, the German DAX gained 1.94% and the French CAC Index surged 2.25%. The US market bounced strongly, led by technology stocks. The Dow once gained 1.31% to 16614, while the Nasdaq Composite Index edge up 2.4% to 4419. The S&P 500 surged 1.46% to 1941.

For the data front, Australian CPI will be released at 11:30 AEST, followed by Chinese GDP and its disaggregated data. UK MPC minutes will be published at 19:30 AEST and US CPI and Canada Retail Sales are at midnight.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.