All traders were focused on the Jackson Hole annual symposium, where central bankers meet in the one place to discuss the future of global economy and monetary policy making. However, the three-day meeting proved to be quite disappointing or even, boring by Wall Street standards.

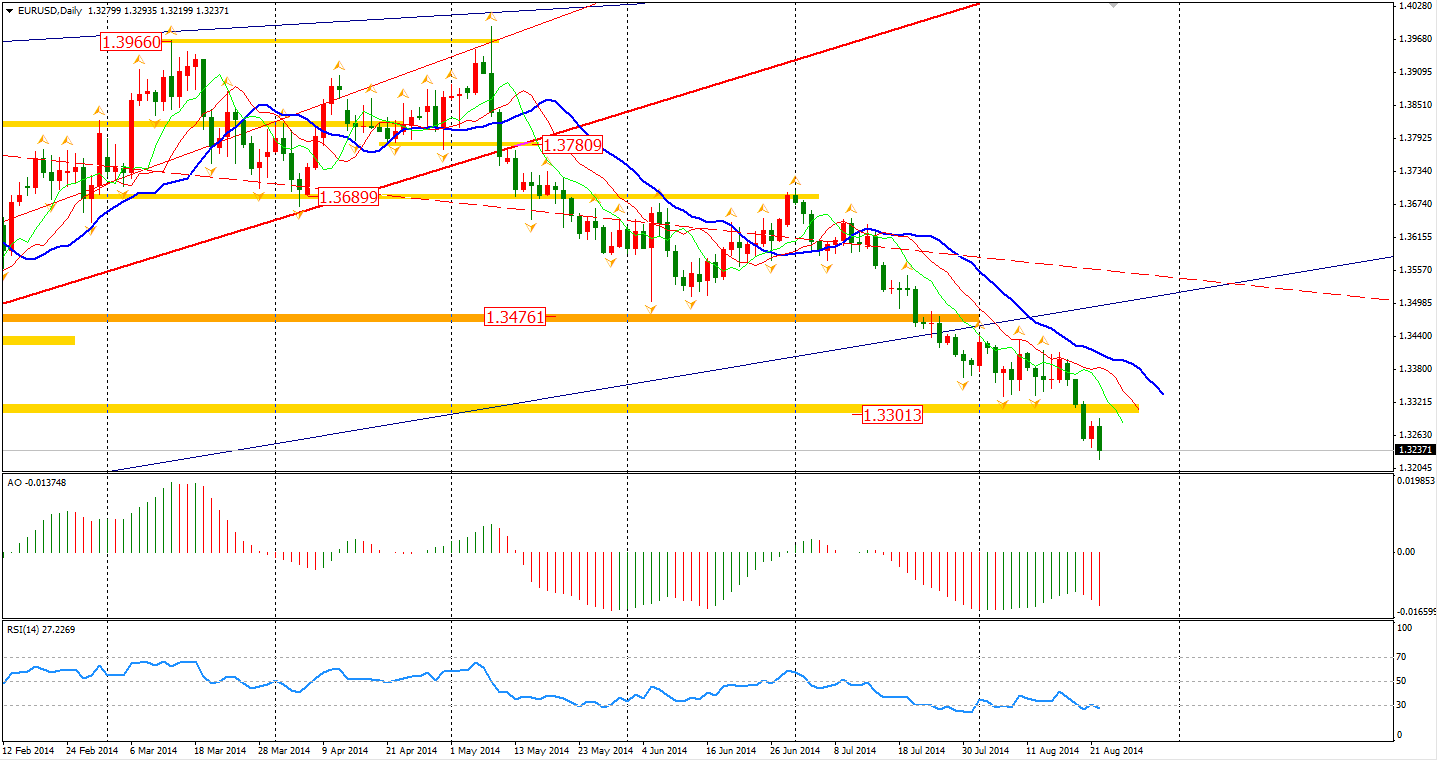

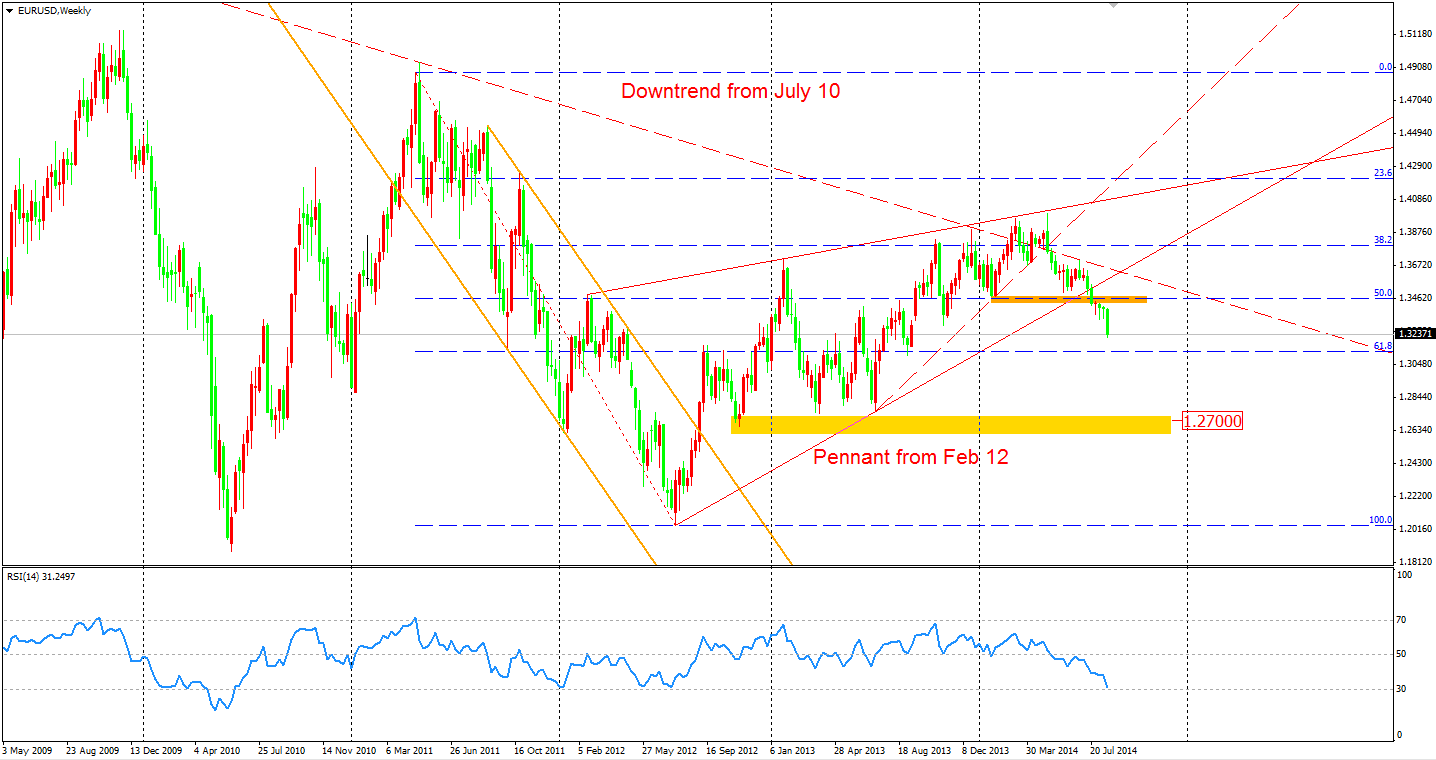

Yellen’s speech can be described as neutral. The markets’ response was limited as the Fed Chairwoman reflected both a dovish and hawkish side. The only currency appeared to be effected, the Euro, fell by over 40 pips against the Dollar. As the rebound in last Thursday confirmed, the 1.33 support had been broken through. The fall of the Euro/Dollar may continue and in the long term, it looks to be heading to 1.27, the low of 2013.

