Today European stock indices continue to grow at the prospect of 500-550 billion euro emission which is likely to be announced on Thursday at a regular session of the European Central Bank. As exchange markets are closed and Thursday is still far ahead, the European Union observes a rather weak share price growth. Significant macroeconomic data are not expected to be published today. On Friday euro hit a new 11-year low as a result of the National Bank of Switzerland decision we had written about in our previous overview. Today the European currency is slightly moving up. We believe that until the next ECB meeting takes place, euro is likely to be traded sideways.

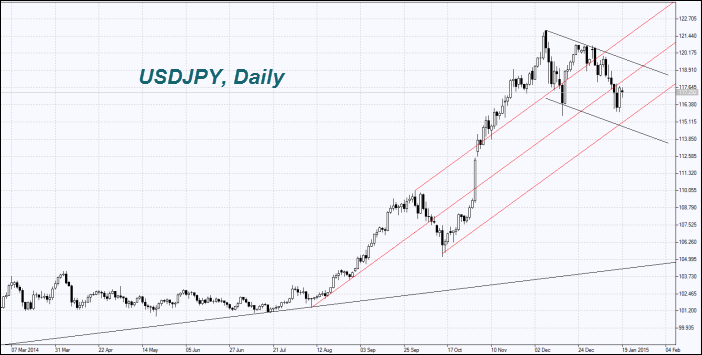

Nikkei has risen this morning together with other world stock indices. It was partly encouraged by the growth of the Japanese consumer confidence marker in December, which slightly outstripped forecasts. JPY/USD slipped in expectation of the Bank of Japan meeting (which is to take place January, 20-21). Investors anticipate the positive forecast of the core inflation rate for the current year, which is likely to decline from 1.7% predicted in October to 1.5%. Herewith, on Wednesday morning the Bank of Japan holds the final press conference and may declare the augmentation of emission and the raised GDP forecast. Analysts do not expect any particular macroeconomic data concerning Japan to be announced tomorrow.

Chinese officials will publish a report on GDP for the fourth quarter along with industrial production and retail sales data in December. In our estimation, forecasts are negative. There is a risk that the GDP growth will not meet the Chinese government’s expectations or even reaches its 24-year low. In this case, commodity futures prices may drop.

As we assumed in our previous overviews, oil and gold prices continued to grow. According to Baker Hughes, the oilfield services company, the number of US-based oil wells reduced by 55. This reduction is the second biggest within 24 years and has already been the sixth one in a row. We recall that the week earlier this number of oil wells decreased by 61. At the moment, there are 1366 operating oil wells, their quantity has been at its minimum since October 2013. We suppose that the rundown in drilling is absolutely logical. When oil price had fell by almost 60% within 6 months, the majority of oil fields became unprofitable. The dwindling number of wellsites may result in oil output declining and the price increasing. According to the U.S. Commodity Futures Trading Commission, the number of net long positions for WTI crude oil rose by 12% last week.

Gold hit its 4-month high at the prospect of the expected euro printing. The SPDR Gold Trust weekly reserves gained 1.9% and made up 730.9 tons. This has been the max growth since May 2010.

Recommended Content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.