Forex alert: Risk markets tread a slippery slope

Asia wrap

US and European equity futures extended their slide, mirroring a rough session in Asia as two weeks of tariff-induced chaos continued to rattle risk sentiment. With market whiplash in full force, the best trade now seems to be sitting flat or positioning selectively and defensively.

Meanwhile, the softer-than-expected US inflation print was largely dismissed, given that it didn’t capture the coming price pressures from tariffs. A few cooling components were noted but don’t carry much weight in the Fed’s preferred inflation gauge.

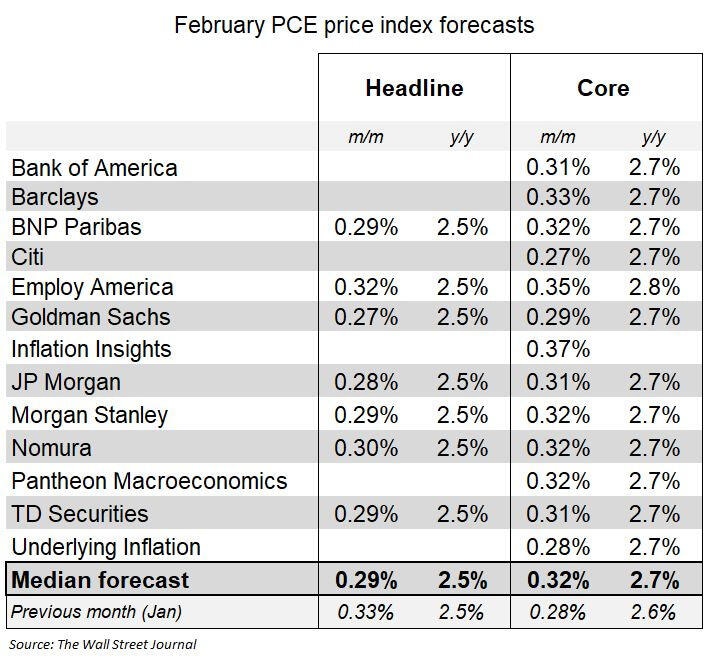

Looking ahead, forecasters now expect a firmer February PCE inflation reading. However, this outlook remains fluid, especially with Thursday’s PPI data in focus—it shares plenty of DNA with the Fed’s go-to metric. As it stands, core PCE is tracking at +0.32%, leaving markets in limbo as they wait for more clarity on the inflation trajectory.

Forex markets

The Euro

For now, tariffs are the central force steering FX markets, with uncertainty over their scope and rates keeping traders on edge. This fluid backdrop makes holding onto a long-term view nearly impossible and adds layers of complexity to hedging strategies. Every fresh twist throws another wrench into market positioning.

Inflation is no longer the runaway beast it was in 2022, but it’s still stubborn enough to keep the Fed’s hands tied. The latest data may not have sparked fresh alarm, but it certainly wasn’t the green light markets were hoping for to reignite the rate-cutting cycle. Traders caught on fast, recalibrating expectations as it became clear that the Fed isn’t ready to flip dovish just yet.

The Fed finds itself in a precarious position from a monetary policy angle. Moving too soon could amplify the very inflationary pressures tariffs are poised to unleash. That reality has significantly raised the bar for rate cuts, supporting the dollar for now. With the Fed stuck in a wait-and-see stance and risk markets still grasping for stability —at least until the dust settles on tariffs.

As expected, EUR/USD continues to grind lower rather than surge higher—probably in direct contrast to 90% of the analyst chatter out there. But the writing was already on the wall for most seasoned FX traders.

The bond market’s reaction to yesterday’s cooler-than-expected core CPI (0.2% MoM) was anything but straightforward. Instead of a dovish repricing, the Fed’s terminal rate edged higher, and Treasuries softened across the curve. This suggests a deep-seated reluctance to fully buy into the deflationary narrative—at least until the impact of tariffs starts to materialize.

For FX, the recalibration is clear: with U.S. yields refusing to break down and the Fed still maintaining a high bar for cuts, the dollar remains supported. Meanwhile, the euro’s high-flying optimism is running into hard resistance as markets reassess just how much of the EU fiscal expansion and rearmament trade has already been priced in. Reality check? We might see the early innings of a longer-legged dollar run

The negative USD-equity correlation seems to be unravelling, with the dollar now picking up some safe-haven demand—likely as April’s tariff showdown looms. This shift was very much part of the expected playbook as traders repositioned ahead of escalating trade tensions. Meanwhile, after slicing through 1.0875, EUR/USD appears to be running out of immediate upside fuel, with the next leg higher likely contingent on Russia officially signing off on the 30-day Ukraine truce.

That said, a ceasefire alone might not be the bullish catalyst the euro needs—peace talks have already been largely priced in.

Markets also remain laser-focused on Germany’s evolving defence and infrastructure spending agreements. The Greens recently indicated that a deal with Chancellor-to-be Friedrich Merz could be finalized by the end of the week. If that happens, we could see a short-lived pop in the euro, but with expectations already baked in, the risk of a "buy the rumor, sell the fact" reaction is growing. For now, FX traders will be watching U.S. tariff developments and broader risk sentiment to determine whether the dollar’s safe-haven bid has more room to run.

Although I still think EUR/USD has room to drift lower toward 1.0800 this month, I decided to lock in some profits, closing out half the position through 1.0870—slow grind trades tend to test my patience.

The Yen

Risk sentiment is back skating on thin ice again, struggling to shake off tariff jitters. And guess what? That’s music to the yen’s ears. JPY-crosses are tumbling, fueled by a surge in JGB yields, as traders brace for what could be a pivotal shift in Japan’s wage growth dynamics.

The latest catalyst? UA Zensen—one of Japan’s largest labor unions—just locked in a 5.37% pay hike for workers. While that’s a slight dip from last year’s 5.91%, it’s still miles above the long-term trend, reinforcing expectations that the upcoming national wage data could keep inflationary pressures alive. That’s exactly the kind of signal the BoJ has been waiting for to justify a policy shift, but will they actually follow through? That’s the million-dollar question.

Meanwhile, the 10-year US-JP yield spread is flashing JPY appreciation ahead, and with global risk sentiment still hanging by a thread, the yen’s safe-haven appeal is only getting stronger. The real test now? Whether the BoJ lets the market run with this or tries to jawbone it back down. Either way, momentum is shifting, and if this trend holds, we could see a much bigger unwind in JPY shorts before the dust settles.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.