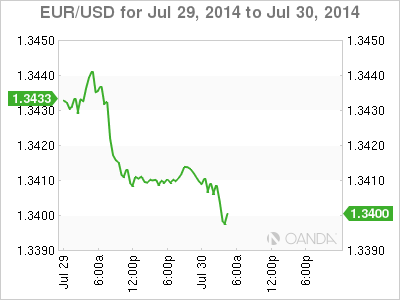

The euro continues to lose ground on Wednesday, as EUR/USD trades below the 1.34 level in the European session. On the release front, it's a busy day, with three key events out of the US - Advance GDP, ADP Nonfarm Payrolls and the Federal Reserve Policy Statement. In the Eurozone, Spanish GDP met expectations, posting a healthy 0.6% gain. However, Spanish CPI softened in June, with a 0.3% decline. Late in the day, Germany releases Preliminary CPI, a key indicator and market-mover.

The euro continues to head south, and has dipped below the 1.34 line for the first time since November. It's been a July to forget for the euro, which has coughed up about 300 points to the surging US dollar. If Wednesday's US employment and GDP figures are positive, the euro could lose more altitude.

CB Consumer Confidence was outstanding on Tuesday, pointing to a sharp increase in June. The key indicator jumped to 90.9 points, crushing the estimate of 85.5 points. This was the indicator's highest level since September 2007. Consumer confidence is closely tracked by analysts since a confident consumer is likely to increase consumption, which is critical for economic growth.

In the Eurozone, soft German data continues to concern the markets. German Import Prices posted a gain of 0.2%, which was the best showing in 2014. This was shy of the estimate of 0.3%. On Friday, German Ifo Business Climate, a key indicator, dipped to 108.0 points, its third straight decline. On the inflation front, Germany has not been immune to Eurozone inflation woes, and we'll get a look at German Preliminary CPI later on Wednesday. The markets are expecting a weak gain of 0.2%.

EUR/USD 1.3399 H: 1.3416 L: 1.3395

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.