FOMO rules

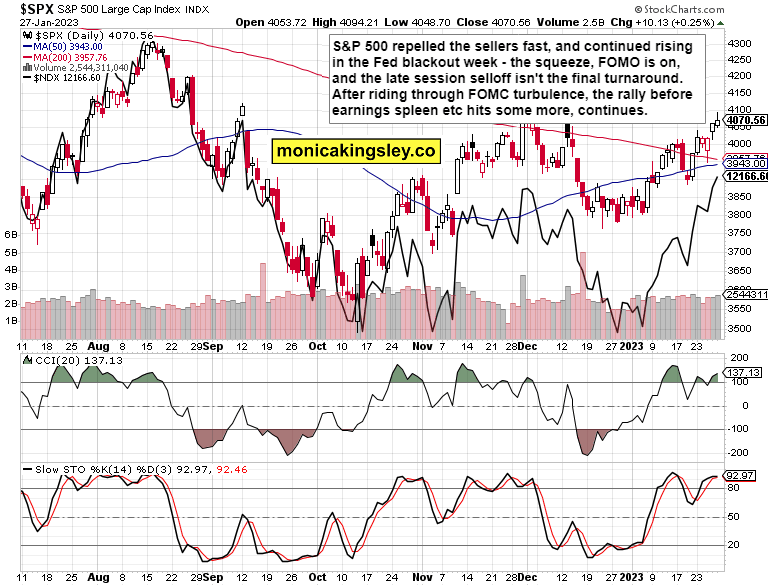

S&P 500 barely stopped, and the broad based rally continued… till the final hour. Was that the reversal? Unlikely! On Wednesday, I discussed what I‘m looking for on the FOMC day:

(…) positioning for next week‘s FOMC with 25bp hike and no change in balance sheet shrinking and more hikes ahead reiteration, goes on. Buy the rumor, sell the news – and this rally of laggards (tech, crypto) is going to notice.

The rumor is still being bought, and selling the news would be overcome. The Fed would of course go with 25bp while not commiting to 50bp Mar (25bp are practically baked in the cake, and when I look at the short end of the curve and various yield spreads, I agree with that. The Fed will try to talk some good restrictive game, and will do its best to keep rates at restrictive levels for as long as possible, but Fed funds rate at 5% appears as sound estimate before recession rubber meets the road in Q2 2023.

The central bank‘s attention would understandably shift from fighting inflation to the realization that slow growth (aka stagflation, the prospect of which I first raised in Jan 2022) has become as much the economic reality as earnings recession and other real economy woes (housing, manufacturing, job market together with GDP painting a. deceptive picture of strength if you look under the hood).

Quoting my key mid Jan analysis:

(…) Let‘s isolate #earnings and the pace of recent surprises. If these continue as before, we are looking at a neutral or negative earnings growth quarter, but greater troubles would strike in Q2 earnings season

No matter how low the bar has been set for the reporting companies this quarter, they have largely undershoot it still. The pace of negative surpsises, of negative earnings growth went from -3.2% expected to around -5% currently. Not good, and that‘s not even the start of real issues. Europe has temporarily dodged the recession bullet, ECB sounds still intent on hiking by 50bp, and energy prices (oil and natgas) won‘t be terribly conducive to Old Continent‘s growth ahead. And I wouldn‘t totally rely on China‘s credit driven expansion to continue through 2H 2023 without pause.

This will all drive further retreat in yields, but for now FOMO, short squeeze and rotation out of non-cyclicals into tech and growth, continues – the S&P 500 is set to rise still as it makes „springboard“ setup into Jan FOMC. Crypto isn‘t rolling over either yet. Making the safest of overly conservative statements, stocks are to eventually overcome first 4,100 and then 4,130. Likewise the dollar relief rally isn‘t yet on the table, and that will be still helpful to real assets. Look forward for plenty of real-time coverage this week – as always!

The „consensus“ narrative of the day is that the Fed has beaten inflation, we have good odds of soft landing, and not only we would get 2 rate cuts this year, and more easy money is on the way in 2024. Good luck with that – Spain‘s inflation is proving sticky already. Plan accordingly, I say.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock. So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

S&P 500 ducks are lined in a row, and the upleg will be driven by energy, industrials, financials and probably materials too. Smallcaps will join emerging markets while defensives would underperform. 4,040 followed by 4,010s is the first and second line of support, breaking the latter is less likely than staying above it. 4,063 is my daily „point of control“.

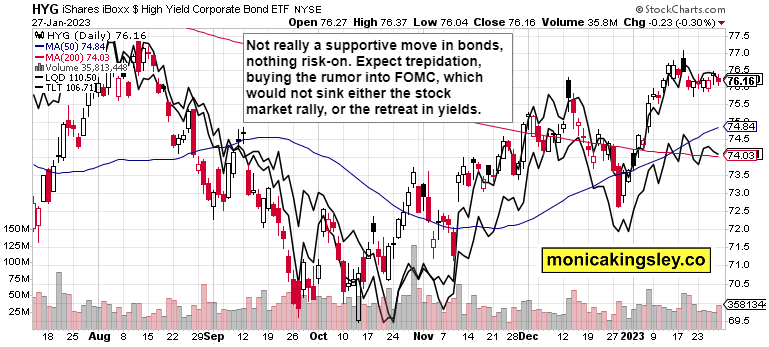

Credit markets

Bonds are pausing, but not yet done on the upside. After a possible fake breakdown, we‘re to see the current consolidation resolve with an upswing, which the stock market would love.

Gold, Silver and miners

Precious metals are short-term vulnerable, but haven‘t topped. Silver could temporarily suffer more than gold, where $1,900 followed by $1,875 shouldn‘t be broken.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.