As of the end of June this year, the Chinese total debt to GDP ratio has risen to 251%, according to the Standard Charter, showing that the leverage of the Chinese economy is growing along with the stimulus. The estimate was 147% at the end of 2008 when Beijing had just implemented an ambitious stimulus plan worth more than 20 Trillion RMB (about US$3.2 Trillion). It’s fairly clear to see the financial burden being correlated with stimulus and the central government has realized that the last policy brought serious problems to the economy. There’s now not much room for them to introduce further stimulus.

It is a worrisome sign though when the growth of debt is at double the rate of GDP growth for several years – a trend that is certainly unsustainable.

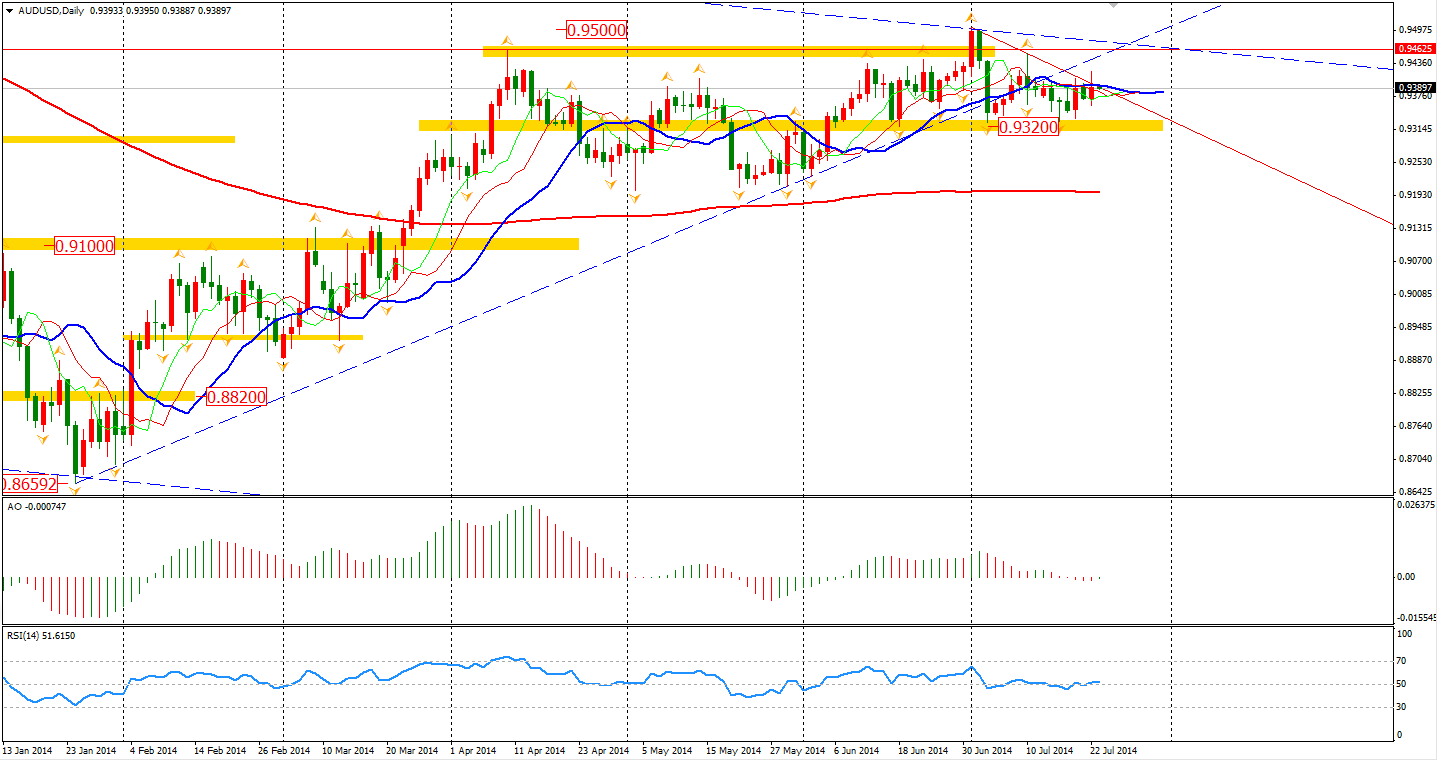

Nevertheless, the news did not affect the strength of Aussie. Traders who are shorting Aussie against the Dollar are probably disappointed with RBA Governor Stevens, who did not mention in his speech how the AUD is at a historical high level. The Aussie Dollar rose 0.22% to 0.9392. The close, though, was still below the short term downward trendline.

In the U.S, the consumer-price index rose 0.3% in June, which is the fastest pace in the two years. This data increased the market expectation of early interest rate rise pushing the Dollar slightly up against other major currencies, bar the Aussie.

