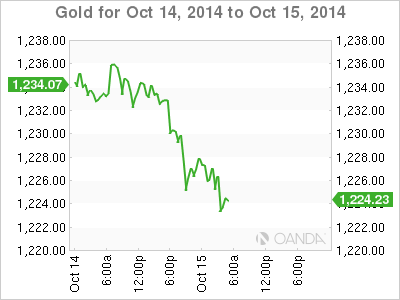

Gold has posted slight losses on Wednesday, as the spot price stands at $122.55 per ounce in the European session. After strong gains last week, gold prices have weakened slightly. On the release front, we’ll get a look at US releases after a quiet start to the week. There are three key events on the calendar – Retail Sales, Core Retail Sales and PPI.

US markets were off on Monday for a holiday, so it’s been a quiet week until now for XAU/USD. That could change later on Wednesday, as the US releases key consumer spending and inflation data. The markets are keeping low expectations, so traders should be prepared for some movement from the pair if there are some unexpected readings from Wednesday’s releases.

The US dollar has looked razor sharp against gold, as the metal has lost about 5% of its value since the start of September. However, the greenback’s rally was interrupted by last week’s FOMC minutes, which were unexpectedly dovish. In the minutes, the Fed poured some cold water on rising expectations of a rate hike, as a number of policymakers said that the Federal Reserve should take a more data-dependent approach regarding a rate hike. The Fed also voiced concern about the rising strength of the US dollar which could weigh on the recovery. On the weekend, FOMC member Stanley Fischer said that the Fed could slow tightening if global growth is weaker than expected. Strong US numbers have raised expectations about a rate hike, but clearly the Fed is taking a cautious approach regarding the timing of a rate hike. Still, with QE set to wind up by the end of the month, rising speculation about higher rates bodes well for the US dollar.

XAU/USD 1222.55 H: 1230.22 L: 1222.08

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.