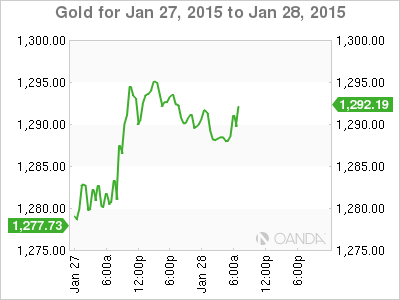

Gold is steady on Wednesday, following gains a day earlier. In the European session, the metal is trading at a spot price of $1292.10. In the US, the markets are keeping a close eye on the FOMC Statement, which will be released later in the day. The only other event is Crude Oil Inventories, with the markets expecting a strong downturn in the upcoming report.

The Federal Reserve will be in the spotlight on Wednesday, with the release of a policy statement at the end of a two-day meeting. The Fed is expected to continue to counsel patience regarding an interest rate hike, and persistently weak inflation means the Fed can take its time before having to make a monetary move. The markets will be combing through the statement and any clues as to the timing of rate hike could shake up a listless EUR/USD.

Tuesday was a busy day in the US. Durable Good reports disappointed, as Durable Goods Orders plunged 3.4%, marking a 4-month low. There was no relief from Core Durable Goods Orders, which declined by 0.8%, its fifth drop in six readings. The markets had expected gains from both indicators. There was much better news later in the day, as CB Consumer Confidence jumped to 102.9 points, crushing the estimate of 95.3 points. New Home Sales followed suit, rising to 481 thousand, well above the forecast of 452 thousand.

XAU/USD 1292.10 H: 1293.63 L: 1285.95

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.