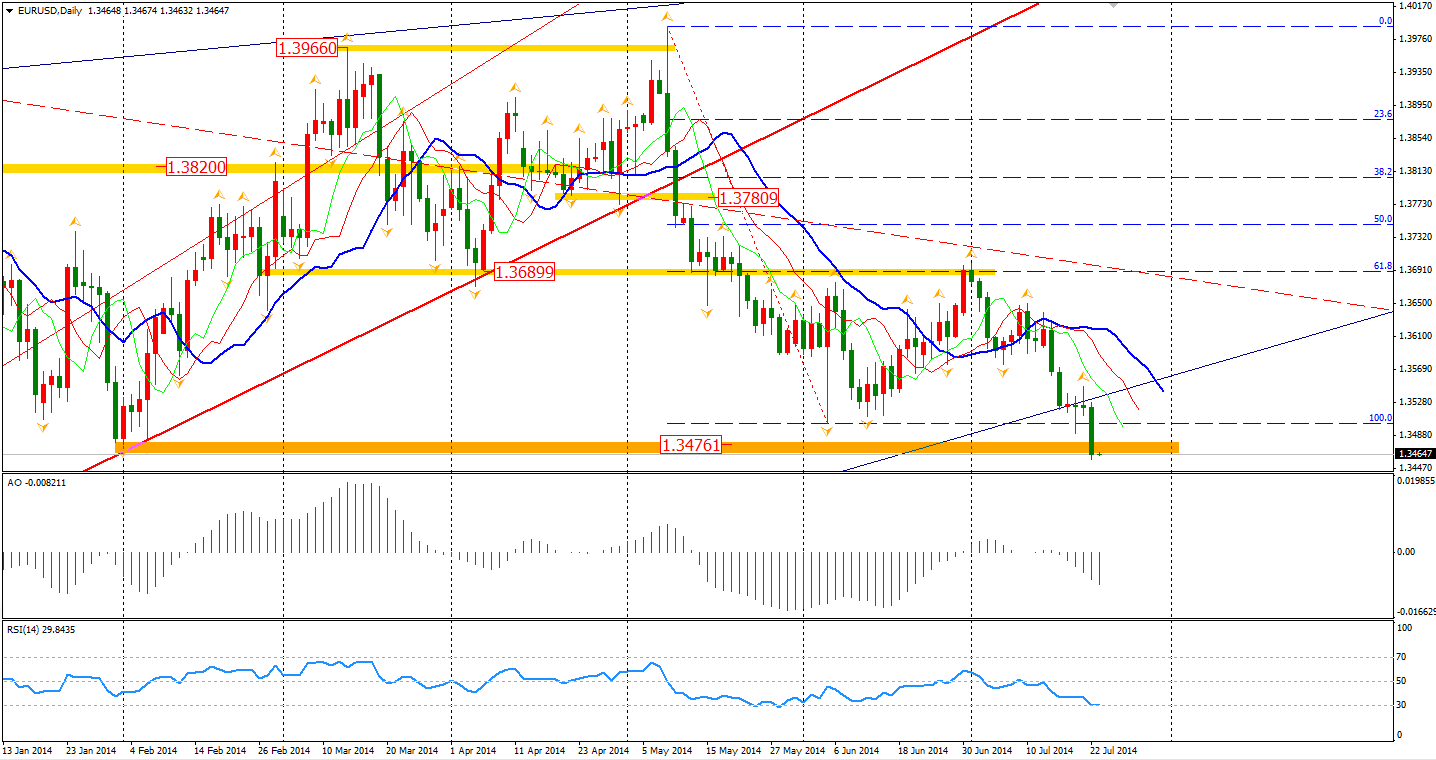

Euro was weak during the Asian and European session. After the CPI release, it fell further to a new low since November last year and broke the support level around 1.3480. We are close to confirm whether this is the breakout I mentioned yesterday.

Most of the Asian market made gains yesterday, as investors speculated on more stimulus policies in mainland China. The Australian ASX 200 rose 0.06% to 5543. The Nikkei Stock Average was up 0.62% whilst the Shanghai Composite surged 1.02% to 2075. In European stock markets, the FTSE closed 0.99% higher, the DAX rebounded 1.27%, and the French CAC was up 1.50%. U.S. stocks traded rallied on Tuesday on upbeat corporate earnings. The Dow gained 0.36% to 17114. The S&P 500 edged 0.50% higher to 1984, while the Nasdaq Composite Index rose 0.71% to 4456.

On the data front, local investors may pay attention to the Australian CPI at 11:30 AEST. The BOE’s Official Bank Rate will be at 18:30 and Canadian Retail Sales will be out at 22:30 AEST. Also, Euro Consumer Confidence will be released at midnight.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.