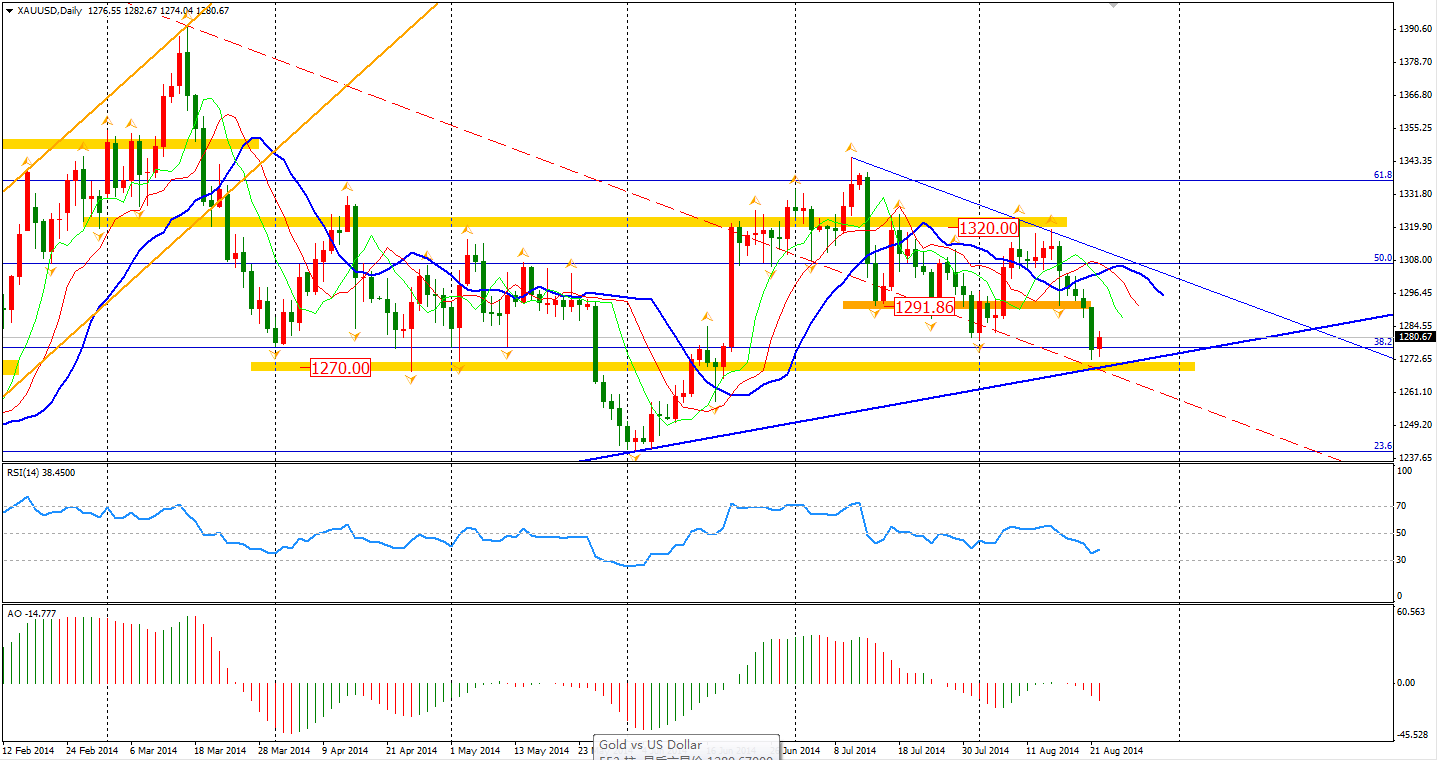

For Gold, the slump temporarily stopped at $1270 per ounce. This area has been a strong support since March and the upward trendline since 2013- at the low of $1180. With expectations that there will be a peaceful result of the meeting between Russian President Putin and Ukrainian President Poroshenko, the markets seem more at ease. Germany has suggested Ukraine accept federalism to alleviate the conflict, showing the largest economy is seeking a peaceful resolution. If so, the middle term outlook of gold price is pessimistic. The breakthrough of $1270 level may imply that the price will once again fall to its former low of $1180.

Asian stock markets closed with little changes on Friday before the Jackson Hole. Shanghai Composite edged 0.46% lower to 2241. The Nikkei Stock Average lost 0.30%. The Australian ASX 200 gained 0.12% to 5646. In the European stock markets, the FTSE fell 0.04%, the German DAX lost 0.66%, and the French CAC Index fell 0.93%. U.S. stocks fell slightly with limited change. The Dows fell 0.22% to 17001. The S&P 500 edged 0.20% lower to 1988, while the Nasdaq Composite Index was up 0.14% to 4538.

No data release during the Asian trading hours and today is UK’s bank holiday. The only data may be worth noting is the German IFO Business Climate at 18:00 AEST.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.