The Bank of England will have its monthly economic policy meeting this Thursday, and is largely expected to maintain the status quo. Governor Mark Carney and the rest of the policy makers will have to assess the effects of the sharp drop in the services PMI, the global economic slowdown and the continued rise in house prices over the economy, all of which support the case for keeping rates low for some more time.

Additionally, inflation in the UK remains subdued. UK inflation rate fell back to 0.0% in August, down from 0.1% in July, weighed by falling oil prices, as the commodity traded at its lowest in more than six years during that month. This Wednesday, the BRC said shop prices in September were 1.9% lower than a year earlier, a bigger fall than Augusts' 1.4% decline.

On the other hand, the economy has been steadily creating jobs, whilst the latest manufacturing and industrial production data picked up in August from the poor figures posted a month before. The uneven development of the different economic sectors however, suggests the UK is not yet ready for a tighter economic policy, despite the comments made by Carney, over a rate hike coming "sooner than expected."

Overall, the market will be looking for any possible change in the MPC votes, which stand currently at 8-1, with only one member pledging for a rate hike. Should more officers vote for a rate increase, the Pound will likely surge on speculation that the Central Bank is getting closer to a lift-off. Also, the market will assess the tone of the statement, as a dovish stance, expressing concerns over the ongoing situation, may lead to Pound weakness, moreover it the votes remain unchanged.

Effects on GBP/USD

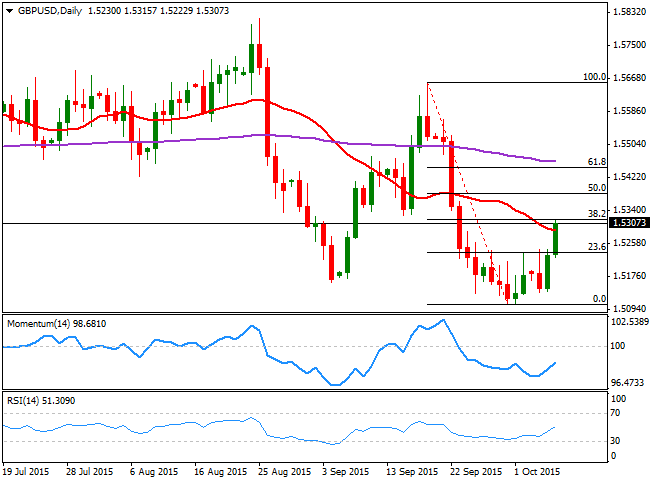

Given the ongoing dollar's weakness, and that a dovish stance is pretty much priced in, the GBP/USD pair may stall its recovery on Thursday, and even pull back below the 1.5200 level with an extremely disappointing outcome, but fresh lows are not seen at the time being. Technically speaking, the daily chart shows that the pair is currently around the 38.2% retracement of its latest decline, and aiming to break above its 20 SMA, while the technical indicators are recovering strongly from oversold territory, not yet confirming an upward continuation. A break above 1.5315, alongside with a less dovish than-expected tone in the Minutes, should lead to a steady advance in the pair, up to the 61.8% retracement of the same rally at 1.5445.

Below 1.5250, the risk turns back south with a downward acceleration through 1.5200 pointing for a test of the lows set this week in the 1.5130 price zone.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD breaks below 1.1000 on stellar NFP

The buying bias in the Greenback gathers extra pace on Friday after the US economy created far more jobs than initially estimated in September, dragging EUR/USD to the area of new lows near 1.0950.

GBP/USD breaches 1.3100 after encouraging US Payrolls

The continuation of the uptrend in the US Dollar motivates GBP/USD to accelerates its losses and breaches 1.3100 the figure in the wake of the release of US NFP.

Gold rebounds from daily lows and flirts with $2,670

Following a post-NFP dip to the $2,640 region, Gold prices now embarks on an acceptable rebound and retest the area of $2,670 per ounce troy despite the marked advance in the US Dollar and rising US yields across the board.

US Payrolls surge in September, as 50bp rate cut ruled out

US payrolls data surprised on the upside in September, rising by 254k, smashing expectations of a 150k rise. The unemployment rate fell to 4.1% from 4.2%, average hourly earnings increased to a 4% YoY rate and there was a 72k upwards revision to the previous two months’ payrolls numbers.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.